The salmon-colored pages of the Financial Times are not the place you turn to these days to find good news. But on the morning of November 4, Jim Chanos, president of Kynikos Associates on West 55th Street, the world’s biggest short-selling hedge fund, read an article in the paper with irrepressible glee. A colleague had e-mailed him a link. The headline: GOLDMAN FUND LOSES $990M AFTER 10 MONTHS.

Chanos had reason to be happy, and not because he had any stake in the outcome. His East Hampton neighbor, Marc Spilker, managing director of the Goldman Sachs division responsible for the billion-dollar loss, was finally receiving his comeuppance. In June 2007, Spilker decided to widen the rather narrow footpath from his house on Further Lane to the beach. One afternoon, Spilker dispatched a crew to widen the path by bulldozing the hedges between his mansion and Chanos’s. Chanos was outraged. “I hope this is not a harbinger of how other Goldman senior executives may act when the markets become ‘just not lucrative enough for us!’ ” he wrote to friends at the time in an e-mail that just happened to find its way to the New York Post. Several months after the Post leak, Chanos pulled nearly $3 billion out of his Goldman trading account, costing the bank some $50 million in annual fees, according to a source, and brought a suit against Spilker. (Goldman disputes these numbers.) Now, a year later, as Chanos sat at his Bloomberg terminal reading the Financial Times’ account of Spilker’s recent hedge-fund woes, a smile broadened across his face. He sent out another mass e-mail to his friends, staff, and financial journalists, directing them to the news. “Mark [sic] Spilker (Head of GS Internal Hedge Funds, and Horticultural Hater) strikes again!”

It might be fun to share in a little Goldman-bashing with Chanos, until you realize that you and he are in very different circumstances. Your 401(k) has been plunging at the rate his fund is rising. Chanos is arguably the most successful hedge-fund manager on Wall Street right now. As hedge-fund all-stars bleed red—SAC Capital’s Steve Cohen is said to be off 18 percent this year, Citadel’s Ken Griffin as much as 44 percent, and even David Einhorn, who presciently called Lehman’s implosion, has seen his fund, Greenlight Capital, slide a reported 26 percent—Chanos’s short positions have earned him a return of a reported 50 percent. He now manages some $7 billion. Trader Monthly estimated his paycheck in 2007 at over $300 million, and he’s on track to earn a similar payout this December. While many Wall Street refugees are liquidating their art collections and listing their trophy houses on the market, Chanos is buying. This summer, he closed on a new $20 million triplex on 75th Street, off Fifth Avenue.

As a short-seller, Chanos earns a living by borrowing and then selling shares of a company he thinks will experience trouble. When the stock tumbles, he buys back the depressed shares and returns them to the lender, pocketing the difference. In other words, Chanos is a financial undertaker. He makes a profit when companies die. And when there’s an epidemic, he gets richer still.

one afternoon last month, Chanos sat in a brown leather chair at an oval table in his eighth-floor conference room. A whiteboard covered one entire wall, for his analysts to scrawl out potential investment ideas. On the adjacent wall, the bookshelves resemble a library of financial doom, lined with titles such as Bubbles: And How to Survive Them, How to Profit From the Coming Real Estate Bust, and Conquer the Crash.

Chanos was excited that afternoon. He had just read a report that China’s electric consumption had dropped 4 percent, despite official government statistics that the Chinese economy was growing at 8 percent. He relished the implications. “I think they’re making up the numbers!” he said. As Wall Street picks up the pieces of the broken financial system, Chanos is already one step ahead. He sees China as the next domino to fall in the global meltdown. In recent months, Chanos has loaded up short positions on the infrastructure companies that have rushed to build China’s new highways, bridges, and tunnels. Now he is waiting for their share prices to tank.

Watching Chanos’s trades over the last six months is like reliving the economic meltdown in slow motion. Since the summer, he has been cashing in his short positions in cratered banking and real-estate stocks, as the crisis has spread from the subprime-mortgage sector to become a full-scale economic meltdown. Starting in 2006, Chanos took up sizable short positions in residential home builders like KB Home and WCI, firms that transformed places like South Florida and Phoenix into exurban nightmares. This past summer, Chanos cashed out his portfolio’s 30 percent stake in financial-sector and real-estate stocks, after bank shares plummeted in the wake of the Bear Stearns collapse. Chanos then went short on construction and engineering companies, predicting that the credit crisis would spill over into a full-fledged global recession and places like China and Dubai would see their overheated economies freeze up. And he bet against his fellow hedge-fund managers’ mania for art collecting, making a bearish gamble on Sotheby’s. Last month, Chanos closed out his short position in Sotheby’s after the auction house’s stock plummeted from a high of nearly $60 to $8. “That wasn’t a hard one,” he says, smugly.

