The most painful thing involved in even thinking about revenue-neutral “tax reform” along the lines congressional Republicans and the Trump administration are allegedly considering is, of course, that one person’s “tax loopholes” are another’s entirely justifiable economic or social policy. And if you are a Republican, you have to sweat the possibility that some anti-tax activist will label the elimination of a deduction or credit a “tax increase,” with all the political heat that generates.

But there is one “loophole” that anti-tax activists would love to kill, partly on grounds that it provides an incentive to higher taxes, and partly because it is perceived to benefit “liberal Democrat” states disproportionately: the federal deduction for state and local income taxes. And sure enough, it is popping up in various GOP “tax reform” plans. Sahil Kapur explains:

Ditching the deduction would raise federal tax revenue by $1.3 trillion over ten years, according to the Tax Policy Center, which found that 90 percent of that increase would be paid by taxpayers who earn $100,000 or more.

The largest beneficiaries of the tax break are California, New York and New Jersey, all relatively high-tax blue states, which eat up more than a third of the nationwide benefits, according to the nonpartisan Committee for a Responsible Federal Budget.

There are also important cities with their own income taxes, including, of course, New York, along with Baltimore, Birmingham, Detroit, Kansas City, Louisville, and St. Louis. Counties in Indiana and Maryland also impose income taxes.

Given the trouble Republicans have in coming up with tax-policy proposals that discomfit the wealthy, you would indeed figure the “reform” would be central to whatever the White House and congressional GOP leaders decide on in the coming weeks. It is already in Paul Ryan’s tax proposal, and will very likely be in Kevin Brady’s. The Trump administration is said to be considering it.

There are two problems, though. First, there’s a wealthy New York taxpayer named Donald Trump who could well be one of the nation’s top beneficiaries of the deduction for state and local income taxes. Even if he doesn’t mind giving it up for lower tax rates, the very issue draws attention to his refusal to release tax returns. After all, inquiring minds will want to know how much POTUS is deducting in state and local taxes.

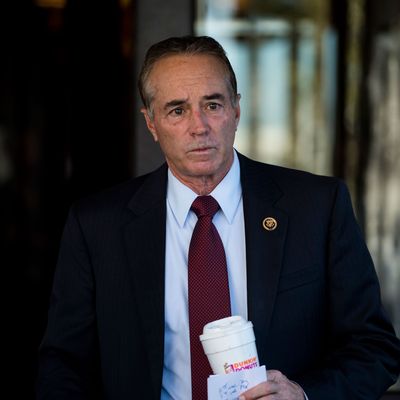

The second and perhaps larger problem is that nobody loves the state and local deduction more than Republicans from those high-tax “Democratic” states. It is, after all, their constituents (and donors!) who get this particular subsidy. As Kapur points out, there are 28 House Republicans representing California, New York, and New Jersey. That’s four more than the number of House Republicans the leadership can afford to lose in what will otherwise likely be a party-line vote on this year’s tax bill. At a minimum, Paul Ryan and company will have to buy them off with some kind of offsetting benefits if there’s any hope of enacting a bill.

Republicans may, of course, wind up deciding not to bother with revenue neutrality or offsets or the closing of “loopholes” — even those perceived as helping Democrats — in which case everyone in the GOP can happily chow down on tax cuts after swallowing all their Obama-era rhetoric about budget deficits.