Rising prices are eroding workers’ wage gains and Joe Biden’s political capital. The consumer price index (CPI) rose at a 6.2 percent annual rate in October, the highest America had seen in more than two decades. A gallon of gasoline costs about 60 percent more today than it did this time last year.

The president’s popularity has fallen about as steeply as prices have risen. In late July, Biden’s approval rating stood at 52.7 percent in FiveThirtyEight’s poll aggregation; today, it sits at 42.8. In the interim, Democrats have lost their advantage over Republicans in the congressional “generic ballot,” while the party coughed up the governor’s mansion in solidly blue Virginia. Now, a supermajority of Americans say that Biden isn’t focusing enough on inflation, and that they trust Republicans to do a better job on the issue.

Thus, for reasons both political and substantive, the White House is desperate to do something about rising prices (or, at the very least, look like it is doing something). But its options are limited. There are many things that the administration should do to ease price pressures but cannot — and plenty that it can do but shouldn’t. The bucket of disinflationary policies that are both (1) eminently politically possible and (2) actually worth doing given their downsides is small.

But reforms that meet those criteria do exist. Before spotlighting a few of them, though, it’s worth briefly discussing what the Biden administration should not do to bring down inflation.

Austerity is not the answer.

For at least the past four decades, the conventional policy prescription for elevated inflation has been to cut social spending and increase benchmark interest rates. This approach eases price pressures by reducing demand: When the state slashes aid to households, they have less disposable income to spend on goods and services. When the Federal Reserve raises the cost of credit, meanwhile, debt-financed consumption and investment decline. Soon, there are fewer buyers bidding over scarce resources, and the price of the latter start to fall.

But throttling demand is an exceptionally costly way of stabilizing prices. In the immediate term, it increases unemployment and reduces growth and wages by design. The strategy’s sole virtue is that it’s relatively easy for the government to enact: Rapidly increasing an economy’s productive capacity is technically challenging; rapidly reducing consumers’ spending power is not.

Yet the costs of austerity are so high that it can only be justified if one posits that inflation will become economically ruinous in its absence; which is to say, that high inflation will persist durably enough to undermine long-term growth.

And there is little reason to think that this is the case. Today’s inflation is the product of a discrete, exogenous shock to the global economy: the COVID-19 pandemic. Of course, fiscal policy has contributed to price pressures. The U.S. government’s COVID-era stimulus measures were unprecedented in their scale. Thanks to the government’s largesse, U.S. households managed to increase their income and savings in the midst of a global economic catastrophe. Without the massive state interventions of the past 20 months, there would be no inflation in the U.S. economy, because we’d be battling double-digit unemployment and deflation instead.

One can reasonably argue that the optimal level of COVID-relief spending was smaller than the amount Uncle Sam ultimately authorized. Regardless, if COVID had not triggered a massive shift in consumer preferences away from services and toward goods, while simultaneously seeding bottlenecks throughout global supply chains, inflation would not be at a problematic level right now. Were America’s aberrantly expansive stimulus policies the primary driver of U.S. inflation, then one would expect prices to be rising much faster here than in the European Union. But since January 2020, inflation has increased by only one percentage point more in the U.S. than it has in the E.U. That marginally higher inflation rate is no obvious indictment of American policy. If erring on the side of too much stimulus bought the U.S. slightly higher price growth, it also gained our country stronger wage and GDP growth than Europeans have enjoyed.

In any case, the available evidence suggests that inflation is not being driven by an endemic economic pathology — like a self-reinforcing wage-price spiral — but rather by the difficulty of reconciling robust demand for manufactured goods with a discombobulated global shipping industry, domestic shortage of truck drivers, international collusion among oil exporters, and shortfall in semiconductor production. The precise ten-year cost of Joe Biden’s economic plans has little bearing on these forces. Means-testing universal pre-kindergarten will not cause OPEC to bring more oil to market, or lead U.S. consumers to rebalance their spending toward services.

Fortunately, the available evidence suggests today’s top drivers of inflation will ease on their own over the course of the next year. In recent days, oil prices have begun to fall as U.S. production has rapidly expanded, with extraction in the Permian Basin set to break its pre-pandemic record before year’s end. Meanwhile, the semiconductor shortage has eased enough to enable Toyota to return to full production capacity beginning next month. With vaccination rates rising, and effective antiviral treatments for COVID coming to market, consumers should grow increasingly comfortable patronizing concerts, yoga classes, and other in-person services, and adjust their spending patterns accordingly.

In a recent analysis, researchers at Goldman Sachs argue that inflation is likely to get worse over the coming winter, but will then start to fall in early 2022, and ultimately settle at a rate just above 2 percent, in line with the Federal Reserve’s target. That estimate is of a piece with the inflation forecast implied by bond markets.

