Shortly after 11:00 on the morning of November 4, Robert Benmosche, the 65-year-old Brooklyn-born CEO of the American International Group, sat across an oval conference table from Kenneth R. Feinberg, the special master for TARP executive compensation of the U.S. Treasury. Benmosche was flanked by AIG’s board of directors, which had requested that Feinberg come to the mahogany-paneled boardroom on the eighteenth floor of AIG’s Pine Street headquarters to explain himself. Light sandwiches and soda were served from a buffet in the hallway.

The mood was distinctly somber. Two weeks before, Feinberg had ruled that a dozen of AIG’s 25 highest-paid executives would have their 2009 income slashed by 91 percent and that salaries could not exceed $500,000 without “good cause.” About half of the executives on this list came from AIG Financial Products, the vilified trading division that had written the disastrous credit-default swaps that brought the civilized world to the brink and forced taxpayers to extend $182 billion (and counting) in financial support for the firm. Benmosche was deeply angry over Feinberg’s decision to limit his executives’ pay. But his traders were even angrier. Though the government had saved their company from imploding last September, they saw themselves as victims, scapegoats—and they were ready to fight back, departing en masse on March 16, 2010, the day after the contracts are due to be paid, if their demands weren’t met.

Benmosche was acutely aware of these feelings. Since he took the job in August, he had been in tense negotiations with Feinberg over the terms of a deal. Since March, AIG has been confronting efforts by the government to cut the “retention payments” that had sparked public furor over the Wall Street bailout. Benmosche saw the current impasse not only as bad for business but also as an affront to his stature as a CEO. It was personal. “He feels like he had assurances from Feinberg that he could pay his people competitively,” one board member told me recently. “Now Bob is feeling totally fucked.”

Benmosche—his name rhymes with touché—is a large man, six feet four, with a flat nose and a shock of metallic-silver hair. He has tan, weathered skin, the result of a long career of vacations in Croatia at his stone villa perched among vineyards on a rocky bluff on the Dalmatian Coast and to his oceanfront home in Boca Raton. Benmosche had been Treasury’s pick for the job over former Wachovia CEO Robert Steel. James Millstein, the Treasury official in charge of restructuring, is said to have told Steel, the former Goldman Sachs vice-chairman who spent nearly 30 years at the firm, that he would be too controversial given the political dimension of running AIG—and the widely held perception that when it saved AIG, the government cut Goldman a sweetheart deal.

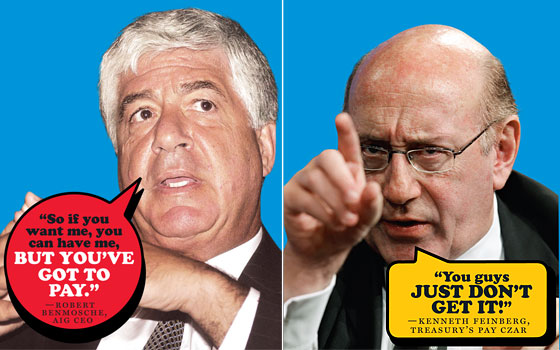

Benmosche, who’d retired as MetLife’s chairman and CEO in 2006, only agreed to take the job after the board convinced him that Treasury wouldn’t interfere with his management. Benmosche has a code. In business—life, really—money determines worth. “With Bob, it’s always about money,” a former senior AIG executive says. Benmosche’s predecessor Ed Liddy, an earnest former Allstate CEO, had answered then–Treasury Secretary Hank Paulson’s call in September 2008 to run AIG and offered to work for $1 per year, a patriotic move, but one that Benmosche must have thought suggested weakness. To come out of retirement and take the AIG job, he had demanded a $10.5 million pay package and personal use of AIG’s jet. (He got the money; the AIG board balked at turning over the jet.) “I am very easy when it comes to doing business, but I’m just not cheap,” Benmosche said in Houston this August, shortly after he agreed to his deal. “So if you want me, you can have me, but you’ve got to pay. The money is about what I am worth, and what my job is worth to be your leader.”

Although they wouldn’t put it so bluntly, the board of directors largely shared Benmosche’s view of compensation—and his outrage. The board members include men and women who had sat atop icons of American capitalism: Dennis Dammerman, former chairman of GE Capital Services; Arthur Martinez, former chairman and CEO of Sears, Roebuck & Co.; Robert S. Miller, former CEO of auto parts giant Delphi; Suzanne Nora Johnson, former vice-chairman of Goldman Sachs; Douglas M. Steenland, former CEO of Northwest Airlines; and AIG’s chairman, former American Express CEO Harvey Golub.

