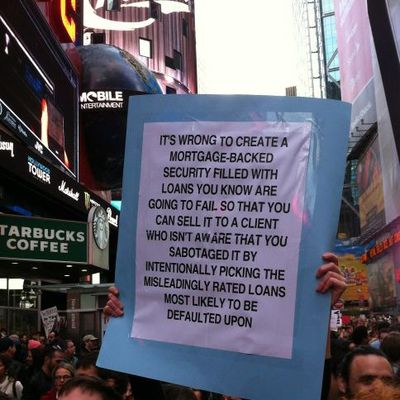

If you read today’s Wall Street Journal story about the return of the synthetic collateralized debt obligation, you might be thinking, Ooh, synthetic CDOs! I remember those from 2007. And then you might recall the famous Occupy sign, or Warren Buffett calling derivatives “weapons of mass destruction,” or vaguely remember that Goldman Sachs got sued for a deal involving CDOs, and you might start to get angry, because didn’t this end kind of poorly last time?

It did, of course. But I submit to you that the re-popularization of synthetic CDOs among certain investors may not be something to freak out about, and that if it is something to freak out about, it is probably not something to freak out about yet.

For starters, the market for synthetic CDOs is still tiny, and most investors want nothing to do with them. As the Journal tells it, a “small number of institutional investors” are now looking to get back into the synthetic CDO business and have approached two banks — JPMorgan Chase and Morgan Stanley (notice: no Goldman!) — for help in assembling some new ones. Those banks may not end up actually issuing the CDOs, if they can’t get enough investors interested. But they’ve been approached by interested parties, which “shows that demand for higher returns is intense,” at least among a handful of people.

That handful of people is also being extremely careful. The lingering impression we are meant to get from the Journal’s report is that the new synthetic CDOs are being approached with the same kind of what-could-go-wrong naïveté that marked the last big wave. But what stuck out to me in reading about the return of synthetic CDOs is how much different the market is this time around. In particular, sentences like these lower my blood pressure:

“Since the crisis, credit-rating firms have made it tougher for deals to get top-notch letter grades.”

“Hedge funds are considered the likeliest buyers for riskier parts of the deals, which are the first slices to absorb losses.”

“In another difference, buyers of the least-risky slices would get more protection against potential losses than buyers of similar slices did before and during the crisis, said people familiar with the discussions.”

Basically, synthetic CDOs are now being viewed in the market as risky, non-investment-grade securities that should be the terrain of extremely sophisticated investors who know what they’re doing, rather than being given AAA ratings and passed along to poor schmucks who are under the impression that they’re entirely safe. That’s sort of what we want, no? After all, the problem with the last wave wasn’t just that synthetic CDOs were being sold — it was also that investors weren’t always clear about what they were buying.

It may be that, as critics like Paul Krugman and George Soros say, synthetic CDOs are too dangerous to exist and should be outlawed entirely. But barring that, the best thing we can do to prevent another 2007-style CDO disaster is to move synthetics into public view (by encouraging listed, rated issuances instead of custom, bilateral deals that can hide in the shadows), make sure credit rating agencies are rating them correctly and banks are providing full disclosure to investors, and get regulators to throw a huge amount of yellow caution tape around every synthetic CDO on the market, making sure that sophisticated investors who want risky assets are able to get them, while making sure that they stay out of the hands of too-big-to-fail banks and investors who don’t know what they’re doing.

From the looks of the Journal’s story, that’s all happening relatively effectively now. That could change, as more institutions dip their toes back in the synthetic CDO pool and less media attention is paid to each successive issuance. But for now, the market seems to be much, much more wary than it was. Which means that, even though we should watch the synthetic CDO’s resurgence carefully, it’s probably not time to panic yet.