The bad guys won. In the most unequal advanced democracy on planet Earth — where middle-class wages are stagnant, 41 million people live in poverty, corporations celebrate record profits, and the richest one percent of individuals claim more wealth than the bottom 90 percent combined — the Republican Party has found a way, over the long term, to raise taxes on the poor to slash them on plutocrats.

The GOP tax bill isn’t the most dangerous legislation of the Trump era (a distinction that belongs to the Republicans’ various schemes for taking health care away from 20 million people). But it might be the most dispiriting to anyone with a taste for democracy. Despite promising Americans a “middle-class tax cut” that would give no benefit to the rich; despite the utter lack of a plausible policy rationale for slashing taxes on wealthy investors at a time of high inequality and a soaring stock market; despite an urgent need for new government spending on an opioid public health emergency and a devastated Puerto Rico; and in defiance of reams of public opinion data showing mass opposition to the Republican plan — even among the party’s own base — GOP lawmakers dutifully honored their fiduciary duty to their billionaire investors.

But don’t Google “Canada immigration process” just yet.

While the intended consequences of the Trump Tax Cuts are contemptible, the legislation’s unintended consequences could actually, eventually make this country a better place. There’s good reason to think that the bill’s immediate effects will be less destructive than liberals feared — and that, in the long run, its passage could actually make the United States a more progressive nation.

Nothing is certain. We could be on the cusp of neo-feudalism (or nuclear war). But the accelerationist case for the Trump Tax Cuts is surprisingly strong. Here are six reasons for progressives to stop worrying and learn to love the GOP tax scam:

1) It will help Democrats take back power.

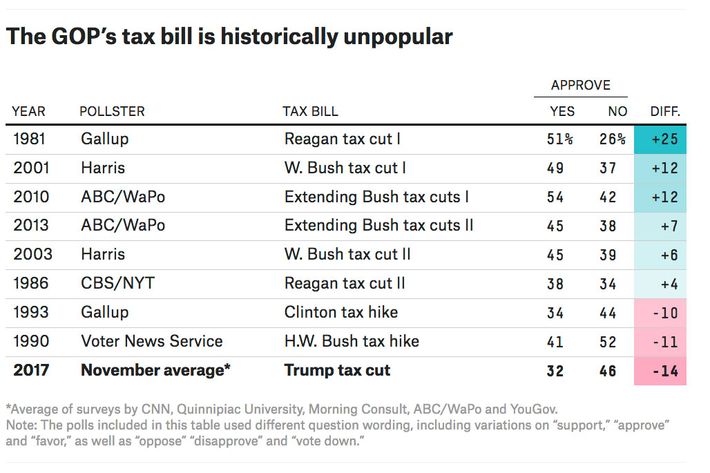

The worst thing about this bill from a democratic perspective is also the best thing about it from a Democratic perspective. The “Tax Cuts and Jobs Act” is the most unpopular piece of major legislation in three decades — and the first tax-cut bill to earn a net-negative approval rating since at least 1980.

