The Babylonian Empire had a problem. Humanity’s banking craze had just gotten under way. Money lenders were in the temples making grain loans to farmers. This expansion of credit was helping to facilitate trade and agricultural production. But over time, the proliferation of debt was also creating big headaches. Subsistence farming is a tough business, even in good times. People often fell behind on their loans. And this insolvency was routinely exacerbated by forces wholly outside of human control — drought, pestilence, angry gods, etc. As a result, large numbers of debtors were falling into bondage or fleeing from the kingdom to escape their creditors, sapping the empire’s supply of laborers and warriors and putting a real dent in imperial morale. So, to make Babylonia great again, the kingdom established periodic debt jubilees: When new rulers ascended to the throne, they inaugurated their reigns by canceling all existing debts, allowing society to reset its financial system.

Forty centuries later, the banking fad has yet to abate, and humanity is still struggling to resolve the problems created by excessive private debts. In the United States, households and corporations were already shouldering onerous debt loads before a pandemic forced the economy into bed rest. Now, every month, families and small businesses are losing income and accruing rent or mortgage obligations. And some economists say that the ancient remedy for their plight is still the best we’ve got: If we want a strong recovery after the coronavirus is contained, we will need mass debt forgiveness.

James K. Galbraith is a leading proponent of such a jubilee. The University of Texas at Austin economist argues that when the pandemic has passed, “there will be a vast tangle of unpaid debts that cannot be cleared,” and thus “the whole financial system will have to be reset.” Intelligencer recently spoke with Galbraith about why he thinks a debt jubilee is both advisable and likely to happen (in some form). We also discussed his contention that the COVID-19 crisis is undermining neoclassical economic orthodoxy, validating Modern Monetary Theory, and offering America an opportunity to build a better, less debt-dependent economy.

Why do you think a mass debt forgiveness is going to be necessary to facilitate recovery after the pandemic?

There’s a certain presumption that what can be shut down can be reopened—that the natural course of events is a rapid economic recovery. And that’s what I’m taking issue with. Every business and household has assets and liabilities. And what’s happened is that their assets have been diminished but their liabilities have not. Unless the liabilities are somehow taken care of, they’re going to be burdened by their debts for a long time to come.

At best, that debt burden will slow recovery, even assuming the best conditions. But I’m inclined to think things will be considerably worse than that. This is similar to what happened after 1929. There’s very little economic activity. And the reason for that is that once certain kinds of activity go down, investment in the durable goods necessary for those activities falls to zero. Take aircraft. Why would anyone buy a new one? Half of all the existing airplanes are sitting on the ground someplace. Who needs a new aircraft? Now you can think of ways you could destroy the existing ones in order to keep the aircraft producers going, but that’s probably not going to happen.

Nothing a good war can’t solve. But why isn’t the airline industry the exception here rather than the rule?

Well, I think you’re working at home, Mr. Levitz.

This is true.

Whereas previously, you were working in an office. As a result, there’s a lot of empty office space. Who would build a new office building? And you’re probably driving less than you were. So your car, like mine, is getting much less depreciation on it than it otherwise would. So chances are it’s going to last longer. Cars obviously aren’t going away. But the producers are dependent on the flow of new demand. And that’s going down.

So start there. And then think about basically any service establishment you want to name, all of which depend upon customer flow, and many of which depend upon packing them in because they’ve got very thin margins. This is true of almost all restaurants and bars. Now, these businesses have accumulated debts. If you cut their order flow in half, there’s no way for them to pay their debts and make their tiny margins. How can you make them viable? Only by eliminating the nonproductive factor that keeps piling up as debt, which is rent.

You can flood the system with cash on a short-term basis, but that doesn’t solve the investment problem or the consumer-demand problem. So, inevitably, there’s going to be a big reconfiguration. Exactly what form it takes, I don’t know. One thing you could do is buy the capital assets of firms that are in principle viable, or that could be viable at a lower rate of return; basically, buy off the landlords and then set up some kind of a cooperative model with the operators. That way, you get some of the community life back. That way, the downtowns come back.

It seems hard to reconcile your analysis of where the economy is headed with the stock market’s recent behavior.

