Capitalism isn’t what it used to be. Since 2008, critics of the world’s dominant economic system have been lamenting its imperviousness to change. And for good reason. In earlier epochs, financial crises and pandemics wrought economic transformation. In our own, they seem to have yielded more of the same. Before the 2008 crash, global capitalism was characterized by organized labor’s weakness, rising inequality within nations, and a growth model that offset mediocre wage gains with asset-price appreciation. All of these have remained features of the world’s economic order. And although the COVID crisis fostered some dramatic shifts in macroeconomic governance, 2020’s historic burst of fiscal and monetary stimulus arguably did less to change the prevailing order than to stabilize it. Globalization may be ebbing in the face of rising geopolitical tensions. But the basic architecture of neoliberal capitalism — including the dollar-based financial system and the interdependence of the U.S. and Chinese economies — has thus far weathered Vladimir Putin’s storm.

If capitalism looks static from a helicopter view, however, a peek beneath the surface leaves a different impression. In fact, the past two decades have witnessed a slow-motion sea change in the structure of corporate ownership, one that challenges many time-honored assumptions about how our economic system works.

In the age of robber barons, corporate ownership was concentrated in the hands of a small number of investors with weakly diversified portfolios. These investors therefore had both a high level of control over the firms they owned and a high-degree of interest in their success or failure: Andrew Carnegie did not stake his fortune on the performance of an S&P index fund but on that of U.S. steel.

In the 20th century, stock ownership grew more dispersed. With the rise of the middle class as well as public and private retirement benefits, pension funds became the corporate sector’s dominant shareholders. Relative to robber barons, pension funds boast limited influence over the firms they own. But they also enjoy far greater security thanks to their diversified portfolios.

In the 21st century, however, pension funds have been superseded by a new breed of shareholder, the asset manager. Whereas pension funds pool the retirement savings of households, asset managers pool the holdings of pension funds, insurers, sovereign wealth funds, and myriad other investors. In other words, they’re huge.

The three largest asset managers — BlackRock, Vanguard Group, and State Street — collectively own about 22 percent of the average S&P 500 company, up from 13.5 percent in 2008. That’s exponentially more than any three pension funds have ever claimed. Thus, like the robber barons, asset managers boast considerable influence over each individual firm they own. Yet asset managers are even more diversified than pension funds: Thanks to their mammoth scale and fondness for index-tracking investment strategies, they own a hefty chunk of virtually everything. There is no precedent for this extraordinary form of power.

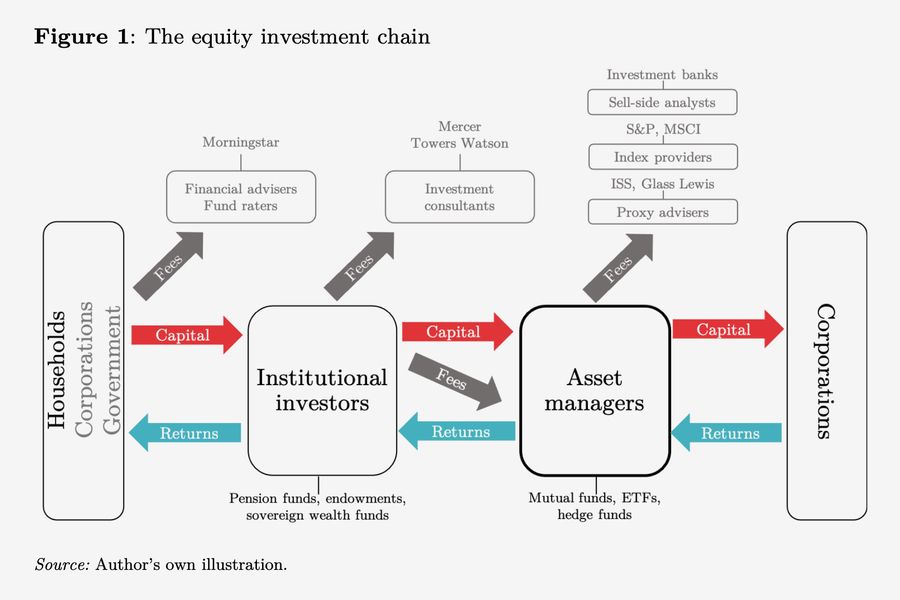

And the oddity of the ascendant order doesn’t stop there. Making matters even weirder, contemporary capitalism’s dominant shareholders have no direct interest in the success or failure of the firms they own. All returns on their holdings get passed down the investment chain to their clients — households, governments, and corporations. Asset managers make their money off of their clients’ fees, not their firms’ returns. This diagram may make the hydraulics of the system more legible:

Of course, an asset manager that delivered consistently poor returns would attract few clients. And asset managers’ fees are calculated as a percentage of the current value of their clients’ assets. Nevertheless, add a fee-based business model to asset managers’ universal portfolios, and their interest in the performance of any individual firm they own becomes extraordinarily attenuated — even when they are the single largest shareholder of that firm (which is very often the case)!

