Americans like tax cuts. Since 1980, a plurality of voters have approved of every major tax cut that Congress has considered.

The conservative donor class has deep pockets. And they’ve invested tens of millions of dollars into advertisements for President Trump’s tax-cut plan this year. Meanwhile, the nation’s most-watched cable news network has been running unpaid infomercials for that legislation on a near-daily basis, for months.

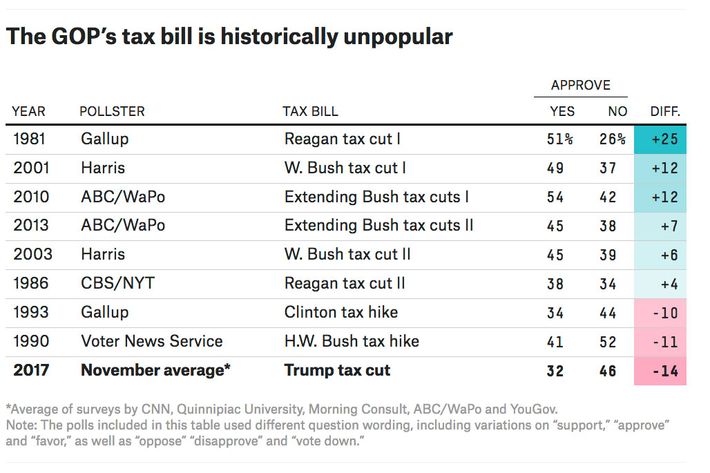

Given these facts, one would expect the Trump tax cut bill to be quite popular. And yet, it is actually the most widely-reviled piece of tax legislation in modern American history. As FiveThirtyEight’s Harry Enten notes, Americans currently view the GOP plan more negatively than they did the tax hikes passed under Bill Clinton and George H.W. Bush.

This opposition appears to be driven by a widespread belief that the tax package will primarily benefit the wealthy. A recent Quinnipiac poll found 61 percent of Americans saying that the bill would mainly help the rich, while just 24 percent said that it would be best for the middle class. This constitutes a remarkable triumph of objective reality over “alternative facts.” According to the Congressional Budget Office, households earning more than $1 million a year stand to gain, on average, nearly $60,000 in 2019 from the GOP plan — meanwhile, those making under $30,000 will actually pay higher taxes. By 2027, all households earning less than $75,000 will (on average) be paying more of their income to Uncle Sam than they do currently.

And yet, the public isn’t just seeing through the GOP’s lies — they’re also refusing to believe the honest parts of the Republican pitch. While the Trump tax cuts are skewed to the upper class, a large majority of Americans will pay lower taxes next year if the plan is passed. And yet, only 16 percent of Americans told Quinnipiac that the GOP plan would reduce their taxes. A Politico/Morning Consult poll similarly found only 20 percent of Americans saying they expected to pay less under the Republican plan. In both those polls, nearly twice as many voters said they expected to pay more (the rest were uncertain).

This is a truly remarkable accomplishment: Despite investing tens of millions of dollars into propaganda for their tax plan, conservatives can’t even get a plurality of Americans to believe one of the few, objectively true points in its favor. Instead, they have found a way to make a tax-cut bill unpopular, for the first time in at least four decades.

Fortunately, for the plutocrats who bankrolled that propaganda, none of this appears to matter: The GOP donor class may have failed to buy off the public, but they seem to be having much better luck with the U.S. Senate.