The most prominent serious economic case against using stimulus to fight the economic crisis — the Reinhart-Rogoff 90 Percent Threshold of Death — has collapsed ignominiously, leaving true believers in austerity grasping for some justification that isn’t based on simple data errors. Washington Post editorial writer Chuck Lane has a new nominee: James Buchanan, Nobel Prize–award-winning economist.

Lane concedes that stimulus can boost the economy in the short run. But there may be a cost. Buchanan’s work, he explains, found “deficit spending is very easy to turn on and very hard to turn off.” Politicians like giving their voters lower taxes and better services, and don’t like giving them the reverse. A short-term stimulus can become a long-term deficit increase. So the real debate is whether stimulus is worth the risk of morphing into permanent deficits. It’s not that the austerians are wrong, he says, they just care more about the long term:

Krugman et al. place top priority on the short-term problem of alleviating unemployment. Although they often cast this as a moral issue, they also argue that avoidable idleness reduces the economy’s growth potential, as jobless workers tend to lose skills or quit the labor force altogether. Compared with these risks, possible future inflation and debt accumulation hardly matter, and wise politicians would proceed accordingly. “In the long run we are all dead,” quoth John Maynard Keynes.

First of all, Lane, like pretty much every critic of Keynes, completely misreads his famous quote. “In the long run we are all dead” was definitely not an argument that we should ignore the long run because YOLO. He was arguing that economic models that ignore recessions and only attempt to explain long-run conditions are useless:

But this long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again.

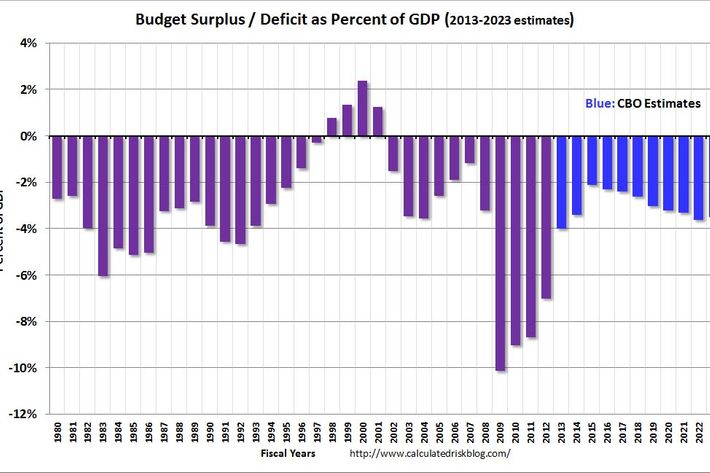

Second, sure, in theory it could be true that a government could design a stimulus program that jacked up the deficit in response to a huge recession, and then kept it jacked up after the emergency had passed. But it’s not like we have to rely on Buchanan’s modeling to figure out whether temporary stimulus is possible in the United States today. We enacted a temporary stimulus in 2009, consisting of short-term tax cuts, aid to states, some infrastructure projects, and higher spending to cover food stamps, unemployment benefits, and other programs to help all of the people thrown into poverty. Conservatives did argue in 2009 that this would all become permanent, but they were wrong. And look, the deficit is falling incredibly fast:

Buchanan’s idea is useful as an argument against passing permanent deficit increases during a recession. To use it as an argument against all stimulus is sort of like saying that when college kids drink beverages they like beer or booze, and alcohol is bad for them, so we should prevent them from having any beverages at all. Why not just try to keep college kids from getting booze while letting them drink all the water they want?

In 2001, George W. Bush passed a permanent tax cut, using as a pretext a recession that was arguably shallow enough that it didn’t require any fiscal stimulus anyway. That’s bad. We shouldn’t do it. The present debate is whether we should pass more short-term stimulus like what President Obama has proposed, or whether we should reduce the budget deficit even more than we already are. The intellectual case for the latter has crumbled, and conscripting the work of James Buchanan into the debate does nothing to revive it.