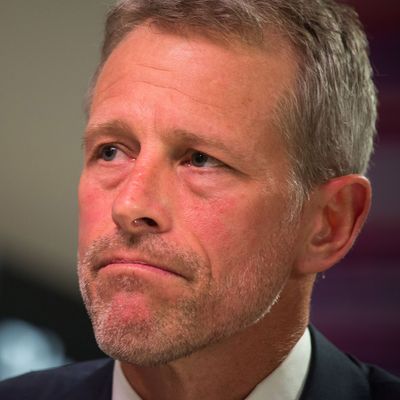

Few hedge-fund managers took a harder public stand against Donald Trump than Whitney Tilson of Kase Capital Management, who often refers to our president-elect as “Con Man Don.” Ever since Trump won the Republican nomination for president, Tilson has sent out a steady stream of emails — usually three or more a day — to his list of 3,000 friends. He covers the latest news of Trump’s outrages, from taxes and charities to sex scandals, becoming something of a one-man news-clipping service.

By Wednesday morning, as stocks made a big comeback rally after a near-800-point plunge late Tuesday night in pre-market futures trading on the prospects of a Trump victory, Tilson was busy unloading shares into the rally.

“I was at 60 percent cash coming into today, and I’m selling stocks today,” he told New York. Tilson said it was the third time in 18 years that he made bearish portfolio decisions on a macroecononic view, the other two being the dot-com and housing bubbles.

During the ugly campaign, Tilson said that he didn’t mind losing friends over the election — the issues were just too important. But by Wednesday morning, the stunned investor sent a congratulatory note to Anthony Scaramucci, one of the handful of hedge-fund financiers who stuck by Trump. “Hi Mooch. Congrats—what you did here will go down as one of the boldest moves in Wall Street history,” he started off.

“I fear the worst,” he continued. “But I will also be praying for the best—namely that you are right and I am wrong: that [he’s] the man you think he is, and that you and other advisers will be able to influence him positively.”

His prayers notwithstanding (Tilson had also told friends to pray for a Hillary victory late Tuesday night), the hedge-fund manager didn’t trust the bounce on Wednesday. He used it as an opportunity to trim his top position, Howard Hughes, a real-estate company rebuilding the South Street Seaport — even though he thinks Trump will, if anything, be good for New York real estate. “I still like it, but I don’t want to have supersize positions in a much more uncertain world,” Tilson explained. Howard Hughes is still his largest holding, but it’s 6 percent, not 8.5 percent, of his fund.

Others agreed that bounce-back was nothing to get too excited about. “Just because the market has rallied back 800 or 900 points, investors should not take that as a profound shift in sentiment,” Josh Brown, CEO of Ritholtz Wealth Management, said on CNBC’s Halftime Report. “People got carried away with protection [Tuesday night], and it’s all unwinding.”

“The ebullience will subside,” said Brown, who also tweeted that he would “enjoy my coming time as a dissident” during the Trump administration.

Tilson said he had done everything in his power to elect Clinton, which included going door-to-door in the swing stage of Pennsylvania, and donating about $40,000 to Clinton and other Democratic candidates.

“I am now going to do everything in my power to make the best of a bad situation,” he said. “There is a possibility Trump could govern from the center and cut deals with Democrats on certain issues and really be a transformative president in a positive way,” he said. But, he added quickly, “I don’t think that’s likely. Putting on my hat as a hedge-fund manager, I think uncertainty is going to reign for the next four years, and markets hate uncertainty” — thus his decision to sell stocks. “There’s a meaningful possibility that global trade could be very negatively affected and tip the world into a recession.”

That prospect didn’t seem to be worrying billionaire investor Carl Icahn, who had been warning of a recession and shorting the market (to great losses) for the past year. Icahn, who was Trump’s first big financial supporter, said on CNBC Wednesday that he had left Trump’s victory party early to go home and buy $1 billion worth of stocks, starting at midnight.

Whatever happens, the finance mavens know they aren’t the ones who will be hurt the most in a Trump presidency. After all, they’re expecting to get a big tax cut. Barry Ritholtz, the chief investment officer of Ritholtz Wealth Management, had a suggestion for his clients in a note Wednesday morning: “I would be remiss if I didn’t mention the possible setbacks to social progress made over the past eight years. Several of you expressed concern about this in emails last night; my suggestion is to think about how you might use your Trump tax cut windfall to follow your conscience in promoting the issues you deeply care about.”