Thus, the long-term inflationary outlook remains the opposite of dire, and cannot justify a turn toward fiscal austerity or tight monetary policy.

At the margin, Biden’s Build Back Better plan will be inflationary; redistributing income from billionaires (who save their marginal dollars) to working families (who spend such dollars) will put upward pressure on consumer prices, all else equal. But the legislation’s spending is doled out gradually over a decade; the annual sums are too small to have much of a macroeconomic impact. It would be madness for Democrats to forfeit what may be their last opportunity to accelerate decarbonization and reduce poverty for a decade or more just to cut core CPI by some infinitesimal fraction.

For the White House, encouraging the Federal Reserve to raise interest rates, or appointing a more hawkish Fed chair to replace Jerome Powell, would also be misguided. To be sure, a tiny hike in benchmark rates would not be as destructive as the gutting of federal climate investment. Some longtime advocates of full employment and expansionary fiscal policy, like Matt Yglesias, have endorsed tightening monetary policy in light of rising prices.

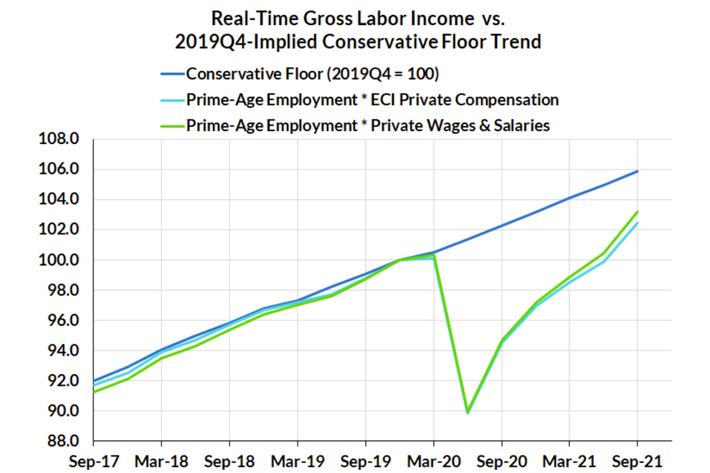

But the costs of raising rates still outweigh the benefits. Prime-age employment and wages remain below their pre-pandemic trend.

The prime-age labor-force — the population of non-seniors who have jobs or are actively seeking them — remains far smaller than it was in February 2020. If we wish to expeditiously restore employment opportunities for America’s jobless, and lure discouraged workers back into the labor market, we should not actively reduce labor demand. Further, if we want to combat shortages in the supply of housing, semiconductors, and automobiles, increasing the costs of debt-financed investment is counterproductive.

What Biden can and should do about inflation.

The ideal anti-inflation program is one that reduces prices without increasing unemployment or slowing economic growth. And it isn’t actually hard to find policy ideas that would meet such criteria. There is a ton of price-gouging and rentierism within the U.S. economy. America spends several times more than similar nations on health-care administration, pharmaceuticals, and physicians’ salaries. In return, we enjoy the 29th-best health-care system in the world (just behind the Czech Republic’s), according to the Lancet. If Uncle Sam followed the example of other major governments and began dictating payment rates for most doctors, hospitals, and drugs, it could bring down health-care prices substantially.

Inflation in the housing market is fueled by a combination of restrictive zoning laws and tepid federal investment in public housing. No technical breakthrough is required to render high-quality domiciles abundant and affordable. Merely legalizing the construction of apartment buildings in booming areas would dramatically reduce rental prices. Although authority over zoning lies at the local level, the federal government could coerce nationwide zoning changes through the conditioning of highway funds. And Congress could also fund a massive build-up in social housing.

But Joe Biden cannot nationalize the health-care industry by fiat, even if he wished to. And congressional Democrats can’t even pass a robust plan for Medicare to negotiate drug prices, let alone impose all-payer rate-setting on the entire health-care sector. The party is poised to increase federal funding for housing a bit in the Build Back Better Act. But that legislation features no mechanism for forcing major zoning changes or dramatically increasing the stock of public housing. Thus, it leaves the fundamental driver of housing inflation — a massive (and legally engineered) shortfall in the supply of homes — intact.

All of which is to say: While it is easy to identify technically viable ways to bring down prices at little macroeconomic cost, identifying politically viable means of doing so is decidedly harder. The Democrats’ slim congressional margins render most ambitious ideas for combatting endemic price-gouging and supply constraints dead on arrival. And given Congress’s jam-packed legislative calendar, it’s unlikely to do much of anything on inflation in an expeditious time frame.

What Biden needs, therefore, are ways to combat rising prices through the exercise of executive-branch authority. The president’s options here are limited. And the impact of those policy options on inflation is likely to be the same. Nevertheless, there are at least four things that the Biden administration can and should do to reduce inflation at the margin.