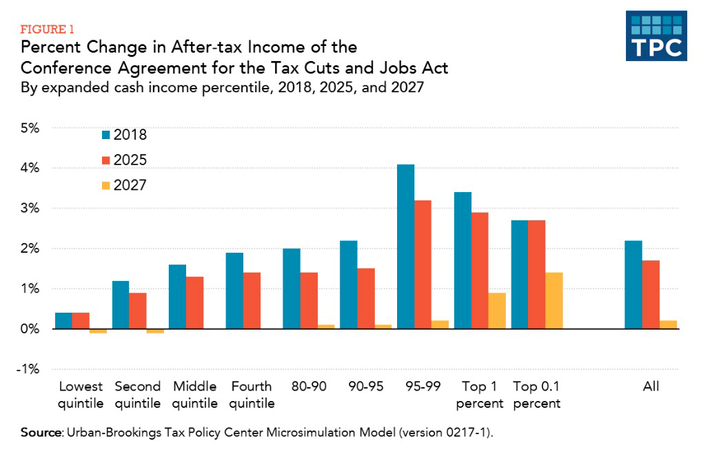

Typically, political parties take pains to avoid validating the public’s least flattering stereotypes of what (and whom) they represent. Democratic presidents have bent over backwards to avoid appearing “soft” on national security, fiscally irresponsible, or weak on immigration (often, with horrific results). But Trump and the congressional GOP have done everything in their power to signal that Republicans are, in fact, the bought-and-paid-for puppets of corporate America and concentrated wealth. By 2027, the GOP Tax Scam raises taxes on the poor and middle class, while slashing them on corporations and the ultrarich. Before 2027, it gives a larger tax break to owners of passive wealth than to Americans who work for a living.

The priorities here proved too stark for a multimillion-dollar propaganda campaign to obscure. In poll after poll, Americans say that the GOP plan benefits the rich more than the middle class, and that they do not expect their own family to gain from the legislation. In August, Quinnipiac found Americans evenly split on the question of which party was preferable on tax issues; now Democrats enjoy an eight-point advantage on that subject.

Republicans were (reportedly) convinced that failing to pass their tax bill would doom the party in next year’s midterms. But there’s no evidence to support that premise — and quite a bit to contradict it. As the Trump Tax Cuts have made their way through Congress over the past month, the president’s approval rating has fallen — while the Democrats’ advantage in the 2018 generic, congressional ballot has risen. As of this writing, Team Blue leads polls of which party the public would like to see control Congress by an average of 11.5 percent. Democrats need to pick up 24 seats to take the House next year — right now, several prominent election forecasters believe they’re on pace to to pick up more than 40.

The passage of the GOP tax plan will likely increase the probability of such a wave. By a 25-point margin, voters say they’re less likely to support their member of Congress’s reelection if he or she backed the tax bill. And this sentiment is likely to be especially prevalent in blue states, where a significant number of upper-middle-class families stand to lose out from the repeal of the state-and-local tax deduction — and where the House’s most vulnerable Republicans will be seeking reelection.

2) And when Democrats take back power, this bill will make it easier for them to pass large expansions of the welfare state.

No matter how well Democrats do in 2018 and 2020, there (almost certainly) won’t be 60 progressive votes in the Senate for the foreseeable future. The upper chamber gives too much power to heavily white, rural, right-leaning states for liberal Democrats to assemble a filibuster-proof Senate majority. Thus, every item on the progressive policy wish list will probably need to be passed through budget reconciliation — a special legislative process that allows the Senate’s majority party to evade the filibuster, and enact laws with 50 votes (plus, the tie-breaking vote of a sympathetic vice-president).

Now, budget reconciliation comes with a big catch: The process cannot be used for any bill that adds to the deficit ten years after it’s passed. Therefore, if Democrats want to pass permanent expansions of the welfare state — or of public investment in education, science, and climate readiness — they’ll need to fund them with dollar-for-dollar revenue increases.

When liberals bemoan the Trump Tax Cuts, they often argue that the legislation will constrain future spending by starving the government of revenue. But this is only true to the extent that public debt is a genuine drag on the economy. At present, the $20 trillion national debt is imposing no discernible economic cost — inflation and interest rates both remain historically low. In a debt crisis, you’d expect to see the opposite. There’s little reason to think adding a couple trillion more onto that sum over a decade will do much damage to our nation’s fiscal health. (The problem with the GOP tax scam isn’t that it expands the deficit — it’s what it expands the deficit for.)

