In 2017, more than 27 million Americans lacked health insurance of any kind. Many of our nation’s public schools were struggling to stock their classrooms with basic supplies, or to pay their teachers a living wage, or to keep their doors open five days a week. Underfunded rehab centers were consigning desperate opioid addicts to waiting lists amidst an overdose epidemic that would kill more Americans that one year than the Vietnam War claimed over its entire duration. Half a million Americans went homeless. More than 10 million children, in the wealthiest country on Earth, lived in “food-insecure” households.

And our congressional representatives decided that the best thing they could possibly do with $1.5 trillion in borrowed money was to give large tax breaks to the wealthy and corporations (and much smaller ones to middle-class households).

In the Trump era, Republicans have become masters of rationalizing the indefensible. But even they couldn’t defend running up the deficit (and clamping down social spending) to boost corporate profits at a time when such profits were already high. Thus, they insisted that the president’s tax cuts would neither increase the deficit nor benefit the wealthy much at all.

On the surface, it might look like Republicans were simply choosing to put cash in the hands of business owners instead of using those funds to address wrenching social problems, or boost the incomes of the indigent. But this was an illusion born of economic illiteracy. Spending $1.5 trillion on health care for the uninsured, or treatment for drug addicts, or raises for public-school teachers might sound better than devoting that same sum to regressive tax cuts. But such comparisons are rooted in a category error, Republicans explained: Unlike social spending, corporate tax cuts pay for themselves by growing our economy’s productive capacity. Give a poor man a handout, he eats for a day; give corporations a tax break, and they will make growth-enhancing investments that enable poor men to discover the “dignity of work” and the middle class to enjoy a jump in living standards.

There was little empirical evidence to support this argument when Republicans were making it two years ago. There is even less today. In May, the Congressional Research Service (CRS) found no sign that the Trump tax cuts made any discernible contribution to growth, wages, or business investment. Corporations did not plow their windfalls into exceptionally productive and innovative ventures. Instead, they mostly threw their handouts onto the giant pile of cash they were already sitting on, and/or returned it to their (predominantly rich) shareholders.

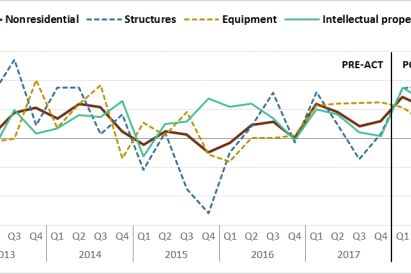

Now, it appears that the CRS analysis may have actually been a bit too kind to Trump’s signature legislation. The federal government’s latest report on economic growth suggests that business investment has been even weaker than previously thought. Initially, the Bureau of Economic Analysis (BEA) estimated that America’s gross domestic product expanded by 3 percent in 2018 (on a fourth-quarter-over-fourth-quarter basis). This week, the BEA revised that figure down to 2.5 percent — due, in part, to decelerating growth in business investment.

Meanwhile, in its initial estimate for the second quarter of this year, the BEA found that GDP grew by 2.1 percent, while business investment declined. Corporations haven’t been growing the economy by ramping up investments in its productive capacity (a.k.a. growing the economy’s “supply side”). Consumers and the federal government have been doing so by spending more money on goods and services (a.k.a. increasing aggregate demand).

In other words: To the extent Trump-era policies have contributed to the (relative) strength of the economy, they have done so mainly by juicing demand, not supply. When the government cuts taxes, while increasing spending, more money circulates throughout the economy. If this happens while real resources are being underutilized — which is to say, while there are underemployed workers and idle capital — then such fiscal stimulus will put people to work, lift wages, and boost growth without triggering high inflation. This appears to have happened.

And yet, as a means of propping up demand, the Trump tax cuts are completely indefensible. If the administration wanted to stimulate consumption through fiscal stimulus, it could scarcely have designed a more inefficient way of doing so. Target $1.5 trillion in tax credits to working people, and they will spend the bulk of that money in their communities; target it at millionaires and billionaires, and they will hoard the bulk of it (often, in offshore tax havens). Republicans never dared to argue in 2017 that the federal government had to prioritize increasing the disposable income of the wealthy over investing in infrastructure, health care, public education, drug treatment, or wage subsidies for working people. But that is precisely what they have done.

And voters just might thank them for it! President Trump never won much popular support for his tax cuts. But by presiding over a tight labor market, he and his party have won the public’s trust on questions of economic management. In recent polls, a majority of voters have voiced support for Trump’s handling of the economy. And while the public has more faith in Democrats than Republicans on many issues, “the economy” isn’t one of them:

If you take Republicans at their word — and assume that they earnestly believed they could massively increase business investment by slashing corporate rates — then the Trump tax cuts have been a miserable failure.

If, however, you assume that the party’s goal was always to prioritize the bottomless avarice of its megadonors over the pressing needs of the American people — without paying a huge political price — then the president’s signature legislation has worked like a charm.