Chanos doesn’t practice the rapid-fire computer trading of a quant fund like SAC Capital or Jim Simons’s Renaissance Technologies. He pushes his analysts to dig into the minutiae of a company’s financial statements. He ferrets out accounting gimmickry that he says companies use to spin their results and inflate profits (he’s particularly skeptical of the toxic practice of “mark to market” accounting, which allows companies wide latitude in valuing illiquid assets).

Once Chanos develops a thesis, he goes all in, taking up a short position while waiting for the rest of the market to come around to his way of thinking. This year, of course, the job has been easier—just about everything cratered, so he’s had an extremely good batting average with his massive short positions. And since he called the credit crisis early, the stocks he picked to collapse have had a long way to fall. On top of his 2 percent management fee, Chanos is paid when his fund rises more than the market falls.

But when the market is not dropping so precipitously, the game is much more nuanced. More than other hedge-fund managers, Chanos has long made use of a potent weapon: the media. Chanos is a media operator. According to the New York Times business columnist Joe Nocera, Chanos is “a guy who’s willing to talk to reporters, and reporters gravitate towards people who will give them information.” You can think of Chanos like the pre-2008 John McCain—the media is his base. In this information culture, Chanos has built valuable relationships with journalists who take his ideas seriously, promote his point of view, and ultimately help make him rich. Like Washington, Wall Street is a game that is fueled by the selective leak. The right tip can mean the difference between winning or losing millions.

To get his ideas into the market, Chanos has often sent his research to reporters he trusts and e-mails stories he finds interesting to groups of journalists and other fund managers.

Chanos disdains Wall Street’s elite culture.“The sense of entitlement that everybody has because nothing has gone wrong for them is frightening to me,” he says.

Earlier this year, that tactic produced substantial blowback. After Bear Stearns went down, in March, Wall Street’s beleaguered CEOs launched an attack on shorts like Chanos, accusing them of manipulating the media, leaking damaging rumors to journalists, and profiting from their banks’ demise. Chanos understands the expediency of going after the guy who announces the party is over. “People who lose money always need someone to blame,” Chanos says. Over the last few months he’s launched numerous counterstrikes. In July, he sent an e-mail to reporters linking to an article about British regulators’ efforts to curtail short-selling on the London Stock Exchange: “It’s almost sickening now that the regulators ‘on the beat’ while the biggest credit collapse in modern financial history unfolded are now patting themselves on the back for their ‘brave’ stance on short-selling!”

And what about the ranks of average Wall Street traders who rode the boom and are now losing? Chanos feels sorry, sort of. “The marginal people on the trading desks, there’s no skill set,” he says. “If they don’t trade derivatives, I don’t know what they can do. The next stop is driving a cab.”

But pity only goes so far. Chanos sees himself as a kind of truth-teller. “I’ll always understand the Schadenfreude aspect to short-selling. I get that no one will always like it,” Chanos says. “I’m also convinced to the deepest part of my bones that short-selling plays the role of real-time financial watchdog. It’s one of the few checks and balances in the market.”

He’s not in the game for charity, though. “It’s from enlightened self-interest,” he says. “I’m not doing this for free.”

If Chanos is something of a Wall Street pariah, the feeling is mutual. A self-professed “limousine liberal,” Chanos disdains Wall Street’s elite culture. “The sense of entitlement that everybody has because nothing has gone wrong for them is frightening to me,” he says.

One afternoon earlier this year, Chanos was relaxing in a cream-colored chair in his Upper East Side living room. “A bachelor pad,” he joked. Several years ago, Chanos and his wife separated, and, at 50, he’s become a feature in the Hamptons club scene. Rival hedge-fund managers gossiped when the Post reported this March that Ashley Dupré was a frequent houseguest—“Uncle Jim,” she reportedly called him. (“I never introduced her to the governor,” Chanos told me.) Chanos had just driven in from his office in East Hampton and looked like the South Fork player he wants to be: designer jeans, a red striped Façonnable shirt, and a navy blazer. Chanos has a thick chest (his trainer told me he can bench-press 300 pounds). His weathered face is lined with deep, topographical contours, and his blond mane parts severely, crashing wavelike across his forehead.

