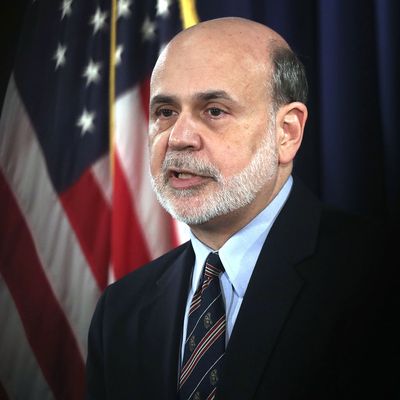

Federal Reserve chairman Ben Bernanke used to be an economic policy maker. These days, though, his primary job seems to be soothing the skittish.

Bernanke spent his day today calming the raised hackles of Wall Street investors who feared imminent doom would be brought on by a decision to “taper,” or gradually dial back, the Fed’s bond-buying stimulus programs, which have kept treasury yields low and juiced the stock market for the past several years. He was forced to start this campaign of assuagement a few weeks ago, after a comment he made about a possible taper sometime in the future was heard by these investors as a message that the taper was definitely happening right now — a hyperbolic misinterpretation that sparked a wild market swing.

Today, the Fed didn’t announce much that we didn’t know already. It will continue buying mortgage-backed bonds at its current pace. It blames Congress’s fiscal policy and the sequester for “restraining economic growth,” thinks that inflation is on pace to remain below 2 percent and that unemployment will shrink faster than expected, and reaffirms that it will aim to taper its bond-buying only “as the outlook for the labor market or inflation changes,” but not until it does.

“If the incoming data support the view that the economy is able to sustain a reasonable cruising speed, we will ease up on the accelerator,” Bernanke said.

Bernanke’s job today, in addition to putting fears of an imminent taper to rest, was to remind Wall Street that Main Street exists and is still hurting. Even though corporate profits are high and the Dow and S&P are in precrisis territory, the lingering unemployment crisis is a reason for the Fed to keep on printing money, buying bonds, and holding short-term interest rates near zero. And furthermore, since inflation is still a nonissue, there’s no real reason for the Fed not to keep stimulating things.

“Our purchases are tied to what’s happening in the economy,” Bernanke said, after saying that the Fed would consider tapering the bond-buying programs when the unemployment rate shrank to 7 percent.

These are all simple concepts, which investors should be able to understand. And yet, hyperinflation worrywarts and shrieking ZeroHedgies remain convinced that total destruction is just around the corner. And as the certainty of the investor class that Bernanke is in over his head grows, half of his job has become asserting a simple message, over and over again: “Chill. We got this.”

Wall Street’s skittishness is somewhat understandable. Right now, the fates of the markets (and those who make a living trading on them) are more dependent upon the Fed’s actions than at any point in recent economic history. The low-rate, high-uncertainty environment and the Fed’s inconsistent communications mean that hedge-fund managers can concoct all the brilliant macro trading strategies they want, and Bernanke can shred them with a single offhand comment to a reporter. Some investors channel their feelings of existential meaninglessness into hatred for Bernanke. Others simply wait and worry.

To his credit, Bernanke is getting better at communicating the Fed’s objectives clearly. He’s gone from being a cryptic oracle to a patient teacher who calmly teaches the same lesson over and over again, until his students show they understand. And he may be savvier than he lets on. Some suspect that his “taper” remarks weren’t a gaffe and were, in fact, a carefully calculated trial balloon, meant to test the market’s reaction to a hint about the end of the Fed’s bond-buying.

Either way, Bernanke got his answer: The market is still a scared animal and will lash out at any unfamiliar presence it senses. Eventually, when they decide the time for tapering is right, he and the rest of the Fed’s open market committee will have to figure out how to communicate it in a way that doesn’t spark a market collapse. For now, though, he seems content to be back in reassurance mode.