Over the next hour, the board members told Feinberg that his salary caps would tip AIG into crisis. The talent would walk out the door. Already, thirteen executives on Feinberg’s top-25 list had left since February. The board hated everything about Treasury Secretary Tim Geithner’s meddlesome involvement in AIG’s affairs. It was deeply humiliating, but it was also, in their minds, bad business. “You will have the implosion of this company if this keeps going,” one director later said. Golub, the chairman, was particularly angry at Feinberg’s decision to limit corporate perks—country-club memberships, private jets, sales retreats—to $25,000. At a board meeting several weeks earlier, Golub was exasperated that the directors spent 90 minutes reviewing a ten-page memo on the company’s expense policy. Could employees host Christmas parties this year? It was, he thought, a ridiculous waste of time. “We think that’s just petty and silly,” Golub told Feinberg.

“You guys just don’t get it,” Feinberg shot back.

For the next twenty minutes, Feinberg answered his critics on the board. He has an enormous round head ringed by tufts of brown hair, and a booming Boston brogue that can sound like Ted Kennedy, his former boss and mentor. “You’re only here but for the largesse of the government,” Feinberg reminded the directors. He saw them as tone-deaf and out of touch. Feinberg believed the populist anger over multi-million-dollar payouts at a time when more than 10 percent of Americans were out of work was a force that couldn’t be controlled—essentially, a political fact that would inevitably become a business reality. He let them know that if a deal couldn’t be reached, Congress was prepared to reignite a populist frenzy and he would be powerless to protect them. “I’m trying to meet your goals and the political goals. I’m trying to bridge the gap between public- and private-sector goals,” he told them.

Benmosche faced Feinberg. “This compensation issue is a distraction,” he snapped. “And there’s another thing that’s not helpful I want to show you.” Benmosche flipped on a television built into the wall and played a clip of Geithner appearing on Meet the Press that previous Sunday.

“Would you like [AIG] to be successful?” asked David Gregory.

“I’d like it to be successful enough the taxpayer can get out,” Geithner replied.

“And then after that you don’t care what happens?”

“No.”

After viewing the video, Feinberg left the room, and Benmosche turned to face his board members in private. Benmosche saw himself and his traders as being on the same side as the taxpayers—it infuriated him that Geithner and Congress seemed to see them as the enemy. With Feinberg gone, Benmosche let his anger loose. The pointed exchange he just watched only confirmed in his mind that Feinberg didn’t think he, or his executives, were worth much. He was going to quit. “I’m just about ready to hit the road,” Benmosche said. “Feinberg stabbed me in the back.”

“It wasn’t a moment of anger,” an executive familiar with the exchange later recalled. “It was the last straw of things that were agonizing him.”

Benmosche told the directors he couldn’t lead the company anymore. “When I came in, I promised these people I could stand up for them. What am I going to say to my senior executives when they say ‘I’ve got an offer across the street’? I cannot, in good conscience, tell the guy to hang around. I can’t manage this company with the assignment I’ve been given from Feinberg.”

As the three-hour meeting drew to a close, the board implored Benmosche to stay. He said he would deliver his final answer at the next board meeting, scheduled for November 24. “I’m still stewing about it. I’ll give you my decision then.”

On November 11, The Wall Street Journal reported that Benmosche had threatened to quit. Later that day, he tried to knock down the Journal report in a staff memo stating he remained “totally committed” to running AIG. One board member cautioned that the memo meant little. “This is a highly volatile situation.”

Whether he stays or leaves, Benmosche understood that he had lost control. “It’s Feinberg’s company. That’s what he learned,” one director in the board meeting later told me. “We all thought there was an ability to run this company. We were wrong.”

O n the evening of November 12, Ken Feinberg raced through the revolving doors of the New York Federal Reserve Bank and hopped into the rear seat of his black Suburban. He was late to the opera Don Giovanni. It had been a full day. He’d flown in on the 2:30 p.m. Delta shuttle from Washington, D.C., and stopped by a meeting at 85 Broad Street, Goldman Sachs’ world headquarters, and then spent the rest of the day at the Federal Reserve’s stone fortress at 33 Liberty Street. For the past hour, he’d been in meetings with William Dudley, president of the New York Fed, dealing with the AIG situation. The previous day, the Journal had reported Benmosche’s threats to walk out, and Dudley told Feinberg the Fed was worried about the billions it had invested in AIG. The company had just reported strong third-quarter earnings—FP had reduced the number of trades on its books by 43 percent and made more than $1 billion—but 20,000 trades remained to be unwound and the market was tight. Dudley told Feinberg that if he pressed too hard on compensation, the talent might leave, making everything more difficult.