(1) Repeal most (or all) of Donald Trump’s tariffs.

Donald Trump imposed a lot of taxes on imported goods. These tariffs were less carefully considered components of a comprehensive economic strategy than arbitrary, ad hoc PR tactics. The substantive case for Trump’s tariffs on steel or washing machines was never very strong. Raising the cost of metal for U.S. producers was always likely to reduce domestic-manufacturing employment, since more Americans earn a living making cars, computers, and construction equipment than do so making steel. Raising the cost of imported washing machines, meanwhile, was bound to be a net loss for America since very few U.S. residents work in the laundry-equipment business while a large majority purchase a washer at some point in their lifetimes.

But the tariffs worked even worse in practice than they did in theory. Trump’s war on foreign steel and aluminum decreased U.S. manufacturing employment, sapped productivity, and raised consumer prices. His tax on un-American laundry equipment made both washing machines and dryers 12 percent more expensive for U.S. shoppers.

Trump’s punitive tariffs on Chinese goods were less controversial but no more successful. The levies have cost U.S. importers $110 billion, while doing little to deter Chinese economic policies that the U.S. government dislikes. As U.S. Trade Representative Katherine Tai recently explained, China “continues to pour billions of dollars into targeted industries and continues to shape its economy to the will of the state — hurting the interests of workers here in the U.S. and around the world.”

Nevertheless, Biden has left the bulk of Trump’s tariffs in place. The president seems to have done this out of political considerations; his administration has consistently worked to project an image of economic nationalism, lacing the president’s policies with “Buy American” provisions. But Republicans are going to accuse Biden of selling out the American worker to the Chinese and/or “globalists” in 2024 no matter what he does. And in today’s inflationary context, deliberately raising consumer prices for little purpose beyond winning a future “fact check” is substantively indefensible and politically inadvisable.

(2) Relax the Renewable Fuel Standard.

High gas prices are the single-most politically salient form of inflation. No other commodity combines gasoline’s centrality to American life (over 80 percent of Americans drive “frequently”) and price transparency (the per-gallon rate is advertised on large signs along every major thoroughfare). Unfortunately for Biden, there’s very little that the U.S. president can do to influence gas prices. Even if the White House wished to abandon its commitments to decarbonization, it could not unilaterally increase U.S. fossil-fuel output, since America’s oil and gas drillers answer to private shareholders (who currently demand the prioritization of windfall profits over expanded production). Biden can harangue the Saudis all he wants, but OPEC would rather maximize its revenues than a Democratic president’s approval rating.

This said, there are some things that the Biden administration can do to knock a few cents off the per-gallon rate. One would be to tap the Strategic Petroleum Reserve (SPR), America’s emergency stash of crude oil. The reserve holds about 620 million barrels of black gold, enough to meet the nation’s consumption needs for about a month. By bringing some of that crude to market, Biden could put downward pressure on oil prices. But market analysts broadly agree that the effect would be “mild and short-lived.” Letting off some gallons from the SPR would not durably change the supply-demand equation in global markets.

Lifting U.S. sanctions on Iranian oil exports, by contrast, would do precisely that. Analysts project that in the absence of such sanctions, Iran would contribute up to 4 million barrels of oil a day to the world market in the near-term. Ending America’s strangulation of the Iranian economy would also mitigate the material hardships of the Iranian people. But the Biden administration appears disinclined to give ground in negotiations with Iran for the sake of modestly increasing the global oil supply.

Fortunately, there is a way for the administration to durably reduce gas prices without increasing the amount of crude in the market: It could reduce the amount of biofuels that oil refiners must blend into their gasoline.

The Renewable Fuel Standard (RFS) requires refiners and fuel importers to either buy and blend a quota of ethanol into their gas, or else purchase tradable credits for forgoing that mandate. The ostensible point of this regulation is to combat climate change. But its actual point is to inflate the incomes of U.S. agricultural interests. Ethanol burns cleaner than gasoline. In our carbon-intensive agricultural system, however, making ethanol — by growing, harvesting, transporting, and then processing corn — requires a great deal of fossil fuel and nitrogen fertilizer. Add in the biofuels mandate’s implications for land-use (the more food you divert into fuel, the more land you need for agriculture), and it’s not clear that blended gasoline has a much lower carbon footprint than the regular variety. Yet it comes at the cost of increasing both gas and food prices, and lowering air quality.

The Biden administration has the power to reduce this year’s RFS quota. The climate implications of such a move would be negligible, and it would likely knock a few cents off U.S. households’ fuel and grocery bills. So it’d be worth doing.

(3) Allow Medicare reimbursement rates to fall.

Democrats may lack the political will to pass new laws that would bring down prices at Big Health Care’s expense. But merely allow existing laws to take effect would reduce Medicare’s reimbursement rates in 2022. And since Medicare’s rates guide broader health-care prices, allowing them to fall would have a significant disinflationary impact.