Yes, I agree.

Do you think there’s mass delusion among investors?

Wouldn’t be the first time. The bailout and lending operations have provided incumbent firms with liquidity. But at the end of the day, a lot of these corporations took on a lot of debt to achieve their valuations. They need to have revenues to pay those debts and sustain those valuations. When it becomes clear that they aren’t going to have strong revenues, maybe we’ll see another turn. (But I can’t predict the market.)

Lots of left-wing economists have argued that we should have a debt jubilee. Recently, you suggested that some form of widespread debt forgiveness will happen — that even those ideologically opposed to the concept will recognize it as a practical necessity. In your words, “People sheltering at home without income are in no way responsible for their circumstances and will refuse to accept the terms of those contracts. So the contracts will have to be suspended, and the debts cleared away, or there will be a confrontation on a vast scale.” What would you say to a skeptic who counters that one should never underestimate the American elite’s capacity to get workers to blame themselves for their misfortunes?

I wouldn’t say I’m optimistic. But let’s make a distinction between two things. The first is the household rental and mortgage payments. There you have a very clear case against evictions and foreclosures, because people have been doing what they were told to do. They’re foot soldiers in the war effort. And so now we’re gonna say, “You still owe your missed mortgage and rental payments, even though your income was cut off by a shutdown we were all ordered to observe”? You don’t do that to people. It’s a very basic question of fairness. And utterly easy to understand.

I just saw that the city of Long Beach is extending its moratorium on evictions and foreclosures. That kind of step is going to have to be taken essentially everywhere. And once you’ve got that embedded in people’s consciousness — that it is not legitimate for people to be evicted or foreclosed on as a result of the pandemic — then the question of how much of the debt people can actually repay, particularly if the recovery is slower than expected, seems unavoidable. So I think we’re building in a reset.

The other thing is small proprietorships and business properties, where you typically have a landlord and some space an entrepreneur is using. The entrepreneur doesn’t have a lot of choice. But the landlord also has incentive to make accommodations. Either they make it possible for the business to break even, or they risk ending up with a boarded-up space. Maybe the landlords can’t afford to maintain the space either, if they have mortgage costs. At that point, if we don’t want our downtowns to become a collection of dilapidated, boarded-up storefronts, we’ll need to invest public resources into maintaining them. Ultimately, the public sector has to come in and make businesses viable again, in one way or another.

You’ve written that the mass debt cancellations that followed World War II were integral to the rise of “welfare-state social democracy” during the three decades following the conflict. Can you explain the relationship between those two things and why you think debt forgiveness could have a similarly auspicious influence on the U.S. political economy over the coming decade?

There was a huge contrast between what happened after the two World Wars. After the first one, the United States insisted that the British and French pay their debts. And the British and French then took a very tough line with the Germans, insisting on reparations that the Germans couldn’t pay — until the U.S. started making loans to the Germans, so that they could pay the British and the French, so that the British and French could pay us. And when that system collapsed beneath the political and economic pressures it generated, you got the rise of Nazism in Germany, Fascism in Italy. These were consequences of the way that financial powers operated in the interwar period.

After 1945, we took a different approach. The interallied debts were canceled; we didn’t insist that the British pay us back. They had nothing to pay us with anyway. And then, in 1953, we wrote down the German debts. As a result, Western Europe emerged from the war financially reset. And the same was true inside the United States. Big debts were accumulated in the 1920s. The Depression cleared much of that away through mass bankruptcies; the debts weren’t paid, but they were largely written off. And then, in the 1940s, during the war, American households were financially replenished to a huge extent. Income levels doubled because everybody was producing war material. So American households were solvent. The economy was driven by rising wages, which were themselves driven by good union contracts and a general sense that wages should rise in line with productivity. Meanwhile, debt was strictly regulated. Mortgages didn’t proliferate like they did in the 1990s. It was a savings-and-loan based system. It wasn’t very inclusive, but it was stable.