Feinberg wanted me to know that he’s aware of the stakes of this fight. “We’re very concerned in the special master’s office about making sure the company thrives and pays back the taxpayer. That’s critical. This has nothing to do with retribution at all,” Feinberg told me as we bounced through the streets of lower Manhattan on our way uptown. “There’s absolutely no vindictiveness at all in any of this.”

Feinberg is familiar with emotionally charged disputes about money. As the special master of the 9/11 victim fund, Feinberg ruled on the dispensation of $7 billion to victims’ families. “The 9/11 fund was much more emotional and tragic,” he said. “There you’re dealing with dead bodies and burn victims and families that had their husbands and wives and sons incinerated. No, there’s no comparison.”

But in other ways, there are parallels. His true power as pay czar is not only to set specific compensation guidelines for the seven largest firms still using TARP money but also to inform Masters of the Universe what the taxpayers ultimately think they’re worth. It is a painful ego check many of them can’t stomach. “This is about money, but don’t pooh-pooh money,” he says. “In our society, money is a surrogate for worth, integrity, self-respect, power, and so there’s a lot of emotion associated with this. That’s a very important point. Contrary to what many people think, it’s not just about compensation and how much will be earned. It’s not just dollars and cents.”

The previous day, Benmosche had flown by helicopter to Westchester County Airport, a short drive from AIG FP’s headquarters in Wilton, Connecticut, where he addressed a roomful of FP traders. He told them he was fighting for their money. On his first official day on the job in August he told the FP traders, “I think you are all worth every dime that you’re owed in these plans,” he said, according to a person present. “If it had been my son or daughter and they had come home and told me the story of what was going on here, I would have been outraged.”

Next he took on Attorney General Andrew Cuomo, who’d threatened to release names of FP employees who received retention payments. “What [Cuomo] did is so unbelievably wrong,” Benmosche told a group of insurance workers, according to Bloomberg News. “He doesn’t deserve to be in government, and he surely shouldn’t be the attorney general of the State of New York. What he did is criminal. You don’t create lynch mobs to go out to people’s homes and do the things he did.”

The AIG board was not happy that Benmosche was potentially inciting a political fight with Washington. A week after his Cuomo remarks, Benmosche apologized to the directors at a board dinner in New York, telling them he had no idea his comments were being recorded. Since then, AIG has muzzled Benmosche and declined to make him available for this piece. “Repaying taxpayers is AIG’s top priority and we are making progress,” AIG spokesperson Mark Herr said in a statement. “We need to attract and retain the best people to earn money to repay taxpayers. To do that, we must pay competitively.”

By stoking his traders’ sense of victimization, Benmosche was playing a dangerous game. Months after being cast as villains, the traders at AIG were on the verge of a full-scale insurrection. This fall, government-supported Citigroup sold its Phibro energy-trading unit rather than pay Andrew Hall’s $100 million contract.

F inancial products traders won’t capitulate like Citi had. After all, they hadn’t caused the problem. Joseph Cassano, who’d driven the disastrous credit-default swap business, and almost all of his team had left in February 2008—with $150 million in cash. Rather, the traders that remain see themselves as doing a necessary service—cleaning up the mess—and getting treated shabbily for it. FP will go out of business in two to three years, after the complicated derivatives trades are untangled. Someone has got to do it. They see themselves as pawns in a political game being played by the Obama White House, which is anxious to inoculate itself against populist outrage over the bailout.

Wall Street, which collectively brought on the crisis, is once again flying high, while Main Street is struggling. There’s a systemic inequity here, an obvious unfairness by any standard. The problem is that the government only has power over a tiny portion of Wall Street compensation. Those most responsible for almost bringing on a depression have already left. The AIG traders wonder why they are the scapegoats, when, say, Goldman Sachs, which was certainly a participant in the sins of the old system, got to walk away with billions the American public supplied. The traders feel they’re paying largely for the sins of others. “What percentage does that have to be to make a steelworker in Pittsburgh happy?” asks one former FP executive. “If people are angry about the arsonists, it’s not a good idea to go out and shoot the firemen,” one FP executive says. “There were over 40,000 positions on our books, and less than 125 of them blew up the company,” adds an FP executive, who, like many people interviewed for this article, spoke on the condition of anonymity, citing threats against AIG employees. “It’s absurd in the extreme,” says another. “Should we punish everyone at FP? Everyone at AIG, everyone in New York? Everyone on Wall Street? Where does it end?”

