“I’ll be gone, you’ll be gone.” Wall Street executives once used this phrase so frequently, it was adapted into an acronym. The “I.B.G.– Y.B.G.” problem is that, for many financial brokers and executives, there’s little downside to making risky bets. If your faith in a certain package of mortgage-backed securities pays off, your annual bonus will go up. If it fails, your firm will take the hit. (And if the bet pays off in the short term but tanks your bank and/or the global economy in the long run, well, in the long run, we’ll all be comfortably retired.) Which is to say, you are a poker player in a casino that charges all your losses to your employer.

But big government is about to encroach on this sterling example of free-market dynamism. On Thursday, regulators announced a new rule prohibiting top Wall Street executives from collecting their bonus pay until four years after it’s earned (in the wake of the financial crisis, many Wall Street firms voluntarily adopted a three-year bonus deferral). If an executive’s risky decision-making causes his or her firm to take on a huge loss, the bank can “claw back” that bonus pay for up to seven years. The rule was first announced by the National Credit Union Administration. Other regulators, including the Federal Reserve and the Securities and Exchange Commission, are expected to follow suit, Bloomberg reports.

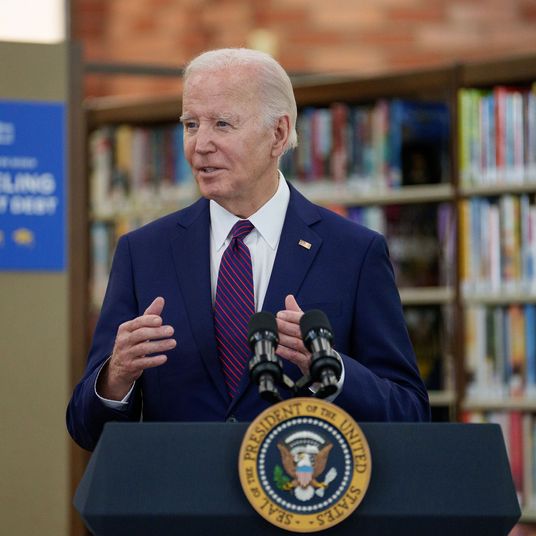

The announcement fulfills one of the core provisions of the 2010 Dodd-Frank financial-reform law. For six years, regulators and lobbyists have arm-wrestled over how to interpret and enforce the provision. In 2011, the Feds scrapped one version of the rules amid a wave of criticism. President Obama met with financial regulators in February, informing them that he’d really like to see the issue resolved before the end of his term. The new rule is far more stringent than its predecessors. However, by narrowly targeting banking executives, it will do nothing to curb excessive risk-taking among hedge-fund managers and other traders.

Another issue with the rules: They don’t nationalize the commanding heights of the economy. Which is to say, they leave Wall Street firms with enough economic power to use the prospect of new regulations as an excuse to increase executive compensation. Per The Wall Street Journal:

If federal regulators influence clawback decisions, “there’s a high probability it will drive people out of the heavily regulated part of the financial-services industry,” said Alan Johnson, managing director of Johnson Associates Inc., a compensation consultancy that closely tracks Wall Street. To retain talent, banks and other affected institutions “will just have to pay more” due to executives’ fears that “you may have to give some of [the money] back.’’

Still, the rule moves us a little bit closer to a sane financial system. And it’s one of several recent moves that the Obama administration has taken to shore up its legacy on financial reform. Earlier this month, regulators passed a new rule forcing brokers who handle retirement accounts to put their clients’ financial well-being ahead of their own. That may not sound like much of a concession, but in the more sociopathic corners of our financial industry, it is. Traders really like gambling with retirement money. But most retirees just want a safe, stable portfolio. Thus, finance lobbyists fought like rabid dogs to kill the rule. Happily, through the determination of the White House, regulators, and the AARP, the lobbyists lost.