If the Biden administration merely finalizes the reimbursement rates that the Centers for Medicare and Medicaid Services have already proposed for next year, it will shave between 0.1 and 0.2 percent off the Federal Reserve’s preferred inflation gauge, according to a new report from the think tank Employ America. If the White House also implores congressional Democrats to let the 2011 Budget Control Act’s automatic cuts to Medicare payment rates take effect (instead of suspending them, as usual), that would knock another 0.1 percent off 2022 inflation. Together, these changes would be nearly enough to offset the projected inflationary impact of rising rents next year.

Neither of these moves would have any impact on Medicare benefits. Rather, they would reduce prices by slightly reducing the incomes of doctors and hospitals. And again, all Democrats must do to impose these cost controls is nothing.

4) Expand immigration.

Increasing immigration isn’t automatically disinflationary for the same reason that it doesn’t generally lower wages: Although immigrants increase an economy’s supply of labor, they also increase its demand for labor.

But the U.S. is an aging country with a large and growing population of retirees (which is to say, people who demand labor, but don’t supply it), and considerable labor shortages in discrete sectors. Thus, allowing more working-age immigrants to enter the U.S. can reduce prices without depressing economy-wide wages. Simply having a lower ratio of retirees-to-workers would ease inflationary pressures. And some targeted expansions of immigration, such as reforms making it easier for foreign-trained physicians to enter and practice in the U.S., would have progressive implications for America’s income distribution by forcing down the elevated salaries of high-income professionals, and thus, the cost of the services they provide to less affluent Americans.

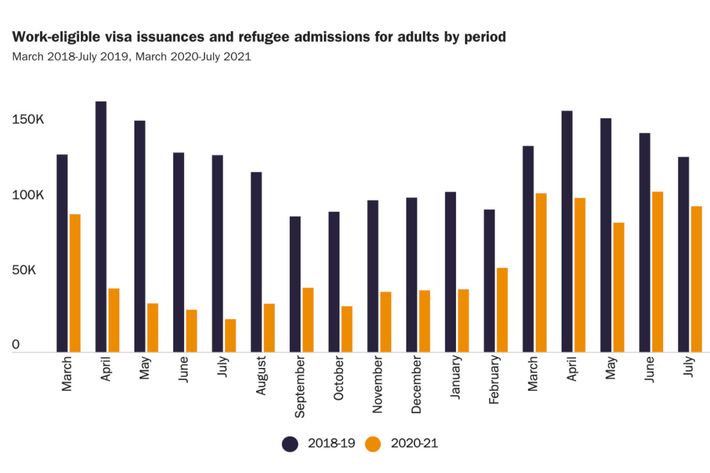

Legal immigration to the U.S. declined during Trump’s first years in office and then fell off a cliff amid the COVID pandemic. Between March 2020 and July 2021, America welcomed 1.2 million fewer immigrants than it had during the same interval in 2018-2019. This falloff goes a way toward explaining the present labor shortage.

Biden cannot pass comprehensive immigration reform without congressional cooperation, of course. But he can still do a great deal to increase immigration through executive action. In fact, according to a Cato Institute analysis, the president can implement the bulk of his immigration plan through invocations of executive authority.

For example, Biden has endorsed a policy known as “visa recapture.” Most years, due to agency delays and inaction, many thousands of green-card slots go unfilled. Since the Immigration Act of 1990 was passed, the total number of unused green cards has hit 220,000. The House’s version of Build Back Better would recycle those unused green cards, effectively increasing potential legal immigration by over 200,000. And the legislation would also abet increases in (so-called) “high-skill” immigration. It is unclear, however, whether those provisions will survive the Senate parliamentarian’s scrutiny. (Under the rules of budget reconciliation, all of the Build Back Better Act’s provisions most primarily concern the federal budget.)

Fortunately, if it doesn’t, Biden should be able to recapture those green cards through his own authority. The Immigration Act of 1990 contains several provisions indicating Congress’s intent for its allotted green cards to be used in full. And there is precedent for the U.S. government recapturing and reissuing unused visas. In the 1970s, the U.S. recaptured 140,000 visas that it had incorrectly denied to Western Hemisphere countries and reissued them, all without an act of Congress, and with judicial approval.

It’s substantively important for the president to ease the burdens of rising prices. And it’s politically vital for Biden to demonstrate that he is taking the problem of inflation seriously. Ultimately, however, the primary drivers of contemporary inflation are not subject to Biden’s control. And for now, those forces appear likely to dissipate next year, irrespective of the president’s actions. So, the White House should do what it can to make a difference at the margin. But the foremost imperatives of Biden’s anti-inflation policy should be to “look busy” and “first, do no harm.”