This is not how capitalism is supposed to work in theory. And it isn’t how corporate governance has ever before worked in practice. To the political economist Benjamin Braun, the contemporary structure of corporate ownership is so novel and consequential as to mark a new era in economic history, the age of “asset-manager capitalism.”

Braun’s papers on this subject are fascinating, and nerds will want to read them in full. Mere dorks, however, may be content to consider the following four ways the rise of asset managers challenges conventional wisdom about how capitalism functions — and how it might be changed.

1.

Market competition is becoming impossible under capitalism — or else increasingly plausible under socialism.

Capitalism is supposed to promote efficiency through market competition: The imperative to expand market share theoretically forces firms to innovate more efficient modes of production so as to keep prices low and attract more buyers. Yet in a world where the same massive asset manager owns every company in a given sector, it’s not clear whether this imperative exists. American Airlines may benefit by undercutting Delta on price, but such competition would probably lower profit margins across the airline industry. And since American Airlines’ top shareholders also own every other airline, it is not in the interest of the company’s ownership for it to engage in competitive behavior.

This reality has long concerned champions of more stringent antitrust policies. Indeed, a 2018 Journal of Finance study found that the rise of common ownership in the airline industry likely led to anti-competitive collusion.

And yet this does not necessarily mean asset-manager capitalism has been bad for consumers. A subsequent study from one of the same researchers found that, on net, the rise of BlackRock, Vanguard, and State Street has actually reduced prices across the economy. This makes theoretical sense. If an entity owns every firm within a single industry — and none outside it — then it is in their interest to promote collusion and price gouging. But if an entity owns every firm in every industry, the calculus changes: High prices in the airline industry reduce the profit margins of every corporation that needs to pay for business travel. The airline tycoon has an interest in collusion, but the universal owner has an interest in efficiency.

As Matt Bruenig of the People’s Policy Project observes, the fact that asset-manager capitalism has proved compatible with low prices and market competition serves as a proof of concept for market socialism. Historically, the most biting criticism of socialism’s viability has been the incapacity of central planners to rationally allocate society’s productive resources. Market socialists have answered this challenge by arguing that it is possible to have market competition between autonomous firms — and the efficiencies and information about consumer preferences it produces — without retaining the private ownership of businesses and capital. In their view, the state could give everyone in society an ownership stake in every business and still maintain incentives for interfirm competition.

As Bruenig writes, “Index funds are basically an extremely unequal version” of this proposition. Today, Vanguard owns virtually the entire corporate sector and inequitably distributes the wealth it generates to its predominantly rich clientele. Under socialism, the Revolutionary Vanguard™ will own the entire economy and distribute its proceeds to each according to need.

2.

There may now actually be a “committee for managing the common affairs of the whole bourgeoisie.”

In The Communist Manifesto, Marx and Engels referred to the capitalist state as a “committee for managing the common affairs of the whole bourgeoisie.” In hindsight, they gave the government too much credit. The wars of the 20th century — and ecological crisis of the 21st — have demonstrated that capitalist governments often fail to act in the rational best interests of wealth holders writ large.

If the wealthy have failed to rationally manage their common affairs through state governance, however, asset-manager capitalism just might allow them to do so through corporate governance. Which might well be preferable to irrational plutocracy.

Historically, a perennial defect of capitalism has been its penchant for rewarding profitable activities that impose large negative costs on society as a whole. Promoting cigarettes or leaded gasoline might make for a sound business model for an individual firm, but doing so is disastrous for society’s general welfare.

In theory, the reign of asset managers could mitigate this problem. BlackRock’s interests are not aligned with those of society as a whole. It exists to maximize the value of its clients’ capital, and its clients are the minority of the population that holds a lot of savings (i.e., the bourgeoisie). Nevertheless, precisely because they own virtually everything, large asset managers’ have less parochial interests than the dominant shareholders of yesteryear.