If anything, the political stakes in the current struggle are even greater than financial ones. In the year since the government committed more than a trillion dollars of taxpayer money to rescue the financial system, AIG remains the proxy for everything the public hates about the bailout and Wall Street’s culture of entitlement and greed. Benmosche’s insistence that FP’s traders receive retention contracts strikes many as outrageous given the billions spent to fix a mess created by traders at the same desks. And AIG suffers from the Goldman Sachs backlash, because Goldman, at the peak of the crisis, when Hank Paulson was Treasury secretary and Geithner was head of the New York Fed, was paid 100 cents on the dollar for its credit-default swap contracts, $13 billion, money it would have lost had the government allowed the firm to go under. A year later, Goldman is set to pay as much as $22 billion in bonuses. For Geithner, everything goes back to Goldman, the original sin. “Everyone is watching Goldman,” one person close to Geithner says. “The pay problem is really a Goldman problem.”

Essentially, the perception, fostered by the Goldman-AIG deal, that Treasury is on the side of Wall Street money, ties its hands with regard to AIG—it can’t let them win again. Geithner already knows what happens. “Tim did get his head chopped off by the bonuses paid in March,” this person close to him told me. “He doesn’t want to go back there.”

The FP traders see the matter entirely differently. In early 2008, as AIG began to founder, they were offered incentives to stay. They argue that their payments weren’t “bonuses” but rather contractual guarantees to remain in their jobs under tough conditions, when some of them could have jumped ship to more stable firms. But Feinberg argues that, in the current environment, perception is reality: The world has changed, even if their contracts hadn’t. “This is not about trying to get even. It’s about realizing the reality,” says a senior Treasury official. “Take the sports analogy. You could be defensive coordinator of a football team, and if your offense can’t score points, you’re not getting any playoff money.”

The company is scheduled to pay another $198 million in retention payments to some 240 remaining FP employees in March 2010. Right now, according to AIG executives and Treasury sources close to the talks, the issue is that Feinberg wants FP’s traders to return the rest of the retention money that was pledged to be returned in March of this year under pressure from Cuomo. FP executives say the contracts are outside Feinberg’s jurisdiction. Feinberg counters that he could use the contracts as a factor when determining a trader’s base salary for next year as indicated in the statute set by Congress. In theory, if an FP employee is due to receive $1 million on March 15, 2010, Feinberg has the authority to compensate by cutting their salary to $1. Of course then, the employee could simply quit.

Senior AIG executives contend that an exodus of traders over punitively reduced contracts risks blowing up the $1.1 trillion derivatives portfolio still left to be unwound, destroying the taxpayers’ $180 billion investment in the company and potentially dragging the fragile economic recovery back into the abyss. “I’m trying desperately to prevent an uncontrolled collapse of that business,” then-CEO Ed Liddy testified last March. “The financial downside for taxpayers is potentially very large and it’s very real.” The AIG executives see Feinberg’s efforts to save a few million in retention payments, given the billions at stake, as a terrible business decision. “I just don’t understand why you would treat people this way,” one AIG executive says. “It’s economic and financial terrorism on the government’s own investment, by the government.”

Feinberg, along with everyone in the Obama White House, recognizes the risks. “I’m concerned about that. I don’t want to see that happen,” Feinberg said as we pulled up to Lincoln Center. But privately, Feinberg has indicated to Treasury officials that he’s not sure the FP employees are as crucial as they say. When the crisis erupted last fall, AIG hired McKinsey and Blackstone to study the portfolio and devise a strategy to wind down the trades. If a mass of FP traders leave, advisers might be able to stabilize the positions in time to bring in new traders. “You could triage it,” a former senior FP trader told me. Essentially, as long as someone managed risks to interest-rate and foreign- exchange moves, traders could be hired to continue the unwind.

