All year long, as congressional Republicans stumbled and mumbled their way through a series of legislative fiascos — most notably on health-care policy — you heard talk that if they could only make it to the part of their agenda involving tax policy, all would be well! After all, everybody — or certainly every Republican — loves tax cuts! And it’s something the GOP managed to pull off repeatedly the last time it controlled Congress and the White House, in the George W. Bush years. So how hard could it be?

Very hard, it seems, now that summer is over and the many months of discussions and public throat-clearing on the subject have come to an end. Somehow, Republicans have managed to complicate the simple matter of cutting taxes in multiple ways, as Perry Bacon, Jr. explains at FiveThirtyEight:

In theory, tax reform could be much easier to accomplish than reforming health care: The Republicans could put forward a tax plan (as the party has successfully passed in the past) that cuts taxes for tens of millions of people across economic brackets and ignores whatever implications that might have for the deficit. That might get some level of pushback from budget hawks, but unlike the Obamacare repeal effort, it would have no obvious mass constituency of angry people worried that something was going to be taken away from them. And Republicans tend to be in more agreement among themselves on tax policy (lower is better), which could defuse some of the internal divisions that made health care so difficult for them.

But nothing has been easy for Trump and the Republicans in Congress this year. And the early signs are that the Republicans running Washington, who debuted an outline of their tax policy Wednesday, are taking many of the same steps that plagued their health care efforts.

As Bacon goes on to itemize, Republicans have already abandoned the balanced approach that makes tax cuts appealing to voters across the income spectrum; refused to work with Democrats and thus placed their efforts hostage to near-unanimity among Senate Republicans; made promises (or let the president make promises) about who will and won’t benefit from tax cuts they have no intention of keeping; and setting “unrealistic timelines” for themselves, which the health-care experience should have warned them against.

But that’s not all. Beyond the mistakes Bacon notes, there are three other ways in which Republicans have complicated the simple politics of a modest tax cut to their great peril.

First, they have gotten too greedy about tax cuts, which has led them beyond what they can paper over with “dynamic scoring” (extremely dubious claims about the economic growth tax cuts will generate, making them pay for themselves) and simple indifference to deficits. That means they are now bandying about revenue raisers that special interest opponents will invariably label “tax increases.” An example is a very likely end to the deductibility of state and local taxes, which will cause a lot of heartburn among House Republicans representing high-tax states like California and New York. Another problem-causer, which isn’t even a revenue raiser, is the proposed doubling of the standard deduction, which happens to reduce the value of the mortgage interest deduction (and for that matter, other tax write-offs), arousing the wrath of the real-estate lobby. These are avoidable conflicts for lawmakers who know how to keep it simple.

Second, and partly because of the greed-induced deficit problems, some Republicans want to combine tax cuts with domestic spending cuts. That’s in fact right there in the budget resolution the House Budget Committee has already adopted. Now most Republicans support domestic spending cuts as a worthy end in themselves, but combining them with tax cuts exposes them to the argument that they are cutting spending that benefits the poor and the middle class in order to cut taxes on the wealthy and corporations. Suddenly the friendly tax-cutting Santa Claus looks more like the Christmas-stealing Grinch.

And third, though this complication remains up in the air, some Republicans want to complicate tax cuts with yet another effort to repeal and replace Obamacare. Since every GOP health-care bill this year has included both major spending cuts and also some health-care-related tax cuts, going in that direction would screw up every major budget calculation made up until now.

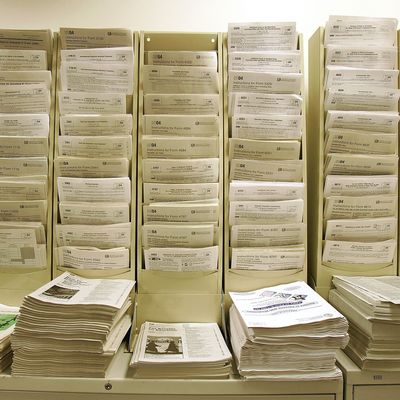

The grand irony is that Republicans clearly want to sell their tax proposals as focused on “simplification” of the tax code — a nifty way to disguise the lowering of top rates — even as their own legislation gets more complicated and divisive every minute. At present, the GOP is in dire danger of taking that easiest of policy initiatives — a broad-based tax cut — and turning it into a mess more convoluted than the Internal Revenue Code.