Republicans passed a massive tax law in the small hours of Saturday morning after a marathon session of last-minute intramural bargaining, in a farcical process that belied the measure’s seriousness and far-reaching impact.

Despite a series of objections from various senators over the last few days, the bill passed 51-49 with every Republican voting yes except Bob Corker, who remained concerned about its effect on the deficit. The process was so rushed that the bill included handwritten amendments in the margins.

Senate Democrats lined up to condemn it, and the slapdash method of bringing it to the floor. Senate minority leader Chuck Schumer said it was “a process and a product that no one can be proud of and everyone should be ashamed of.”

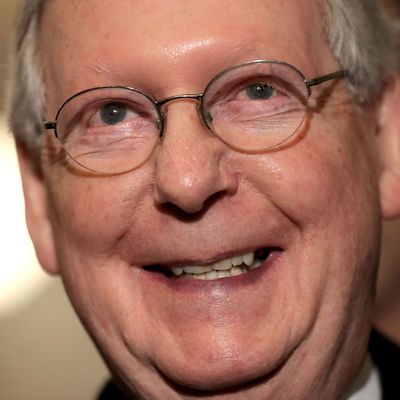

Senate majority leader Mitch McConnell called it “a great day for the country.”

The bill, which is expected to be successfully reconciled with the House version by the end of the month — or perhaps even passed as-is by the lower chamber — consists of a huge windfall for the wealthiest Americans, with uneven benefits for everyone else. It is almost certain to exacerbate income inequality at a time when the playing field is already heavily tilted toward the rich.

Its centerpiece is an enormous corporate tax cut, from a rate of 35 percent to 20 percent. But it also includes a long wish list for Republican donors and lawmakers, including: a repeal of the estate tax; tax breaks for private-school tuition; a measure to make it easier for wealthy individuals to classify themselves as businesses (and thus get a tax break); the opening of drilling in the Arctic National Wildlife Refuge preserve; and more.

The bill also repeals Obamacare’s individual mandate, which is projected by the nonpartisan Congressional Budget Office to leave millions uninsured.

Given its complexity and the 11th hour alterations, the full ramifications of the Senate bill are still not entirely clear. Though the majority of Americans would see a tax cut starting next year, much of the middle class and low-income people would see their taxes tick up by 2027. Meanwhile, the partial repeal of the state and local tax deduction is likely to hit some blue-state residents hard.

The bill also explodes the federal deficit — which was (supposedly) a life-or-death issue for Republicans during the Obama administration — to the tune of almost $1.5 trillion. Republican lawmakers brushed off concerns by leaning on the supply-side dogma that the tax cuts will pay for themselves, though few, if any, credible economists believe that.

The tax cuts are hugely unpopular among Americans, but represent a major victory for a Republican party that has been beset by internecine bickering since President Trump took office, without a major legislative victory to its name. The donors who increasingly drive the agenda of the party had been demanding a radical reshaping of the tax code, and now they’re tantalizingly close to seeing their vision realized.