And when it comes to budget reconciliation, the Trump Tax Cuts will actually make it easier for Democrats to fund large expansions to the welfare state. The process does not require a Senate majority to reduce the deficit that it inherits; reconciliation only prohibits that majority from passing bills that add to that deficit (in the long term). In passing their tax bill, Republicans provided a future Democratic Congress with a multitrillion-dollar pile of politically popular pay-fors. In 2012, Mitt Romney campaigned in favor of a 25 percent corporate tax rate. Now that the GOP has cut that rate down to 21 percent, Democrats can raise about $400 billion by enacting Romney’s tax plan — enough to fund a child allowance that would lift 3.2 million American kids out of poverty, or to finance Bernie Sanders’s plan for paid family and medical leave. Meanwhile, reversing the bill’s tax breaks for wealthy business owners and multimillionaires would provide Democrats with hundreds of billions more to work with.

Before this bill passed, Democrats already had a solid list of politically viable tax hikes. Creating a new, much higher top marginal rate on millionaires, lifting the cap on payroll taxes, increasing the taxation of capital gains, and eliminating the carried-interest loophole are all sound policies that produce considerable revenue. But now, a future Democratic Congress will be able to cobble together nearly a trillion dollars in revenue just by undoing the GOP’s most politically toxic changes to the 2017 status quo. Layer the party’s other tax ideas on top of that, and you’ve got the funds to pass a new New Deal with 50 Senate votes.

3) Republicans just raised taxes on everyone in a durable way — a likely precondition for social democracy in the United States.

While Democrats will now be able to pass major expansions to the welfare state without raising taxes on the middle class, to bring Nordic-style social democracy to the U.S. — and maintain it in the long-term — will eventually require some politically difficult tax increases.

Fortunately, Republicans just did (part of) the left’s dirty work for it. In order to keep their tax cuts compliant with budget reconciliation, the GOP went after upper-middle-class welfare, curtailing the mortgage-interest deduction. More critically, they undermined one of conservatives’ biggest structural advantages on fiscal policy. Before the 1980s, tax brackets weren’t indexed for inflation. This meant that, over time, taxes automatically — and imperceptibly — went up on nearly everyone, as people steadily moved into higher tax brackets. The default fiscal policy was an expansion in the size of government. Republicans had to cut taxes just to keep revenue neutral.

The Reagan tax cuts put an end to that state of affairs. And tax brackets have adjusted for inflation ever since.

But in their scramble for inconspicuous ways of raising taxes on ordinary Americans (to finance giant cuts for corporations), congressional Republicans decided to change the inflation formula. Specifically, they chose to slow it down. This is one of the few permanent changes to the individual tax code in the GOP bill — and it functions as a small, annual, across-the-board tax hike. The measure will raise about $14.5 billion in new revenue in 2025, $33.8 billion in 2030, and $83.6 billion in 2040, according to the Penn-Wharton budget model. In total, between 2018 and 2040, the provision will add $766 billion to the federal government’s coffers.

Now, $766 billion over 23 years isn’t going to fund single-payer health care. But it nonetheless raises taxes on the middle class in a way that Democrats would have been afraid to. And now that Republicans have alerted Democrats to the fact that you can pass large, long-term tax increases — with little public attention or fanfare — by toying with the tax code’s inflation model, Team Blue could milk even more revenue from that mechanism in the future.

4) It could mollify future Democratic leaders’ fear of deficits, thereby removing a constraint on progressive policy.

Arguably, President Obama’s biggest political error was believing that the Republican Party — and the American electorate — care deeply and sincerely about the deficit. Fear of being branded fiscally irresponsible led the Obama administration to propose a woefully inadequate stimulus package, leading to the persistently high unemployment that tilted the battleground toward the Republican opposition in 2010. The GOP’s consequent triumph in that year’s midterms secured the right disproportionate power in our politics for a decade (and made the Trump Tax Cuts possible).

And terror of deficits also prevented Democrats from making Obamacare’s subsidies more generous — or expanding eligibility for those subsidies to the entire middle class. Either of those measures would have almost certainly increased the law’s popularity, while saving lives and reducing medical bankruptcies.