In early 2020, BlackRock and myriad other asset managers called on drug companies to collaborate on vaccine development. In doing so, these financial Goliaths were not merely seeking favorable publicity; they were also pursuing their own pecuniary interests. As universal owners, they had little stake in whether Pfizer or Johnson & Johnson dominated the vaccine market. Nor did they have much investment in either company maximizing their profits from vaccine sales. The top three asset managers may have owned roughly 20 percent of Pfizer, but Pfizer still accounted for a tiny fraction of their holdings. And virtually everything else in their portfolios stood to increase in value as soon as shots went into arms. Thus, in the age of asset-manager capitalism, it was in the financial interest of Pfizer’s largest shareholders for the firm to put public health above private profit.

In theory, a similar logic applies to the climate crisis. Given the deleterious economic effects of unchecked warming, maximizing long-term asset values requires a green transition. And since Exxon’s largest shareholders are asset managers — who have more to gain from high asset prices than high Exxon profits — a green transition is in the financial interest of Exxon’s largest shareholders.

The large asset managers are wont to spotlight this fact. BlackRock CEO Larry Fink famously champions so-called “ESG” investing, a long-term investment strategy that purportedly weighs firms’ environmental, social, and governance impacts.

Alas, even though there is some correspondence between the lofty rhetoric in Fink’s annual letters and BlackRock’s financial interests, large asset managers do not reliably live up to their billing as socially conscious stewards of upright corporate behavior. Between July 1, 2020, and June 30, 2021, BlackRock supported 64 percent of shareholder resolutions related to improving corporations’ environmental practices and one-third of those linked to social and governance reforms. And yet, according to a study from ShareAction, BlackRock and its peers were nevertheless more likely than other shareholders to vote against ESG resolutions. What’s more, the six largest asset managers supported fewer resolutions than the advisory firms ISS and Glass Lewis had recommended. In 18 cases, the collective opposition of BlackRock, Vanguard, and State Street to environmental or social resolutions was decisive in averting their enactment.

Given their pecuniary interest in mitigating climate change, why do large asset managers often use their power to block environmental resolutions? One possible answer is asset managers have a more immediate financial incentive to maintain good relations with corporate managers, who typically oppose any measure that would reduce short-term profits. This is because asset managers compete with each other for the right to manage firms’ 401(k) plans, and corporate managers get to decide who wins that competition. If BlackRock runs afoul of a large firm’s CEO, it may lose precious fees to State Street.

All this said, on net, asset-manager capitalism may still be more amenable to climate-change mitigation than the economic order that preceded it. For one thing, by centralizing vast amounts of investment authority under the auspices of three firms, asset-manager capitalism has given activists ripe targets for pressure campaigns. For another, asset managers have served as a powerful lobby for green policy, albeit of the kind that would redistribute income upward as they nudged carbon emissions downward. Which is to say: the kind that would serve the common interests of the whole bourgeoisie (though not necessarily those of their grandchildren).

3.

The dominant theory of corporate governance no longer makes sense.

For most of the past four decades, the dominant theory of corporate governance — at least in the United States — has been the theory of “shareholder primacy” (a.k.a. shareholder value). This doctrine holds that every corporation’s first responsibility is to maximize value for its shareholders, with that imperative taking precedence over the interests of all other stakeholders (employees, consumers, society, etc.). Critically, this is not just an assertion of the shareholding class’s sense of entitlement. Rather, it is premised on a theory of economic efficiency.

According to shareholder primacy’s proponents, there is an inherent conflict of interest between a firm’s shareholders and its workers and managers. The former have an interest in maximizing the firm’s profitability over the long haul; the latter, in maximizing their own compensation. Stipulating that highly profitable firms generally use resources more efficiently than unprofitable ones — and that the maximally efficient use of scarce resources promotes general prosperity — the shareholder’s interest is closer to that of the general public than the (potentially parasitic) interests of workers or managers. Unfortunately, shareholders tend to be weak actors in the realm of governance. They can’t directly monitor day-to-day goings-on at the firms they own or exercise much direct voice over corporate strategy. What shareholders can do, however, is sell their equity and put downward pressure on a firm’s stock price. To make this “exit” option a more powerful means of disciplining wasteful managers, proponents of shareholder primacy advocate for tying executive compensation to stock performance and exposing underperforming firms to the threat of hostile takeovers.