While he lunches at Michael’s, chairs the board of the Browning School, and is a major Democratic fund-raiser, Chanos fashions himself as a Wall Street outsider. “Most of the people I socialize with are not in the business,” he says.

Chanos grew up far from the power corridors of Wall Street. He is the oldest of three brothers; his father, a second-generation Greek-American, owned a chain of dry cleaners in Milwaukee; his mother worked as an office manager at a steel company. As a fifth-grader, he was introduced by his father to the stock market, and he was hooked. At Yale, he quickly gave up on a premed major and signed up for economics classes. But despite his lanky frame and Coke-bottle glasses, Chanos didn’t want to be a nerd. He rowed crew, chaired his dorm’s social committee, and threw boozy postgame parties for his friends on the hockey team. “He was one of those special guys who could light the candle at both ends and never get burned,” says his former suitemate Keith Allain, who now coaches Yale’s hockey team. “When he had parties, he spent the week before making mixtapes. He introduced me to Bob Seger.”

After graduation, Chanos moved to Chicago. He eventually landed at the brokerage firm Gilford Securities. Early in his career, he discovered the value of uncovering frauds and using the media to move the market. In the summer of 1982, he started tracking the insurance firm Baldwin-United, which was then a darling of Wall Street. Its stock was soaring, and the company had blue-chip supporters like Merrill Lynch. But Chanos had his doubts. After getting a tip from a disgruntled insurance analyst, Chanos wrote a research report that recommended shorting Baldwin stock. Wall Street lashed into his thesis. Powerhouse lawyer Marty Lipton called Chanos’s boss and threatened to sue.

Back in New York, Dick Stern, a Forbes writer, got wind of the brewing fight between Chanos and Baldwin. Stern started researching a story and flew to Chicago, where Chanos guided him through his financial analysis. Stern then interviewed Baldwin’s CEO in a suite at the Chateau Marmont, peppering him with questions Chanos had suggested. “Jim gave us the outline,” Stern recalls. As Stern continued to work on the Forbes piece, Chanos acted as a crucial background source. Stern would call him late at night at his Chicago apartment and play back the tapes of his interview with Baldwin’s CEO to dissect. In December, Forbes published Stern’s piece, which came down on Chanos’s side. Months later, Baldwin collapsed, filing a $9 billion bankruptcy. At the time, it was the largest corporate meltdown in history.

The Baldwin bankruptcy put Chanos on the map. At just 26, he was recruited by Deutsche Bank in New York. In the spring of 1984, Chanos began analyzing Michael Milken’s Drexel Burnham junk-bond empire. “That was my next jihad,” he says. At one point, private detectives were sent to nose through Chanos’s trash outside his East 92nd Street townhouse.

When Chanos recommended shorting a Drexel-financed company called Integrated Resources, his bosses at Deutsche Bank balked: The company pressured the bank’s top executives to bury his research. Chanos was furious. According to his boss at the time, Jim Levitas, Geraldo Rivera, who’d heard about the situation, wanted to do a story. “Jim likes publicity. He was interested in getting it aired,” Levitas told me. “I had to tell Jim, ‘No, we can’t do that.’ ”

Then, on September 5, 1985, The Wall Street Journal named Chanos prominently in a damaging front-page piece that accused short-sellers of slimy tactics like spreading rumors and even impersonating a Journal reporter to get access to insider information. His bosses at Deutsche Bank hated the attention, and Chanos soon found himself out of a job.

Over martinis at a bar near South Street Seaport, Chanos and a colleague talked about what to do next. Chanos decided to strike out on his own and, with his former boss Levitas, launched Kynikos in 1985 with $16 million. A year later, Levitas burned out, unable to endure the stress of betting against companies and waiting for stocks to decline. “Constitutionally, I couldn’t make a living being short,” he says now. “Jim is able to endure the pain.”

By 1990, Chanos was managing $600 million. But he nearly went bust as the tech bubble pushed the bull market to record highs. Chanos posted losses of 30 percent in 1991, 15 percent in 1992, and 40 percent in 1993. Stocks kept rising, and there were no companies to bet against. By the mid-nineties, Chanos was on the ropes, and his fund was down to less than $150 million from a high of $600 million. He survived only when Dirk Ziff, heir to the Ziff Davis publishing fortune, agreed to give him office space and pump new money into Kynikos.