Ever since populist outrage erupted in March, FP traders are not waiting to see what happens. Andrew Goodstadt, a partner with Thompson Wigdor & Gilly, which represents some twenty current and former FP employees, told me they are prepared to sue the firm if their retention contracts aren’t upheld in March. “We are set to litigate,” Goodstadt told me. “The employees’ view is that they’re going to get paid, either March 15 or through litigation,” an FP executive says. “Everyone will walk out the door on March 16,” adds another. “Anyone capable of running the place, why would they stay? It’s a hostile environment.”

J ust how hostile the environment at AIG had become began to be made clear last Spring. On the afternoon of March 18, Benmosche’s predecessor Ed Liddy appeared in Washington to testify before the House subcommittee on capital markets. Nominally, Liddy was there to brief the representatives on the progress of dismantling AIG and its attendant issues. But Congress, sensing the storm, did not like getting played as a sucker. Shortly before Liddy testified, President Obama poured fuel on the fire. “I don’t want to quell anger. People are right to be angry. I’m angry,” he said from the South Lawn.

During five hours of blistering questioning, committee members demanded that Liddy justify his decision to authorize $165 million in retention payments. Congress wanted Liddy to name names. Liddy refused, citing death threats, but offered a fig leaf: That morning, he had asked AIG’s traders to return 50 percent of the money. “Mr. Liddy, we are in effect at war,” said Congressman David Scott, a Georgia Democrat. “Getting half of the money back is not the answer. The answer is getting all of the money back.”

Liddy quavered under the verbal assault. With his ruddy cheeks and soft-spoken manner, Liddy, unlike Benmosche, wasn’t willing to fight back. But privately, he was furious at his treatment by Congress. He felt hijacked, and surprised the hearing would be focused solely on bonuses. “He believed he was personally thrown under the bus in the process,” a former senior AIG executive said.

Inside AIG, senior executives came to believe that Treasury was manipulating the debate to deflect populist rage from blowing back on the government’s participation in the bailout. According to four current and former AIG executives with direct knowledge of the matter, Liddy disclosed the FP payments in a draft of a letter to Geithner on March 12. In the original draft of the letter, which I obtained, Liddy said he was “not a fan of these arrangements” but struck a defiant tone: “I cannot, however, spend my time being an armchair quarterback.” Shortly after 8 p.m., James Hennessy, a lawyer for the New York Fed, e-mailed AIG HR head Anastasia Kelly and AIG’s outside counsel, Marc Trevino of Sullivan & Cromwell, saying that Geithner wanted Liddy to edit the letter. There was a feeling inside AIG that Geithner wanted Liddy to strike a more negative tone toward the traders’ compensation. “They demanded more outrage out of Ed. It was Kabuki theater,” a senior AIG executive says. Treasury officials sent back Liddy’s statement with edits, according to a copy of the revised letter I obtained. “He was set up to be the mouthpiece,” a former senior AIG executive said.

Liddy amended his language and testified that he viewed the retention contracts as “distasteful.” But that comment infuriated the traders at the FP office in Wilton, a low-slung building along Route 7. Already, they felt under siege. The House was working on a 90 percent retroactive tax on their retention contracts, and their leader seemed to be caving under the media onslaught. “We lost the PR battle right from the get-go,” the former senior AIG executive says. Then the death threats started. One e-mail read: “I would really like to put a size-12 boot up the ass of every one of you motherfuckers. Stay out of my neighborhood, you won’t be safe there.”

When traders showed up to work on the morning Liddy testified, they received a memo from Liddy requesting they return 50 percent of the retention payments. The traders were outraged—another sign of Liddy’s weakness.

Plus they felt they had the law on their side. Since the company collapsed last fall, they had been repeatedly reassured by senior management that their retention contracts would be honored if they stayed in their jobs. On October 3, 2008, two weeks after the government had bailed out AIG, staffers received a memo from William Dooley, a senior AIG executive who took over FP when Cassano was ousted in February 2008, that stated the company would uphold the contracts that had been put in place. “The uncertainty you’ve been faced with has been frustrating,” Dooley wrote, “although many issues remain to be resolved, I can tell you that AIG will live up to its commitment in honoring your retention guarantees.” It was a message that was reiterated several times. On December 23, Dooley announced the early retention payments in a letter to employees. “Congratulations!” he wrote. “I continue to be impressed with your commitment and focus.” No one had challenged those payments, why now? They expected another installment to be paid on March 15, 2009. “The message all along,” one FP executive says, “was, we know this is difficult, you had nothing to do with the mess, but you’re now here. We’re going to pay you.”