Shareholder primacy was always a tendentious theory of corporate governance. But now that asset managers have become the world’s predominant shareholders, the theory no longer makes sense on its own terms. Since asset managers tend to own a large piece of the companies they invest in, they typically have a direct voice over corporate governance (e.g., the way they choose to vote on shareholder resolutions can be decisive). At the same time, “exit” can’t be a routine lever of power for BlackRock: For one thing, its index-tracking strategies require it to own a bit of everything. For another, its stake in companies is often too large to sell all at once: Try selling off 20 percent of a corporation’s shares and you’ll tank the value of your own assets before you’ve managed to unload them.

More fundamentally, asset managers patently have less interest in the economic performance of any individual firm they own than that firm’s workers and managers do. After all, the latter’s job security and wage growth is contingent on their employer’s success. The top asset managers’ profits, by contrast, are barely impacted by the relative performance of any single one of their investments. As already discussed, it would actually be in BlackRock’s interest for one of its firms to lose money if it did so in a manner that increased the stock market’s overall value.

4.

Wall Street and organized labor are now aligned on monetary policy.

For most of capitalism’s history, monetary policy has been a key battleground between the financial sector and the working class for two reasons.

First, monetary policy balances the competing goods of tight labor markets and low inflation. When the Federal Reserve System keeps interest rates low, consumers and businesses borrow more, and demand for labor (among other resources) goes up. When labor markets are tight, workers become harder to replace and therefore enjoy more leverage over their bosses. This can lead to higher wages but also higher prices. By contrast, when the Fed raises interest rates, labor demand declines, as does the risk of inflation.

Second, large creditors like banks have a lot to lose from inflation, which erodes the real yields on their loans, but little to lose from elevated unemployment. Workers, by contrast, have less to lose from modest inflation than from high unemployment.

During the stagflation crisis of the late 1970s, this latent conflict came to a head. Under Jimmy Carter, organized labor fought for legislation that would have forced the federal government to prioritize full employment over the minimization of inflationary risk. The financial sector, meanwhile, pushed for austerity to curb inflation. Ultimately, under Paul Volcker, the Fed opted to give absolute priority to price stability, engineering a brutal recession that successfully drained inflation from the economy and paved the way for a new, wildly inequitable model of American capitalism. For decades after, the Fed erred on the side of price stability, deliberately slowing economic growth whenever the unemployment rate threatened to fall too low.

In recent years, however, the central bank has changed its posture. Under Jerome Powell’s leadership, the Fed has touted the social benefits of tight labor markets, reinterpreted its mandate in a pro-full-employment direction, and initially took a dovish view toward COVID-era inflation, partly out of reluctance to stymie a fragile labor-market recovery.

This pivot could be attributed to shifting intellectual currents. But from a materialist perspective, it long seemed difficult to explain. Organized labor has only grown weaker since the late 1970s, and Wall Street, more powerful. And the Fed itself has always been more attentive to the latter’s concerns. So why was the cause of full employment finally gaining ground?

Asset-manager capitalism resolves this conundrum. High interest rates and low inflation may be good for lenders. But they’re suboptimal for asset managers.

What BlackRock and its peers want, above all, are high asset prices. In 2020, the asset-management sector earned $5 billion from acquiring new clients — and $29 billion from the aggregate increase in overall asset prices. When the Fed raises interest rates, most asset prices drop, and BlackRock’s fees fall with them.

Thus, BlackRock’s analysis of today’s inflation is nearly indistinguishable from that of left-wing economists. “The primary driver of inflation is constrained supply, not an overheating economy,” BlackRock’s Scott Thiel wrote in January, advising the Fed not to raise interest rates too aggressively lest they induce a recession.

This harmony of interest between unemployed workers and BlackRock executives is highly limited. After all, if wages rise high enough, they can lower profit margins and, thus, asset prices. Meanwhile, high asset prices exacerbate intergenerational inequality, as those who already own stocks and houses see their purchasing power rise at the expense of those who’ve yet to build savings or acquire a home.

Nevertheless, asset-manager capitalism has aligned billionaire financiers and trade unionists on one of the most consequential questions of macroeconomic management. In this respect, as in many others, today’s economic order departs markedly from yesterday’s. Understanding contemporary capitalism requires paying as much attention to its novel oddities as to its myriad continuities. Capitalizing on opportunities to change it for the better will almost certainly require much the same.