Enron made Chanos’s career. He followed the trail of Enron’s fraudulent accounting and did as much as anyone to bring its malfeasance into the light, by sharing his insights with a reporter. Historically, short-sellers and reporters have made convenient allies. Journalists and shorts are both natural skeptics who want to challenge authority (Kynikos is the Greek root for “cynic”). In many ways, digging into a company’s finances is analogous to reporting an investigative story. Not surprisingly, Chanos employs former journalists from the Financial Times and the Times of London.

Reporters, too, have a vested interest in cultivating short-selling sources. When a short-seller uncovers fraud, it often translates into the sort of epic story that can make a business reporter’s career. After Chanos tipped Bethany McLean, then at Fortune, to the problems at Enron, she landed a $1.4 million book deal and an Oscar-nominated documentary, and she recently was hired as a contributing editor at Vanity Fair. McLean and Nocera recently nabbed a reported seven-figure book deal chronicling the fall of Wall Street.

Some believe these symbiotic interests can steer reporters to favor Chanos’s point of view over the defense of a CEO or a company’s PR department. “Everyone wants to be the next Bethany McLean,” says one anti-short corporate lawyer.

Of all the journalists whom Chanos deals with, McLean—a former Goldman analyst turned financial writer—maintains a special relationship with Chanos that is the subject of lore and jealousy among rival business writers. At Fortune, McLean wrote features about the Australian bank Macquarie and Fairfax Financial—both companies on which Chanos had significant short positions. Through McLean, Chanos had access into the pages of Fortune.

Fairfax Financial, a Canadian insurance company, is now suing Chanos and a group of hedge-fund all-stars including Steve Cohen and Third Point’s Daniel Loeb. The suit reads like a mash-up of a John le Carré novel and Den of Thieves. Fairfax alleges that Chanos and his fellow short-sellers paid for negative stock-research reports that helped drive down Fairfax’s stock price. Chanos’s allies, including Nocera, dismiss Fairfax’s charges, maintaining that the suit will have a chilling effect on legitimate criticism of companies.

Chanos sees China as the next domino to fall.He’s loaded up short positions in Chinese infrastructure companies.

But the suit paints a different picture of Chanos’s trading tactics. Throughout the summer of 2006, Roddy Boyd, then a New York Post business reporter, published a series of critical pieces about Fairfax that alleged Enron-like dealings by V. Prem Watsa, the company’s CEO. The suit claims Chanos and Loeb told Boyd, who, like McLean, is a former financial analyst, that Fairfax was “the next Enron,” and that Chanos was a background source for his reporting. Both Boyd and Chanos deny the allegations.

Whatever the case, Chanos wasn’t right this time. Unlike Enron, Fairfax hasn’t been charged with any wrongdoing, and the stock has gone up since Boyd covered the company. In September, John Gwynn, a stock analyst named in the suit, was fired by his brokerage for allegedly leaking his Fairfax research to the hedge-fund managers. Chanos is still short Fairfax and refuses to talk about the case. So far the suit is wending its way through the discovery phase in New Jersey state court, and a trial is slated for next year.

If the heads of Lehman and Bear Stearns have been the last year’s primary villains, the shorts have attracted their share of negative attention. The SEC opened an investigation into whether short-sellers spread misinformation that may have contributed to the banks’ downfalls (to date, they haven’t turned up any wrongdoing). In September, the SEC banned short-selling for 799 financial stocks while forcing notoriously secretive hedge funds to disclose to the SEC which stocks they’ve shorted. “We feel like guys in a foxhole together taking shell fire,” one angry short-seller puts it.

So even as he’s been reaping his profits, Chanos has been fighting a PR war. “I’m trying to lay the groundwork for people to understand what happened, so when the facts come out, maybe they’ll see that the people who were raising the alarms aren’t the ones to blame,” he says. He sees the political posturing as nothing more than blaming the messenger. For the past two years, he has been warning of the impending financial reckoning to almost anybody who would listen (after he went short, conveniently). In July, he met with Treasury Secretary Hank Paulson over lunch at the offices of Eton Park, the $12 billion hedge fund run by the ex-Goldman trader Eric Mindich, according to one person who was at the lunch. Three days after Lehman Brothers imploded, Chanos sent an e-mail to State Attorney General Andrew Cuomo and copied his father, Mario, the former governor, on the message. Earlier that day, Cuomo had held a press conference and attacked short-sellers, calling them “looters after a hurricane.” Short-sellers weren’t responsible for the crisis, Chanos wanted Cuomo to know. If the market ever recovered, Chanos cautioned, according to one person familiar with the exchange, Cuomo would be on the wrong side of history.

