Carl Richards has a post over at the New York Times’ Bucks blog in which he puzzles over the enduring appeal of hedge funds, despite the fact that they have historically underperformed the S&P 500. Why, he asks, are people paying exorbitant fees to hedge-fund managers who don’t even make money for them?

Richards takes a stab at the answer in a few ways. First, he implies that there’s an element of groupthink in Hedgistan, with investors all chasing increasingly complex hedge-fund strategies because “the more complicated and secretive and exclusive it is, the better.” He also gets at the false correlation between exclusivity and superior returns: “People want to believe there’s a better way of investing that’s only available to a select few.”

I think those are both true, to an extent. But I don’t think it’s correct to draw the sweeping conclusion that rich people are dumb and desperate to get richer, and therefore easily fooled by hedge-fund managers bearing Powerpoint decks and sleek Brioni suits.

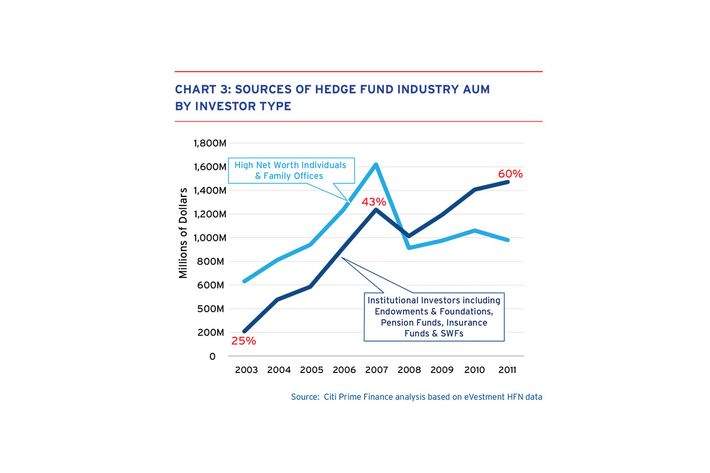

First, I question Richards’s assumption that “people” — as in individual, high-net-worth investors — are flooding into hedge funds unabated. Look at this chart from a Citi report last year, for example, which shows that the percentage of hedge-fund assets coming from individuals and family offices is actually down since the crisis, while the amount of money hedge funds get from institutional investors like pension funds and endowments has overtaken it.

What this tells us is that the money flooding into the likes of Greenlight Capital and Pershing Square and SAC Capital (well, until recently) is increasingly coming from sources that are forced to invest in those firms. If you’re the chief investment officer of CalPERS, a huge California pension fund, and your hedge-fund allocation is 2 percent — meaning that your board has said that 2 percent of your total assets must be invested in hedge funds — you don’t have a choice to invest in other stuff instead. You can pick one manager over another, but you’re not “choosing” to be in hedge funds as a category, except at the yearly meetings where you and other board members shift around the fund’s allocations. (Of course, these allocations rest on their own tenuous logic. But that’s another post.)

And contra Richards, who believes that investors are happy to be “paying through the nose for the privilege of investing in hedge funds,” I think it’s clear that most hedge-fund investors are averse to huge fees and are using their leverage to knock them down. Look at the way Réal Desrochers of CalPERS has used the huge size of his fund to hammer out special fee-lowering arrangements with his private-equity managers. This kind of thing is becoming more prevalent among institutional investors as hedge funds continue to underperform, and it shows that most of the people who invest in hedge funds do care how much they’re being charged for the privilege, and are actively trying to bring those fees down in line with performance.

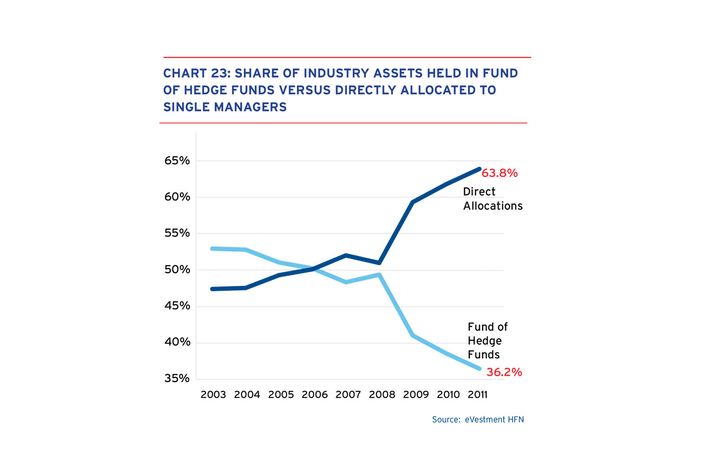

Individuals seem to care about fees, too, a phenomenon best evidenced by the way that the fund-of-funds — a horrible, fee-heavy way of investing in a fund that then invests in other hedge funds, taking its own fees in addition to the ones the hedge funds charge — is mostly dying out. This Citi chart (which Felix Salmon pulled last year) shows the declining popularity of the fund-of-funds, and perhaps implies that investors are wising up:

So, to answer Richards’s question (“Why do you think people still invest in hedge funds?“), I think you have, on one hand, a bunch of pension funds and sovereign wealth funds that are duty-bound to make a certain amount of money for their members, and would rather use a single-digit fraction of their cash pile to swing for the fences in Hedgistan (investing in a fund that might gain 80 percent in a year) than eke out 5 or 6 percent gains in plain-vanilla funds. I think you have, on the other hand, a set of high-net-worth individuals who want to invest in hedge funds because it makes them feel special and exclusive and gets them invited to cool parties, but are increasingly trying to scale back their obviously stupid investments (funds-of-funds) in favor of slightly less stupid investments.

There’s another obvious part of the hedge-fund equation, which is that hedge-fund managers are — on the whole — pretty smart, and really, really, good at selling you their ideas. Look, for example, at the way Ray Dalio of Bridgewater Associates explains the concept of “risk parity,” which he says allow Bridgewater’s investors to use leveraged bond derivatives to offset equities losses. It’s very convincing, and even though I don’t know what risk parity is or how it functions, if I’m the CIO of a midsize pension fund, I’m inclined to give my money to Dalio even if I don’t fully understand what he’s going to do with it. Investing at the scale of a pension fund is a division of labor, and if I can’t fully get my head around Sector X or Bond Derivative Y, I’m inclined to pass that responsibility off to someone who does understand it deeply.

Now, this approach to portfolio management contains flawed logic all its own. But it’s hardly as simple as wanting to feel like a VIP at all costs.