The biggest effect of the Trump tax cuts is obvious: People who own businesses and other sources of concentrated wealth will have a lot more money, and the federal budget will have less. But the advocates of the tax cuts insisted it wasn’t about letting the makers keep their hard-earned money rather than handing it over to the takers. It was about incentivizing business to repatriate funds and ramp up its investments, thereby increasing growth and wages.

The Congressional Research Service, a kind of in-house think tank for Congress, has a new paper analyzing the effects of the Trump tax cuts. It finds that none of those secondary effects have materialized. Growth has not increased above the pre-tax-cut trend. Neither have wages. After a brief and much smaller than expected bump, repatriated corporate cash from abroad has leveled off.

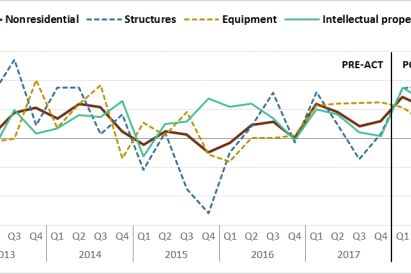

It’s of course possible that the growth in wages would take longer than the year or so that has passed since the tax cut to show up. If the Trump tax cut had encouraged new business investment, it might take years for the new investment to bear fruit. But the study looks directly at business investment and finds … nothing:

Supporters of the Trump tax cuts insisted not only that they would promote growth, but that they would promote so much growth the measure would pay for itself. Even moderates like Susan Collins repeated assurances by the party’s pseudo-economists that the plan would not increase the deficit. So far, the growth feedback from the tax cuts has made up about 5 percent of the plan’s revenue loss, a mere 95 percent shy of the predictions.

The passage of the plan was met with a coordinated wave of corporate public-relations announcements of worker bonuses. But the paper finds no widespread increase in bonuses or worker compensation.

When assessing these arguments, keep a close eye on the number of Republican officials or conservative policy-makers who revise their position on the Trump tax cuts in light of the data. If their true primary goal was to increase business investment, then the complete failure of a highly expensive program to achieve its stated goal would lead them to question their support. Why not cancel the Trump tax cuts and use the couple trillion dollars in lost revenue to fund a more effective growth-promoting policy?

So far, the number of Republicans reassessing their support for the Trump tax cuts is, give or take, zero. What this suggests is that the alleged growth-incentivizing secondary effects of the plan were rationales, and the primary effect — giving business owners more money — was the hidden main goal all along.