But some hedge-fund rivals don’t necessarily want Chanos to be carrying the mantle for the industry. In March 2006, Chanos started his own lobbying group, the Coalition of Private Investment Companies, to promote hedge funds in Washington. But recruitment wasn’t easy at first. At one dinner with a group of female hedge-fund executives at the University Club in 2006, the audience pelted Chanos with questions about why he was starting a rival lobby when the industry already had an established lobbying group on Capitol Hill, the Managed Funds Association. “He was practically stuttering,” one person at the dinner remembers. “It was so ego-driven,” another attendee says.

And while tensions between the groups have since eased, Chanos maintains that hedge funds, known for their secretive ways and grotesque displays of wealth, risk starting a class war. “The fact that hedge-fund and private-equity people pay lower taxes than schoolteachers and soldiers is absolutely an abomination,” he says. “It’s a pretty self-absorbed industry. I want to try and change it.”

Chanos’s sense of righteousness has tracked roughly with the size of his returns. “I feel a little bit personally affronted,” he says when I ask him in September about the public criticism. “I’m defending myself. That’s why I’ve been so vociferous in this fight. I’m used to being vilified. I have a tough skin on that, I think many people are never going to love this. I don’t know if it’s from The Godfather or what, but you know that saying: ‘This is the business we’ve chosen.’ ”

On the morning of November 13, Chanos stopped by CNBC’s studios to guest-host Squawk Box. It was a victory lap, of sorts. The debate over short-sellers had eased. The ban on shorting banks had expired and the SEC also lost a fight to force hedge funds to publicly disclose their short positions. After posting some of the highest profits of any trader, Chanos was basking in the limelight that had previously eluded him. Hosts Becky Quick and Joe Kernen fawningly plugged him for investment advice, touting his 50 percent returns (which Chanos declined to confirm). As one of the only guys on Wall Street making serious money, Chanos may have finally earned some cred.

Later that day, he received an e-mail from two Greek-American ladies in Connecticut whose portfolios had been hard hit. “We have a lot of respect for your accomplishments and that you are Greek too!” they wrote. “We both speak fluent Greek and are attractive and even know how to Greek dance. Can we treat you to spanakopita? We hope to hear from you very soon!”

Chanos isn’t dwelling on the attention he’s finally won. He’s already moved on, looking for his next short targets. He’s now investigating the health-care industry and defense companies that will likely see cutbacks and face tighter regulation during an Obama administration. For depressed investors still piecing together their wounded portfolios, it’s not a pleasant thought to contemplate the next wave of failed companies. For Chanos, it’s just playing the game.

“It sounds kind of crass, but I like being right,” he says. “It’s interesting and fun to find these companies that you see gaming the system and pulling one over on their investors. It’s fun to point it out. It’s great to say, ‘No. These guys are bad guys!’ ”

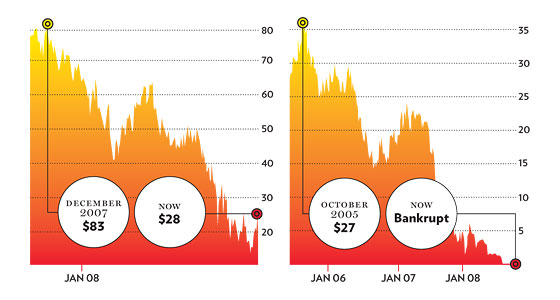

Playing to Lose

Some of Chanos’s big short-selling plays.

Macquarie Group (above left)

Australian Investment Bank

Once labeled the bank’s finances a “Ponzi scheme.”

WCI Communities (above right)

Luxury-Home Builder

Called the McMansion bubble early. “We hit home runs,” Chanos says of his call.

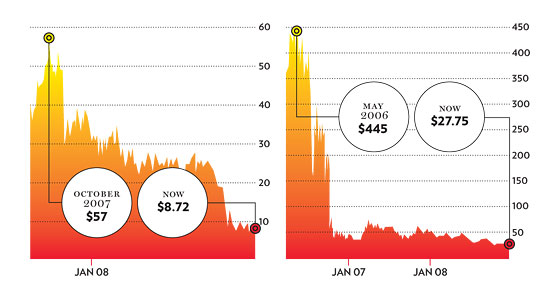

Sotheby’s (above left)

Auction House

“The contemporary-art market was going to burst,” Chanos says.

Sportingbet (above right)

Online Casino

Saw tougher regulation coming from Washington.