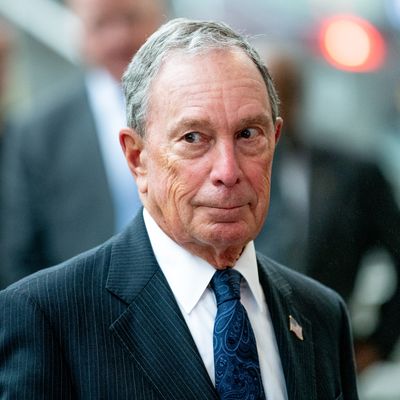

Mike Bloomberg, the other billionaire thinking about running for president, isn’t just another billionaire, and I don’t just mean that because, unlike Tom Steyer, he has actually held a major elected position. I mean Bloomberg is especially wealthy by billionaire standards. According to Forbes magazine estimates, he’s the eighth-richest person in America with a net worth of $53.4 billion — making him 17 times wealthier than President Trump. And unlike Trump, he’s a self-made billionaire.

Perhaps most remarkable of all, Bloomberg’s wealth — most of which comes from his continued ownership of 88 percent of Bloomberg LP, the financial-data company he founded in 1981 — has continued to grow handsomely over the past two decades. How handsomely I am not exactly sure. When he ran for mayor in 2001, Forbes magazine estimated his fortune at $4 billion, but for reasons I will discuss below I believe this was a significant underestimate. Still, he is clearly much richer now than he was then, in large part because Bloomberg LP has prospered in a period that has not been kind to many other companies, from Time Inc. to America Online, whose business models could be described broadly as “information services.”

A large majority of Bloomberg LP’s $10 billion in annual revenue comes from Bloomberg Terminal subscriptions. For a bit over $20,000 a year, you get either a physical device or computer software that provides access to a wealth of real-time financial-market data. The terminal will tell you everything from interest rates on obscure bonds to the current utilization of oil storage tanks in Cushing, Oklahoma. Importantly, you also get access to Instant Bloomberg messaging, which you can use to contact other terminal users — frequently, traders need IB to reach the people they trade with. This suite of services is considered valuable enough to enough financial professionals that there are over 300,000 Terminal subscriptions around the world. (I was employed at Bloomberg LP in 2012 and 2013 as a writer for “Bloomberg View,” the editorial page of Bloomberg News.)

But there are many kinds of information that people used to pay for and now get for free, or much more cheaply, over the internet. Who needs to buy the Zagat guide when Yelp reviews are free? Similarly, there is an ever-increasing number of specialized financial-information services available on the internet priced far below $20,000. And since the typical Bloomberg Terminal subscriber uses only a handful of the vast number of available Terminal functions, I feel like I’ve been hearing and reading takes for over a decade saying many financial professionals and firms were eventually going to decide that the Terminal was too expensive and that they could get by with something much narrower and much cheaper.

Headlines appear periodically about major banks finding ways to cut down on how many Terminals they pay for, yet Bloomberg’s subscriber base has grown at a modest pace over the past decade. The current Terminal count of 325,000, as reported by the company, is up from approximately 170,000 in 2001 and 280,000 in 2009, according to estimates previously published by Quartz.

“The goddamn thing works,” says Josh Brown, CEO of Ritholtz Wealth Management and a frequent panelist on CNBC’s Halftime Report. “It does what it’s supposed to do. It’s reliable. They’re constantly adding new features.”

Brown agreed that it would be possible for many Terminal users to cobble together web services providing the information they truly need for much less than Bloomberg’s subscription fee. But he said this approach is less user friendly and less reliable and that users remain willing to pay a high price for the Bloomberg Terminal because of the cost savings they can generate from using it. For example, he said the Terminal has made it easier for bond investors to trade directly with each other instead of paying fees to brokers. Why scrimp on your Bloomberg subscription when the functionality it offers you may be saving you huge amounts in commissions?

Plus, there is the importance of the Terminal as a status symbol. Who wants to admit they don’t really need one — or that their boss doesn’t think they’re worth one?

“Scott Galloway does a good job of talking about Apple being a luxury brand and a brand that signifies to others,” says Brown. “On Wall Street, having a Terminal has some element of that.”

If you look at the Forbes lists, it appears that Mike Bloomberg has achieved an astounding pace of wealth growth since 2001. But my sense is that his true wealth gains over that period have been somewhat less outsize because his true net worth was significantly higher than the $4 billion Forbes estimate in 2001. Compiling the Forbes 400 list is not a science, and it can be difficult to estimate the true value of a privately held company like Bloomberg LP, which does not have a public stock price. But in 2008, Mike Bloomberg agreed to buy, for $4.5 billion, a 20 percent stake in Bloomberg LP that had previously been owned by Merrill Lynch, establishing a $22 billion valuation for the company and causing the magazine to revise upward its estimate of the value of the stake he already held.

Bloomberg’s extensive spending on political and philanthropic activities would also seem indicative of substantial financial resources beyond his ownership stake in Bloomberg LP, which makes sense since he has been receiving profits from the firm for decades. It’s another sign of his company’s remarkable robustness in a difficult time for media and information companies more broadly. If he runs for president, I think he is highly unlikely to win. But if he spends $2 billion in the process, it won’t crimp his style like it would an ordinary billionaire’s.