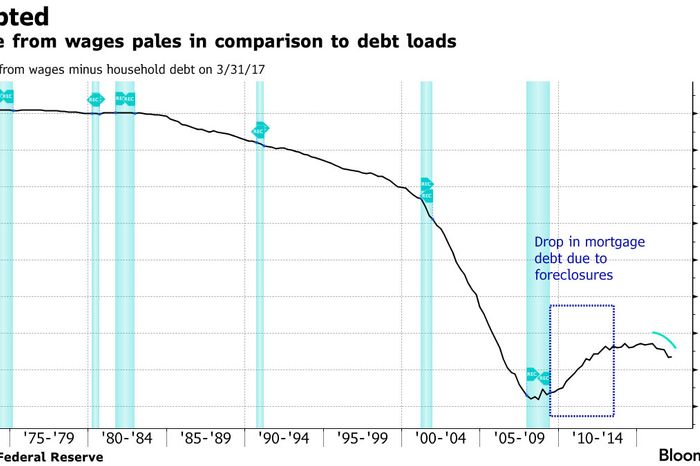

That situation started changing in the late 1970s, early 1980s. That’s when we started moving away from a wage-driven system to a debt-driven one. And that’s why we are where we are now, 40 years later. We’ve become so heavily debt dependent. We should have learned after 2008, but we didn’t. We cooled off on mortgages, but corporate debt, personal debt, student debt and automobile debt, that’s what drove the post-2008 recovery. The pandemic took a reckoning that was coming anyway and made it happen with a real vengeance.

You write that the crisis has “obliterated certain shibboleths of the economic textbooks and the Congressional Budget Office. Among these, especially, are crowding out, deficit and debt thresholds, and the natural rates of interest and unemployment.” Can you briefly summarize how precisely the pandemic has invalidated these economic concepts?

All of those concepts are part of a system of thinking in which there’s a market equilibrium, a state of normality that the economy tends toward — that there’s a “natural rate” of unemployment, the natural rate of interest, natural rate of growth. And the CBO’s model is built around these ideas. They are models in which everything converges back to those normal values in the long run, no matter what. But there isn’t any such thing as a normal future. We’re going to have to learn that the world doesn’t work that way. We can — at best — anticipate the near future. But the distant future is something we have to create.

These ideas of market equilibrium are archaic. They date back to the 18th century. Or, really, to classical China, to the 5,000-year-old concept of celestial harmony, yin and yang. That’s how they came into Europe, through a study of China in the 18th century. From there, they diffused to the French physiocrats and Adam Smith and then down to Alfred Marshall and the supply-and-demand analysis. That’s where economists get this stuff. Whereas after the 19th century, all the rest of science adopted a model that was based on evolution and thermodynamics. In other words, a model that posits a world in which there are resource costs, instabilities, and sequential change that is path dependent. Economists — and the CBO in particular — haven’t integrated these concepts into their thinking.

I think the current crisis will throw this failure into sharp relief. The idea that we’re going to return to the previous path just because it was a path — there’s no reason to think that. There’s an asymmetry between liabilities and assets that is not going to be “naturally” repaired. So that means we have to reorganize; we have to implement policies consistent with how bad the situation is. Tinkering around the edges to nudge the market back toward equilibrium isn’t an option. We need to do some structural engineering.

The crisis has triggered a lot of chatter, even in some mainstream circles, about the vindication of Modern Monetary Theory, an economic doctrine that emphasizes, among other things, that large deficits aren’t inherently undesirable and that the true constraint on public spending in the U.S. isn’t tax revenue or interest rates but real resources. Congress has responded to the COVID crisis by approving trillions in new deficit spending — and the Republican chairman of the Federal Reserve has been calling for even more. Meanwhile, Jerome Powell is also poised to buy up trillions in U.S. Treasury bonds, effectively monetizing the debt. You’re not an MMT-er per se, but certainly a fellow traveler of that contingent. Do you think that the crisis, and the response to it thus far, has demonstrated MMT’s superiority to more mainstream schools of economic thought?

I’ve always been very sympathetic to MMT because it is essentially John Maynard Keynes’s monetary theory. So what the MMT people have done, which is really remarkable, is take these ideas, which were largely abandoned, and project them into the current discourse in a way that’s made an impression.