The spectacle of the GOP adding $1.5 trillion to the deficit over a decade — to finance a supply-side stimulus in the middle of an economic expansion — should prevent future Democrats from replicating Obama’s mistake. While budget reconciliation will likely prohibit the next Democratic Congress from adding to the long-term deficit, it puts no limit on how much a given bill can add to the debt in the first decade after it’s passed. The next time a Democratic president needs to choose between the better policy — or the less eye-popping price tag — chances are, he or she will pick the former.

5) Blue states should be able to shield their safety nets from the effects of SALT repeal.

From one angle, the GOP’s attack on the state-and-local-tax (SALT) deduction looks good for liberals. That tax benefit is, ultimately, deeply regressive — virtually no one outside the top 10 percent of American earners utilizes that deduction. And yet, SALT repeal also threatens to undermine the progress that liberals have made toward achieving social democracy on the state level.

New York recently established paid family leave, free public college, and, in New York City, universal prekindergarten. California boasts one of the most generous safety nets in the country, and is making significant investments in renewable energy. Sustaining these programs requires (relatively) high state and local taxes, and while the federal government can run deficits, states can’t.

That last fact has always been an obstacle to state-level liberalism. But the state-and-local-tax deduction mitigates it: When affluent Californians can put some of the cost of funding their state’s public sector onto Uncle Sam’s tab, they’re less inclined to mobilize against progressive fiscal policies. Should they suddenly lose the ability to do that, such voters could move sharply to the right.

But, in all probability, they won’t. As Bloomberg explains:

State legislators will have a lot of decisions to make about how their tax codes will change, so a stratagem to offset the loss of the SALT deduction could be part of bigger overhauls, said Darien Shanske, professor at the University of California-Davis School of Law.

… One tactic: Allow residents to make charitable gifts to the state instead of paying income tax.

That would involve legislators encouraging residents to donate to, say, New Jersey (insert quip here), instead of paying income taxes. The self-interested philanthropists who took up the state on the offer would receive a state income-tax credit for the full amount of their gift, which would qualify for a federal deduction.

… The charitable-gift gambit isn’t the only potential loophole. States could quit relying on income tax, paid by individuals, and switch to payroll taxes, levied on employers…If employers pay the payroll tax and reduce employees’ salaries by the same amount, workers wouldn’t have to deduct anything and would wind up being paid the same amount. That would allow states to collect the same revenue while preserving individuals’ deductions on federal returns.

6) Republicans probably don’t have the votes for spending cuts.

If the GOP guts social spending next year, most of the policy benefits of this tax bill will be nullified. Democrats would then need to spend precious budget reconciliation revenue just to restore the safety net to its current (threadbare) state.

But there’s little sign that there are 50 Republican senators who are ready to take food away from poor kids and medicine from the elderly. If there was consensus for dramatic cuts to social spending in Mitch McConnell’s caucus, he would have attached them to this tax bill — the party was desperate for pay-fors. Instead, the GOP decided it was more politically tenable to raise taxes on the middle class (in 2025) than to cut their social services now.

Once Doug Jones assumes his Senate seat next year, it will only take two Republican senators to kill a “welfare reform” package. Given that Susan Collins and Lisa Murkowski were unwilling to cut Obamacare earlier this year — at the time, one of the least popular safety net programs in the U.S. — it seems doubtful that they’ll be interested in slashing overwhelmingly popular programs like Medicare, Medicaid, and food stamps. Collins, for her part, has called for Republicans to increase Obamacare funding by several billion dollars, as soon as the tax cuts are passed. Without the support of Collins and Murkowski, any spending cut package will be dead on arrival in the upper chamber.

In sum: It’s quite possible that this hideous tax cut bill could boost the prospects for progressive governance in the United States over the next decade, without inflicting significant short-term harm on blue-state budgets, or the American welfare state.

It’s also possible that the tax bill will inspire billionaire donors to increase their investments in our political system, leading them to buy control of both major parties, and veto any mildly progressive piece of legislation proposed between now and the collapse of our republic — and/or, that nuclear winter will arrive before the fall of 2020.

But hey: