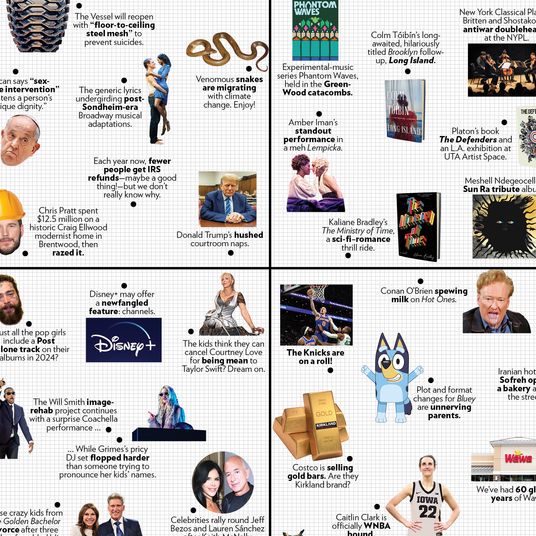

In 1993, Bill Clinton, young and full of hope, aspired to prod the still sluggish economic recovery to life by passing an economic-stimulus measure. But the Federal Reserve, reported the New York Times, feared Clinton “would embrace too large a stimulus plan of, say, $60 billion.” Clinton’s aides, for their part, feared that if the plan did succeed in accelerating growth, the Fed would simply choke it off by raising interest rates. Even if they could pass it through the Senate (which they couldn’t; even after the House reduced the cost to a trivial $16 billion, Republicans filibustered it), then–Fed chair Alan Greenspan would just shoot dead whatever staggered through Congress.

Last week, Jerome Powell gave a speech on the labor market. The current Fed chair implicitly approved President Biden’s $1.9 trillion plan. The goal, he said, was to rapidly restore full employment, which required “contributions from across government and the private sector.” Powell’s speech was the equivalent of taking Greenspan’s gun out of its holster, removing the bullets, and laying it on the table.

There is a peculiar paradox to the opportunity facing Biden. On the one hand, his party lost House seats and eked out the narrowest possible margin of Senate control. On the other, the fiscal and monetary constraints that have shackled every Democratic president for more than half a century have broken, and now the way is open to revive a liberal dream of full employment and prosperity.

To find the last time a president enjoyed an atmosphere like this, you would have to go back to the halcyon days of Lyndon Johnson’s Great Society before it all went bad in his last two years. The fiscal pressure of Johnson’s domestic programs, in combination with the Vietnam War, created the first stirrings of the inflation that dominated the political economy of the 1970s.

The ghost of inflation haunts nearly any economist or business leader who came of age in that decade. After struggling with the dilemma of balancing low unemployment and low inflation throughout the 1970s, and failing at both, the Federal Reserve ended the cycle of inflation by engineering a brief but severe recession in the early 1980s. Accepting short-term pain became the Fed’s guiding principle; an obsession with inflation lost all contact with pragmatic economic stewardship and became a totem of seriousness and virtue. When the Fed’s vice-chairman, Alan Blinder, argued that it had placed too much emphasis on price stability at the expense of employment, columnist Robert Samuelson described him as “ ‘soft’ on inflation” and therefore lacking “the moral or intellectual qualities needed to lead the Fed.”

To inflation hawks, it was not merely a matter of adjusting the sliders on one’s preferences for inflation versus growth. The quality needed in central bankers was the discipline to refrain from indulging in prosperity now so as to prevent catastrophe later (that sacrifice would, of course, be borne by people not employed as central bankers). As late as the Obama era, the Fed maintained that the unemployment rate could not fall much below 5 percent without triggering a rise in inflation it was duty bound to suppress.

The evidence has been growing for years that the Fed’s calculations were off and that unemployment could go lower than officials believed without triggering inflation. But the person who ultimately proved the case was Donald Trump.

Trump did not have any theoretical breakthrough on monetary policy. Indeed, by all evidence, he believed the conventional wisdom that pleasure now would lead to pain later. What made Trump different from other presidents was that he didn’t care about the moral implications of this trade-off. He naturally concluded that the pain of higher unemployment should be borne by Democratic administrations so that the pleasure would accrue to his own.

When he was running for president, Trump claimed Janet Yellen was keeping rates dangerously low to benefit Obama’s political standing. “She’s not raising rates for a very specific reason,” he charged. “Because Obama told her not to because he wants to be out playing golf in a year from now, and he wants to be doing other things, and he doesn’t want to see another bubble burst during his administration.” As usual, the accusation of venality directed at his rivals doubled as a confession of Trump’s own plans. Once in office, he reversed his stance. Smashing the old taboo against presidents pressuring the Fed, he publicly demanded lower interest rates.

The Fed — perhaps intimidated by Trump, or perhaps persuaded by the growing evidence presented by its dissidents — complied. The result was a vindication of the monetary doves. Unemployment dropped below the level at which economists had previously considered employment “full” — and then kept dropping, all the way down to 3.5 percent. The whole time, inflation remained below the Fed’s 2 percent target.

The experiment in permitting unemployment to go below its “natural” level was interrupted this past March by the pandemic. But in the short time it ran, its results were extraordinary. Workers at the bottom of the wage scale finally became scarce enough to force employers to bid up their wages, producing the first real working-class income gains since the late 1990s, the last time the economy experienced sustained full employment.

The upper-middle class may not have noticed the difference. If your job requires a college education, a “good” economy with falling unemployment feels about as good as a red-hot economy with full employment. But for workers toiling on the labor market’s bottom rungs, that is the difference between insecurity and prosperity.

The old notion that ruled Washington was that deficit spending is an unaffordable indulgence. The new idea says that what we can’t afford is unemployment. Every unemployed worker is a waste. And every month that goes by without full employment represents not only more privations but the atrophy of wasted skills and the accumulation of the social problems, such as depression, drug use, family stress, and crime, that afflict communities where adults can’t find work. (It’s telling that while crime has declined overall since the pandemic hit, murders and gun violence have gone up.)

Many of these social ills that have long defied policy solutions tend to melt away under full employment. Powell strikingly spoke about full employment as not only an economic objective but a social imperative. “Steady employment provides more than a regular paycheck,” he said. “It also bestows a sense of purpose, improves mental health, increases life spans, and benefits workers and their families.” One of the benefits Powell cited is racial equality — since Black employees tend to experience discrimination in hiring, they often benefit from economic expansions only when labor markets tighten to the point that employers have to give them a chance. Biden has expressed the same idea as Powell in simpler terms. Maybe you’ve heard his refrain that a job is not just a paycheck but a source of dignity. It’s not just a hokey sound bite designed to flatter the working class but the expression of his paramount social-policy goal.

If this experiment works, it would have a transformative impact not only on the economy but on American life. Generations of Americans have no experience growing up in a country where ordinary people without college educations can reliably find work and enjoy rising living standards as they age. A conservative Republican central banker and a liberal Democratic president both believe with some cause that such a world just might be summoned into existence.

*This article appears in the February 15, 2021, issue of New York Magazine. Subscribe Now!