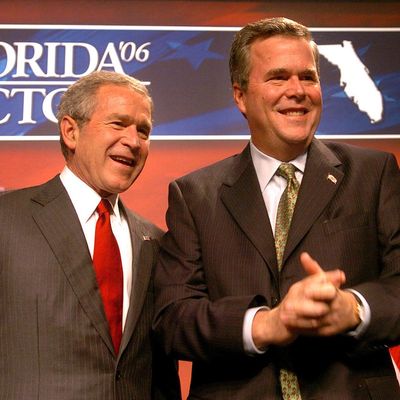

George W. Bush passed a sweeping across-the-board tax cut in 2001, promising his plan would promote faster economic growth while still allowing budget surpluses. Instead, Bush’s plan brought back the structural deficits that had disappeared during the 1990s, along with a mediocre recovery that was itself inflated by a housing bubble, the popping of which culminated in the deepest economic crisis since the Great Depression. You might think that the brother of that guy would go out of his way to prove that he has different ideas for fiscal policy. Instead, Jeb Bush has unveiled his tax-cut plan, and it’s the same thing his brother did, only more extreme.

Bush’s plan, unveiled in a Wall Street Journal op-ed, would replicate his brother’s program in extremis. Like Dubya, Jeb would reduce income taxes at the bottom of the earning scale. Dubya reduced the estate tax; Jeb would eliminate it entirely. Dubya cut the top tax rate to 35 percent, while Jeb would lower it all the way to 28 percent. Unlike his brother, he would also slash corporate tax rates, from 28 percent to 20 percent.

George W. put a number on the size of his tax cut. He proposed a tax cut of $1.6 trillion over a decade, which Congress ultimately reduced to $1.35 trillion, though subsequent tax cuts pushed the size higher. It is impossible to precisely measure the impact of the Bush tax cuts on either the budget or the economy, since nobody can know what would have happened under identical conditions if the tax cuts had never been enacted.

But the results certainly were not good. Economist William Gale, using mainstream forecasting assumptions, estimated that the Bush tax cuts slightly reduced economic growth, as the (small) negative effects of higher long-term deficits outweighed the (even smaller) positive incentive effects of lower rates. The biggest impact of the Bush tax cuts was not its meager, indirect effects on growth, but its large, direct effects on income and the federal budget: Revenue cratered, and taxpayers — disproportionately those with higher incomes — had way more money.

Jeb Bush, unlike his brother, has not put a number on the size of his proposed tax cut. Indeed, he has not even described his plan as a “tax cut” — Bush’s op-ed calls his proposals “reforms,” a “complete overhaul of the tax code,” “policies,” or at one point “relief and reform,” perhaps to spare him from acknowledging its impact on the deficit or any trade-offs it would require. He promises to “cap the deductions used by the wealthy and Washington special interests,” implying that he will stick it to the rich.

But a very large and very regressive tax cut is exactly what Bush has described here. It is a provable fact, despite his effort to escape scrutiny through vagueness. In 2012, the Tax Policy Center analyzed proposals by Mitt Romney, which ran along the same lines as what Bush has put forward. Like Bush, Romney proposed to reduce the top tax rate to 28 percent, eliminate the estate tax, and eliminate the taxes that pay for Obamacare. Romney also called his plan a “tax reform,” and promised it would not add to the deficit. The Tax Policy Center found that the loss in revenue from these proposed cuts was so large that even the complete elimination of every deduction and loophole that benefits the rich would not fill the fiscal hole. Therefore, enacting his proposed rate cuts without reducing revenue would have resulted in a tax hike on the middle class to pay for the tax cut for the rich.

Bush, unlike Romney, does not promise revenue neutrality. But he is offering essentially the same goodies to high-income taxpayers. So his huge tax cut for the rich would — as a necessary, arithmetic outcome — result in some combination of higher taxes for the non-rich and reduced revenue — ergo, higher debt. Bush has not explained what spending he would cut in order to offset the higher deficits his tax cuts would usher in. He has proposed to raise the Social Security retirement age, but the savings of these cuts would be minuscule in comparison with the revenue loss.

For obvious reasons, Bush does not cast his policies as a reprise of his brother’s. Instead he argues that they replicate the success he claims to have brought about as governor of Florida:

I know that enacting these policies works because I’ve done it before. As governor of Florida, I cut taxes every single year — returning a total of $19 billion to Floridians. The state’s economy took off, growing at an average rate of 4.4%. Households saw bigger paychecks as median incomes rose by an average of $1,300. Florida’s pro-growth climate created 1.3 million new jobs.

In fact, economists have examined the performance of Florida’s economy under Bush and found that the high rates of growth were attributable to a housing bubble much larger than the one in the country as a whole. (Jim Tankersley has a particularly strong analysis, but others have reached the same conclusions.) During Bush’s tenure, housing prices in Florida soared, fueling economic growth. Bush was fortunate to leave office at the beginning of 2007, before the popping of the housing bubble wreaked havoc on Florida’s economy and state budget.

The Florida economy under Jeb Bush was the American economy under George W. Bush, but more so. His tax plan is the same thing. It has been clear for months that the policy direction of the Republican Party is a return to Bushism. Marco Rubio is trying this too, as is John Kasich. The odd proposition of the Jeb candidacy is that the man best positioned to sell this idea to a skeptical America is another guy named Bush.

Update: Some reporters are swallowing the spin Bush is using to pitch his plan as a progressive attack on tax loopholes enjoyed by the rich. Alan Rappeport of the New York Times leads his story on Bush’s plan by asserting that Bush “is challenging some long-held tenets of conservative tax policy with a populist plan that targets valuable deductions that benefit the wealthy and the ‘carried interest’ loophole that has enriched hedge fund managers for years.” It is true that Bush has come out against the carried-interest loophole. But that is the only specific loophole for the rich he has targeted. The rest of his “reforms” are unspecified.

And again, as a matter of simple math, even if Bush eliminated every possible deduction for the rich, his elimination of the estate tax and reductions in the top tax rate would furnish the rich with a large tax cut. A plan to cut taxes for the rich is not a departure from long-held tenets of conservative tax policy. It is exactly that policy. Which is why Bush has won the favor of the very people who have designed those policies in the past.