Several years ago, the private equity beat was a less-than-desirable job within business journalism — sexier than reporting on mutual funds, but not nearly as sexy as covering big banks. Then, when Mitt Romney announced his presidential bid, it exploded. Nowadays, any journalist who knows his private equity stuff is immediately in demand as a political pundit, TV commentator, and all-around wise man.

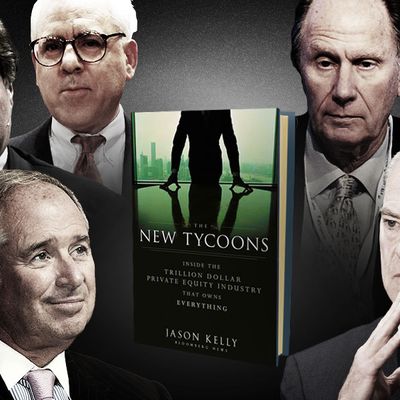

Jason Kelly, a Bloomberg News reporter who has covered the PE industry since 2007, just published his first book about the industry: The New Tycoons: Inside the Trillion Dollar Private Equity Industry That Owns Everything. Kelly charmed and chronicled the leading figures of private equity — Steve Schwarzman of Blackstone, Henry Kravis of KKR, David Bonderman of TPG, among others — and wrangled what he learned into an even-keeled book about how private equity works and why it’s so important.

We sat down to ask him what he thinks about private equity, Mitt Romney, and the fact that no one may care about his beat after November 6.

Hi, Jason — great book. So, how does it feel to be a month away from possible obsolescence?

I don’t expect that private equity in any sense is going away after November, even though the political aspect of it certainly will die down. What keeps it alive is how much money is involved, and where the money comes from.

Do you ever feel like a hipster? Like, you were covering this stuff before it was cool.

Even I was a little bit late to it. I took over the beat in 2007, when the real boom was in full swing. Having covered the tail end of the boom and the bust and then the recovery, I’d like to think I saw a full cycle.

How would you grade private equity’s response to all the attacks that have been made against it?

Up until very recently, they would not even get a passing grade. They did a terrible job. The story got told for them, and they were beyond late to the game. But over the five or six years I’ve been covering it, I’ve seen an evolution.

But have any of the attacks — like, say, against Bain Capital — actually been bad for business?

It seems like — and I’ve heard this from a lot of guys within the private equity world — they are starting to encounter some skepticism, if not resistance, from the investor base. The investor base is definitely emboldened to ask for more information, to demand lower fees, etc. The problem, of course, is that the investors are in trouble themselves. They desperately need returns. And they’re looking to anyone they can to get it.

Real talk: If Mitt Romney loses this election, is he going to go back to private equity?

I don’t think he’d be hired. Despite Steve Schwarzman’s optimistic viewpoint, the private equity industry would not have chosen this, certainly in 2012. And despite the fact that Romney has political supporters and people within the industry who would like for him to be elected president, I don’t think he has ultimately done a huge amount of favors for the private equity industry.

There are roughly 100 instances of the word but in your book, according to my Kindle’s search function. Your employer, Bloomberg News, frowns on the word. Are you going to get fired for this?

[Laughs.] I hope not. Bloomberg has been very supportive.

Okay, hypothetical time. If every major private equity firm were placed in a locked room and made to fight to the death, which one would come out alive?

My money would go with [TPG founder David] Bonderman. He’s just wily, and that whole idea of a death match implies something very messy. The TPG guys love the messy stuff.

One more: You can eliminate one private equity buzzword from the Earth with a snap of your fingers. Which do you pick?

“Alignment of interests.” I think it’s nonsensical. If you have to keep talking about it, it’s a bit of “the tycoon doth protest too much.”

So, last question. It’s a simple one: After having covered the industry for so many years, do you like private equity?

It’s so pervasive at this point, and there are so many different iterations that it’s hard to make a big call one way or the other. The tools are there for it to be a force for good, and the tools are also there to wreak complete havoc.

This interview has been condensed and edited.