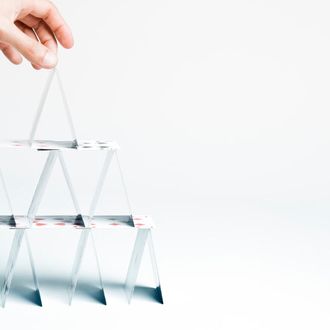

S&P, the ratings agency that became notorious for giving AAA ratings to piece-of-crap mortgage-backed securities during the financial crisis, while their analysts privately e-mailed each other bons mots like “Let’s hope we are all wealthy and retired by the time this house of cards falters,” has a message for the investors who lost billions of dollars because of its flawed ratings: It never meant for you to rely on those ratings.

That’s essentially the claim being made by S&P in response to a lawsuit brought against it by the Justice Department. S&P is claiming that the ratings it gives are simply opinions, and that obviously they’re not meant to be taken at face value, even if they do claim to be impartial and objective:

S&P said in its request to dismiss the case that the government can’t base its fraud claims on S&P’s assertions that its ratings were independent, objective and free of conflicts of interest because U.S. courts have found that such vague and generalized statements are the kind of “puffery” that a reasonable investor wouldn’t rely on.

See, investors? Those AAA-rated CDOs weren’t S&P’s attempt to scratch the backs of the banks who issued those securities (and who pay for the ratings on them), nor were they a failure to give investors (many of whom have fiduciary duties to invest only in top-rated securities) the official all-clear. They were just giving you a friendly heads-up, a nudge in the right direction, which you were free to heed or ignore. Try to keep up next time.