Lost in all the discussion of whether big banks are constitutionally a Good Thing or a Bad Thing for America is that big banks are increasingly not where the action on Wall Street is happening. More and more, as large, complex financial institutions are being pilloried and sued for their misdeeds, and their executives are being forced to cut back on bonuses until profits recover, small and midsize banks are eating their lunch.

Take, for example, Richard Handler. He is the CEO of a bank called Jefferies. You’ve never heard of Jefferies, but that is kind of the point. It’s a small, boutique bank, recently bought by a conglomerate called Leucadia, that generally flies below the radar, and as such can do things that much larger banks can’t get away with. Like paying all-cash bonuses. Like giving Handler a $58 million pay package for 2012, which makes the pay packages of Goldman Sachs CEO Lloyd Blankfein ($21 million) and JPMorgan Chase CEO Jamie Dimon ($11.5 million) look like chump change.

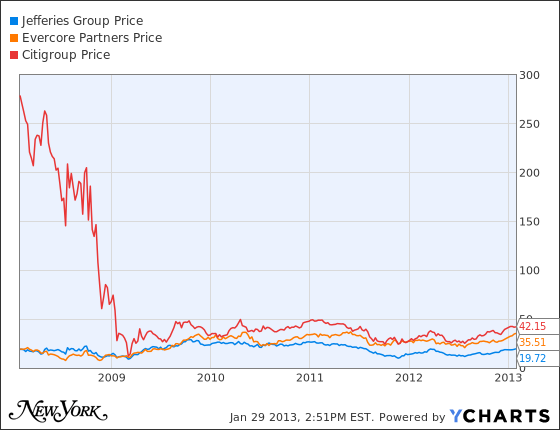

The rise of little banks started almost immediately after the financial crisis. Boutiques that specialized in M&A advisory and other old-school banking functions stayed relatively steady during the crisis, unlike their too-big-to-fail brethren, most of whom were loaded down with piles of toxic mortgage-backed securities. Compare the five-year stock charts of Jefferies and Evercore Partners (another little bank) with the chart of Citigroup during the same time period:

As this month’s earning season showed, big banks are slowly recovering, but they still have some hard-to-fix problems. The most important issue to these banks’ employees — compensation — is not likely to come back up to pre-2008 levels for many more years (if ever), both because firms can no longer afford the insane bonuses of the pre-crisis era and because shareholders and regulators would balk at the return to profligacy.

Lauren LaCapra had a good piece the other day about the “talent drain” on Wall Street. As workers become disillusioned with the regulatory pressure and falling pay at big banks, they are increasingly seeking their fortunes at hedge funds, private-equity firms, and in the VC/tech sector.

Now Jefferies and other small banks are trying to peel away disgruntled big-bank employees by giving them another option — remaining in banking, but going to a small firm, where they can get paid more, dodge the scrutiny of regulators and the wrath of the Occupy crowd, and generally live a much nimbler, unburdened existence. It’s a brilliant marketing move on Handler’s part, and I wouldn’t be surprised if as the talent drains out of large Wall Street firms, some of it ends up on his payroll.