I have written repeatedly in the last few months that the main way President Trump influences monetary policy is through his other economic policy actions. To the extent he does things that worsen the economic outlook (generally, by escalating the trade war), he changes the parameters the Federal Reserve considers when setting interest rates, and thereby makes rate cuts more likely. This isn’t a great tool for enhancing his political standing — these rate cuts don’t really juice the economy, they just partly offset the economic damage Trump causes — but it’s what he has available, and it does somewhat reduce the political risk he faces when he pursues his trade war.

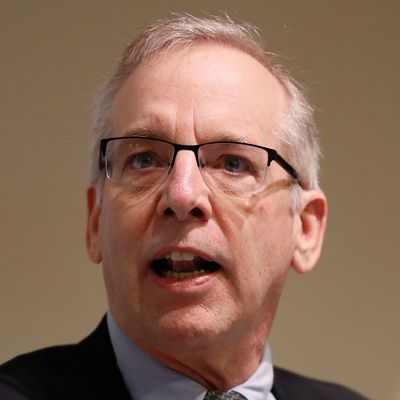

Former New York Federal Reserve Bank president Bill Dudley, in a very unwise op-ed, says the president should be stripped of this tool. He writes:

Central bank officials face a choice: enable the Trump administration to continue down a disastrous path of trade war escalation, or send a clear signal that if the administration does so, the president, not the Fed, will bear the risks — including the risk of losing the next election.

This argument is extremely ill-considered for a few reasons.

First of all, the Fed does not bear the risk of anything. The Fed is supposed to pursue a dual mandate of full employment and stable prices in order to protect the public from risks associated with recessions. If the Fed makes a new exception to its mandate — essentially, saying it will not change interest rates in response to changing economic conditions when the president has fostered that change in economic conditions through bad policy — then it is the public that will bear the consequences in the form of reduced wages, employment, and output.

Effectively, Dudley is making the Bill Maher argument, but to people with actual power to operationalize it. He’s urging the Fed to intentionally undermine economic conditions in order to undermine the president, either to push him to change trade policy or even (as he suggests in the last paragraph of his op-ed) to reduce his odds of reelection. This argument is alarming when it comes from someone who used to have major influence over monetary policy.

Second, because what Dudley proposes would be an explicit deviation from the Fed’s mandate, it would undermine political support for Federal Reserve independence. Nobody elected the Federal Reserve Board, and the regional bank presidents who sit on the Federal Open Market Committee aren’t even appointed by elected officials. The Fed is established by law to pursue a specific policy mandate, which does not include deciding what tariffs should be.

If the Fed explicitly starts saying it’s making monetary policy to punish the president for making bad trade policy, it would undermine political support for Fed independence, which could lead to more frequent and more severe recessions in the future. It would also strengthen the president’s argument that his political cronies should be appointed to the Fed Board; how else will the Fed be held accountable for trying to undermine him by shirking its legal mandate?

The constitutional power to impose tariffs belongs neither to the central bank nor to the president. It belongs to Congress. The policy-makers in Washington who have the power and the obligation to constrain the president’s unwise trade policy are on Capitol Hill, not at the Fed.

Third, there is a technical problem: How does the Fed even decide which changes to economic conditions are a result of the president’s trade policy? When the president announces tariffs, that has effects on financial conditions (e.g., stock and bond prices) and ultimately on economic data. When the Fed considers these data in determining how to meet its dual mandate, would Dudley have them impose ad-hoc adjustments, trying to identify and disregard which portions of the changes to, say, stock prices or unemployment rates are due to trade policy (which the Fed should not try to offset) versus other factors (which it should still consider)? This process would be inherently arbitrary.

Dudley does have one good point: The Fed may not be very effective at offsetting the economic costs of the trade war. Interest-rate cuts are not magic, and they do not perfectly offset the economic costs imposed by disruption in the global trading system. But this is something Jerome Powell has already been publicly clear about. And not very effective is not the same thing as not effective at all — to the extent the Fed has the ability to partially ameliorate the negative economic effects of the trade war, its mandate instructs it to do so.

The president has put the Fed in a very difficult position. If the Fed followed Dudley’s advice, it would make its own position worse, cause economic damage to ordinary Americans, and make it harder for the Fed to pursue sound policy in the future. It’s a terrible idea all around.