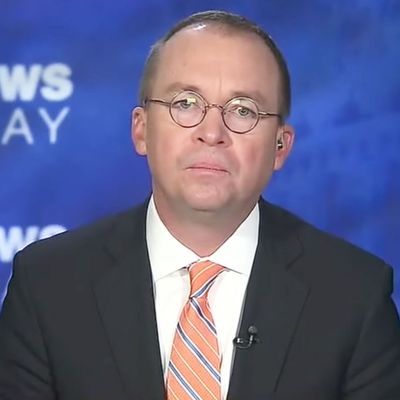

Friday, the Tax Policy Center published an analysis of the Republican tax-cut plan, finding that nearly 80 percent of its benefits would accrue to the highest-earning one percent of the public. Asked about these findings, White House Budget Director Mick Mulvaney called the center the “National Tax Center,” erroneously charged that a former economic adviser to Joe Biden works there, and used this imagined fact to discredit its calculations (“It’s not surprising that, you know, a former chief economic for a Democrat vice-president doesn’t like a Republican tax plan.”)

A slightly more coherent version of the argument comes from the The Wall Street Journal editorial page. The Journal dismisses the Tax Policy Center’s findings as “propaganda,” arguing that the Republican plan is not completely finished. That is true: The GOP framework omits key details, as the Tax Policy Center acknowledges (“Many aspects of the plan were unspecified or left to be determined by the tax writing committees in Congress. The Tax Policy Center (TPC) has completed a preliminary analysis of the proposals contained in the unified framework based on previous proposals such as the House Republican leadership’s ‘A Better Way’ blueprint and the Trump administration’s April outline,” read the third and fourth sentences of the report).

Republicans would prefer to use this ambiguity to prevent any analysis, so that there is no hard evidence available for a public debate. Instead, TPC filled in the details with the elements of the plan that House Republicans proposed. The Journal has repeatedly gushed about the House plan, so it would be very strange for the Journal to attack the TPC for assuming House Republicans will take up the ideas the Journal has urged them to take up. If House Republicans change the contours of their proposal, then the Tax Policy Center will publish a new analysis reflecting the changes.

The Journal editorial argues that, while journalists describe the Tax Policy Center as bipartisan, “Its record of hostility to any GOP tax reform that cuts tax rates shows the opposite.” It is true that the TPC regularly publishes reports indicating that Republican tax proposals confer a large proportion of their direct benefit upon the highest-earning households. “The Tax Policy Center hates Republicans” is one way of explaining this fact pattern. Likewise, the FBI’s long-standing pattern of charging members of the Gambino family with federal crimes could be explained as FBI bias against the Gambinos. On the other hand, it might just be the case that the Gambino organization commits a lot of crimes and TPC calculations keep showing that Republican tax-cut plans benefit the rich because Republican tax cut plans always benefit the rich.