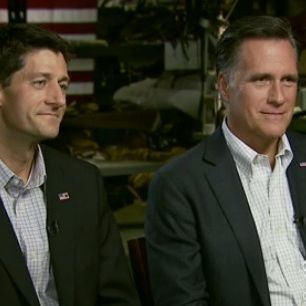

On Sunday night, Mitt Romney and Paul Ryan sat down for their first joint TV interview with 60 Minutes and took the opportunity to highlight their newfound friendship. Romney praised Ryan’s (questionable) knack for bipartisanship several times, and looked on with approval as his charismatic running mate attacked President Obama for his “fundamental lack of leadership.” The duo are apparently so in step that they’ve started wearing matching outfits, and even share the same policy on disclosing financial information. When asked how many years of tax returns he released to the campaign, Ryan said it was “a very exhaustive vetting process,” yet also a “confidential vetting process.” Thus, he’ll only be sharing two years of returns with the American people, just like his new boss.

The two were less clear on how a Romney-Ryan administration would affect Americans’ taxes. Bob Schieffer didn’t really ask any hard-hitting questions (and as Politico notes, that may be why Romney gave him another big exclusive), but he did have an interesting exchange with Romney about whether he believes in tax cuts for the rich:

Bob Schieffer: Does fairness dictate that the wealthiest people should not be paying the lowest taxes because that’s what happening many times?

Mitt Romney: Well, fairness dictates that the highest income people should pay the greatest share of taxes, and they do. And the commitment that I’ve made is we will not have the top income earners in this country pair– pay a smaller share of the tax burden. The highest income people will continue to pay the largest share of the tax burden and middle-income taxpayers, under my plan, get a break. Their taxes come down. So, we’re not going to reduce taxes for high-income people, and we are going to reduce taxes for middle-income people.

Bob Schieffer: You say of course the wealthiest people pay the larger share, but don’t they also pay at a lower rate? When you figure in capital gains and all of that?

Mitt Romney: Well, it depends on the individual, what their source of income is. But if you look at the top one percent or five percent or quartile, whatever, they pay the largest share of taxes. And that’s not something which I would propose making smaller.

As Jonathan Chait has discussed several times, a recent study by the Brookings Institution and the Tax Policy Center concluded that Romney’s tax plan would require a tax increase for the middle class, while the richest Americans would pay lower rates and a lower share of the tax burden. At this point in the interview, Ryan jumped in to elaborate on Romney’s plan:

What we’re saying is take away the tax shelters that are uniquely enjoyed by people in the top tax brackets so they can’t shelter as much money from taxation, should lower tax rates for everybody to make America more competitive.

If Ryan wants to take away Romney’s tax shelters, maybe they aren’t on the same page after all.