There are policy positions associated with MMT. But the main thing it does is describe how modern credit capitalism actually works — and, as Keynes once said, “modern” in that phrase means the last 4,000 years or so. Double-entry bookkeeping came in the Middle Ages. It’s not a new thing.

And how does modern credit capitalism work?

Money is created in one of two ways: by the government making payments (Uncle Sam writes you a check, the bank then credits that to your account) or the bank extending a loan, in which case the bank credits money to your account against a contract saying you’re going to pay it back. The government extinguishes money by taking in taxes; the bank extinguishes it by taking in loan repayments.

The question of how much money is created is determined by how much activity the public and private sectors are willing to animate. How many loans does the banking sector wish to extend? How much spending will the public sector approve?

By contrast, the neoclassical view holds that money is just a unit of account. It’s just an accounting convention. And if you try to use it as a policy variable, it will only affect the price level. Create a lot of new money, you’ll get higher prices — but you won’t, in the long run, have any impact on employment or output. Because the economy eventually reverts to its natural equilibrium.

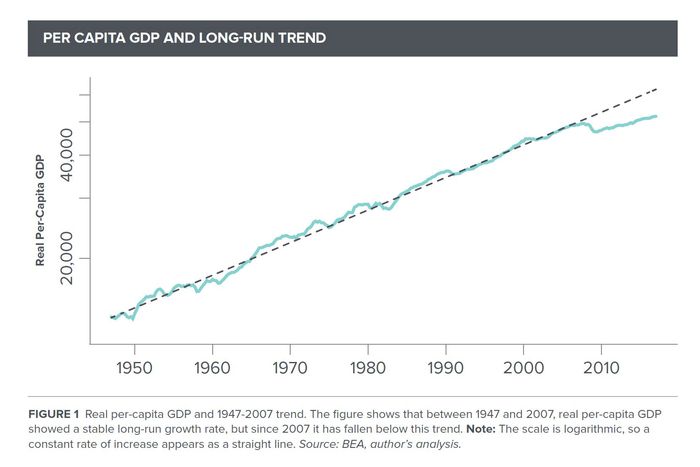

Well, this creates all kinds of difficulties. Go back to the forecast the CBO made in 2009. It said that a stimulus program would accelerate recovery — but, in ten years’ time, interest rates would be higher and output would be lower than would otherwise be the case. That’s just crazy: the idea that there’s this long-run process you can accelerate but that you’re not really driving. That’s not the way the world works. The recovery didn’t return the economy to its previous path; it restructured the economy. And the growth model it settled on has now collapsed. It was a process that was fueled by corporations taking on big debts to bid up the price of their own stocks, activity that could only be sustained by robust revenues. And now the revenue isn’t there, and the system is in a state of collapse.

To clarify: Contrary to neoclassical theory, when the federal government injects money into the economy, it expands the capacity of states, consumers, and investors to generate economic activity. And precisely because there is no natural rate of growth, expanding the money supply today can potentially increase the economy’s long-run growth potential. So, for example, we know that many workers displaced by the Great Recession never returned to the labor force. If you had a fiscal policy strong enough to have sustained their employers’ revenues in 2009, some of those workers might still be in the labor market in 2020 — and, thus, the total productive capacity of our economy would be higher. Is that right?

Absolutely. Everything has cumulative consequences. Go back to the history of the 1930s. The New Deal rebuilt the whole country — really built much of it up for the first time. Roads, airfields, power systems, railways, tunnels, bridges, cultural centers, and all kinds of things. As a result, you had an infrastructure that could be mobilized to fight the war. If you didn’t have the Tennessee Valley Authority in the ’30s, you wouldn’t have had a lot of the ammunition factories or the Manhattan Project in the 1940s; that required lots and lots of electricity. The Reconstruction Finance Corporation, which was set up in the Depression, built the synthetic-rubber industry for the war effort. If those institutions hadn’t been built, this country would not have been the decisive factor in the war that it was. History is cumulative. There isn’t some magic system called the market that’s going to get us back to a good place by itself. We need to do it, which means we can decide what kind of economy we wish to rebuild.