Congressional Republicans said that their No. 1 priority was to deliver tax relief to the middle class. Then they released a pair of bills that raised taxes on some middle-class households in order to finance a 15-point reduction in the corporate tax rate.

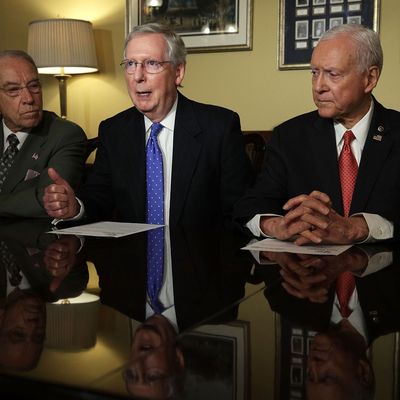

The Senate version of the Tax Cuts and Jobs Act made the GOP’s relative indifference to middle-class tax relief especially stark. In order to comply with arcane budget rules, Mitch McConnell’s caucus had to write a bill that wouldn’t add to the deficit after 2027. The upper chamber solved this puzzle by phasing out most of their bill’s middle-class tax cuts in 2026, while making corporate tax cuts — and provisions that raised taxes on a broad swathe of the middle class — permanent.

Still, Republicans could tell a story about how this wasn’t actually a betrayal of America’s “forgotten men and women.” The party didn’t let Wall Street keep its tax cuts — while clawing back Main Street’s — because it cared more about helping the former than the latter. Rather, the GOP had to make the business tax cuts permanent because a temporary corporate cut would have created investment-suppressing uncertainty. And the whole point of cutting corporate taxes is to boost private-sector investment — and thereby, middle-class wages and jobs. Obviously, if Republicans had the power to both pass a giant permanent cut to the corporate rate and give more tax relief to ordinary Americans, they certainly would.

This story is halfway coherent, if largely fictional. But, alas, the GOP couldn’t curb its insatiable appetite for corporate tax cuts long enough to maintain their tale’s credibility: On the night before releasing their bill, Senate Republicans added a last-minute provision that declares their party’s disregard for the middle class in unequivocal terms. As the Washington Post’s Heather Long writes:

In a section titled “Revenue-Dependent Repeals,” the Senate plan would prevent some tax hikes on businesses from going into effect in 2026 if tax revenue hit a certain “trigger” level. In total, businesses would get nearly $120 billion more in breaks in 2026 and 2027 if the trigger goes into effect.

Republicans say it’s a sign of fiscal responsibility. The additional corporate tax cuts only kick in if the government is bringing in more money than expected.

To review: Senate Republicans wrote a bill that phases out tax cuts for the middle class in 2026, while keeping corporate America’s cuts on the books. They insisted that they wanted to cut taxes on the middle class more, but fiscal constraints simply wouldn’t allow them to. Then, they went back into their bill and added a section stipulating that, should their bill expand the deficit less than expected — which is to say, should they have fewer fiscal constraints — then all unexpected revenue should be immediately spent on making corporate America’s permanent tax cuts larger, even as some middle-class families see their tax bills skyrocket.

Why would you put this in your tax bill? Is shelling out an entirely theoretical $120 billion to big business really worth so explicitly exposing your party’s unfaithfulness to its voters?

Perhaps, like so many cheaters before them, the GOP wants to be caught.