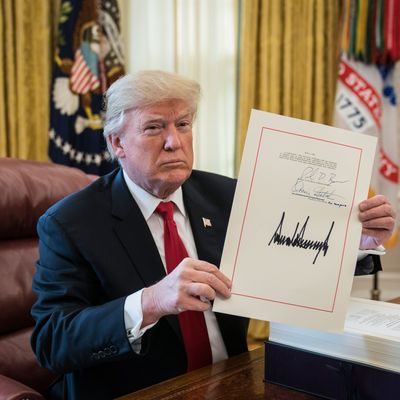

The first two years of the Trump administration have mostly combined ethical calamities large (the separation of migrant children from their parents) and small (petty graft ranging from lavish office expenses to making staff procure high-end hand cream) with a succession of pratfalls. Trump has proved unable to do the large things (like repeal and replace, or even just repeal, Obamacare) or the small things (staff his administration, produce correctly spelled official documents). But against this shambolic backdrop, there stands in bright shining succession the Tax Cuts and Jobs Act. Here is the crown jewel of the Trump presidency, the singular legislative achievement that even Trump-skeptical Republicans can point to as the payoff (worth it or otherwise) for the embarrassment of having to endure Trump’s clown show.

The tax-cut backers have relentlessly promoted their handiwork, most prominently in Paul Ryan’s valedictory video series, but also in a series of choreographed corporate announcements of bonuses for workers and news of a brief spike in business investment last year. As Ryan has boasted, the tax cuts indeed represent the cutting edge of conservative policy-making, the very best case for what the Republican Party has to offer the country.

And yet it has not sunk in how completely this project is failing. Remember that at the time of the tax-cut debate, the Joint Committee on Taxation, Congress’s official revenue forecaster, projected that the law would reduce tax receipts by $1.5 trillion over the next decade. Republicans insisted that this projection reflected “static analysis,” which failed to account for all the extra growth that would be stimulated by lower tax rates. They have spent years browbeating the committee to adopt their pet ideological assumptions, and in response to the pressure, it dutifully produced a complementary “dynamic” analysis that predicted, with the additional growth, the tax cuts would lose just $1 trillion dollars.

Republicans dismissed even the dynamic analysis as too cautious. Nearly to a person, they insisted the tax cuts would create so much additional growth that they would not lose any revenue at all! This wildly optimistic forecast was accepted so widely in the party that even Susan Collins, the most moderate member of the caucus, touted it. (“Economic growth produces more revenue and that will help to offset this tax cut and actually lower the debt,” she insisted.)

In fact, tax revenue in general, and corporate tax revenue in particular, have dropped — an unusual event for an economy running at full capacity. Bloomberg’s Stephen Gandel recently crunched the numbers and found the tax cuts hemorrhaging revenue:

Not only was the Republican assumption that zero revenue would be lost too optimistic, and not only was the more modest “dynamic” model that presumed just a trillion-dollar revenue loss too optimistic, but the “static” revenue model was also too optimistic. The tax cuts are losing more than forecasters predicted even when they assumed it would do nothing to encourage growth.

And as for that spike in corporate investment last year? Alexander Arnon suggests the entire thing was caused by higher oil prices. As oil prices go up, energy firms invest more money in sucking it out of the ground. “The response to the rise in oil prices,” he writes, “explains the entire increase in the growth rate of investment in 2018.”

Obviously the Trump tax cuts have had an effect. They have bequeathed a gigantic windfall benefit to business owners (as well as the heirs to large fortunes, who will have to pay even lower taxes on the largest inheritances). The Trump tax cuts are of a piece with the endemic corruption that has tied the party’s political class to its buffoonish president. He has made his partners richer, at least temporarily. But by the public-facing standards set out for it, as opposed to the private venal reasons, the Trump tax cuts have failed as miserably as everything else.