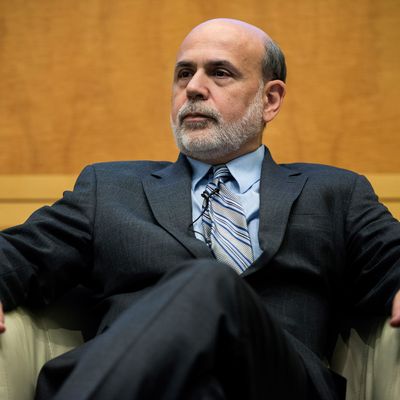

It’s been widely expected that, at some point this winter, Ben Bernanke and the rest of the Federal Reserve’s monetary policy wizards would decide to slowly lower the dosage of morphine that the struggling economy was receiving, in the form of tens of billions of dollars of bonds the Fed has been purchasing every month for several years. The timing of that dosage-lowering process, which economists have been calling the “taper,” has been extremely important to Wall Street investors, who have gotten used to all that morphine, and now they have their answer:

The time for tapering is now.

The actual change announced today was extremely small: The Fed is shaving $10 billion off its $85 billion monthly bond purchase. So there will still be help for the economy, in the form of loose monetary policy, until we see much better unemployment figures.

The truly important things about today’s announcement had to be read between the lines. And they are:

1. Janet Yellen now has her marching orders.

Ben Bernanke really, really wanted to be the Fed chief who brought the economy back to prosperity from a deep and bruising recession. He couldn’t quite do that in time – he steps down in January, and unemployment, while at 7 percent and shrinking, is still large enough to forestall claims of a fixed economy. What Bernanke could do is effectively give orders to his successor, Janet Yellen. As of today, Yellen has no real choice about what to do with her first year at the top of the Fed. In order to avoid a jarring change of course, she has to continue tapering, at a pace slow enough not to spook the markets, and while maintaining clear guidance about when the monthly bond purchases will hit zero. Yellen’s Fed will be making these moves, officially, but they’re effectively being choreographed today by Bernanke.

2. The Fed is being extremely careful.

The worry of progressive economists, for years, has been that the Fed would pull back stimulus before the economy was ready to stand on its own legs. It’s now clear that’s not going to happen. Today, at the press conference announcing the taper, Bernanke warned people not to expect a “preset course” from the taper, and emphasized that the Fed wasn’t going away altogether – it was just making one program smaller. He’s not saying, “We’re going to be done stimulating in May,” or even, “We’re going to be done stimulating once unemployment hits 6.5 percent.” He’s saying, “Look, we can’t keep stimulating forever, so expect some changes. But don’t worry — we’ll be gentle.”

3. Wall Street is going to have a rockier 2014.

The stock market is rising on the Fed’s news, in part because investors had priced in a bigger taper and were pleasantly surprised at how small it was. But the mood on Wall Street will quickly fade. The Fed’s bond-buying program has effectively been making it very easy for investors to make money for years, and the prospect of losing that stimulus (and the market support it provided) is going to make a lot of those investors very insecure.

This is especially true in the bond markets, where the Fed and other central banks in the G4 have been among the biggest buyers of bonds in the world, and the single biggest buyer last year. Now, Wall Street bond departments are seeing their biggest customer walk slowly toward the door.

4. It’s probably not too late to get a mortgage.

For normal people, the only question that matters about Fed announcements is, “When will interest rates go up?” The answer, this time, is “Probably not soon.” The Fed had previously said that it would aim to raise interest rates when unemployment fell to 6.5 percent. (It’s now at 7 percent.) Today, it gave home buyers a little more time to lock in low interest rates, by saying that it will likely keep rates near zero “well past the time that the unemployment rate declines below 6-1/2 percent.”

So, if you’ve been on the fence, buy that house! A few more months to borrow cheap money is Ben Bernanke’s Christmas present to America.