Then, as the media pounced on the story, AIG’s senior management studied the contracts to see what, legally, they could get out of. On March 16, 2009, two days before Liddy testified, Patrick Shea, a partner at Paul Hastings retained by AIG, wrote a letter to Thomas Baxter, general consul of the New York Fed, affirming the legality of the $165 million payouts. “The failure to pay [these contracts] would expose AIG FP and AIG to double damages and attorney fees under the Wage Act.”

Sensing a tough legal fight, Attorneys General Andrew Cuomo and Richard Blumenthal of Connecticut brought the weight of public pressure, Cuomo by threatening to release some of the names, Blumenthal by trying to make some of the traders testify publicly. Panic and confusion erupted in Wilton and in FP’s offices in Paris and London. On Friday afternoon, two days after Liddy’s testimony, Gerry Pasciucco, FP’s chief operating officer, hastily e-mailed his staff a form to sign indicating what percentage of the money they would return by Monday afternoon. “To the extent that we meet certain participation targets,” Pasciucco wrote, “it is not expected that the names would be released, at all.”

One trader fired back an e-mail: “Gerry, the statement ‘to the extent that we meet certain participation targets, it is not expected that the names would be released, at all’ suggests we are being blackmailed. Is Mr. Cuomo above the law?”

Over the weekend, the Working Families Party sent protesters up to AIG executives’ homes in Connecticut. By Monday, only a handful of employees, now being represented by their own lawyers, had agreed to sign their name to a document, even given COO Pasciucco’s assurances it wasn’t legally binding. Only some $45 million of the $165 million had been pledged (and to date only $19 million has actually been returned). By the middle of the week, Jake DeSantis, a 40-year-old commodities trader, spoke for his colleagues in his remarkable op-ed in the New York Times. If the public felt DeSantis’s letter was arrogant and out of touch, he reinforced a feeling of moral outrage among his fellow FP traders. “This had nothing to do with reality,” one FP executive says. “It has everything to do with politics. These guys were out to get votes and trying to appeal to the everyday man so they can win elections. That’s what March was all about.”

T he hysteria of March didn’t solve the problem of what to do with the $198 million that AIG was scheduled to pay FP employees in Spring 2010. Talks between AIG and Treasury continued. By mid-April 2009, the broad contours of a deal took shape. Treasury explored the idea of AIG slashing the 2010 retention contracts by 50 percent, according to people involved in the talks. “There was a view that this would take a tremendous amount of pressure off FP,” one AIG executive says. In return for a reduced number, AIG pressed to have the retention payments made in installments, since many of them didn’t trust they would be paid a lump sum in March 2010. “You would eliminate the risk that the money would get held up,” the source said. AIG also wanted Treasury to agree to publicly affirm support for the FP employees.

“I would really like to put a size-12 boot up the ass of every one of you.”

Shortly before 10:00 on the evening of April 10, Hennessy, the New York Fed lawyer, e-mailed Liddy and Reynolds with the subject line “Urgent: Comp.” He indicated that there was “UST acceptance” with the 50 percent deal, but cautioned some details needed to be “further socialized.”

Over Easter weekend they drafted Liddy’s letter, and on the afternoon of April 11, Kelly of Human Resources sent the draft for Geithner to Michael Hsu, a Treasury official assigned to the AIG issue. “We continue to think that a 50 percent reduction is possible,” Kelly wrote. In a draft of Liddy’s letter to Geithner dated April 11, 2009, marked “Highly Confidential,” Liddy outlined the proposal with five bullet points detailing how he would cut FP contracts by 50 percent and instead pay FP traders based on their performance in winding down the portfolio.

Negotiations continued over the next several weeks. Treasury pressed for deeper cuts. In a second letter to Geithner dated May 7, Liddy stated that no FP employees would earn more than $2 million in total compensation and that cash salaries up to $500,000 would be recalibrated based on performance. “The amount of any award over $500,000 will be paid only when and if certain additional individual performance measures are met,” Liddy wrote. “A deal appeared very, very close,” said a person close to the talks.

A few weeks later, Hsu traveled from Washington to Wilton to meet with FP COO Pasciucco and explained that the Treasury was going to name a pay czar to handle the compensation issue. A few days earlier, Hsu had learned for the first time that FP traders had only returned $19 million of the $45 million pledged last winter and was not happy about it. According to two people familiar with the talks, Hsu asked Pasciucco why the pledges to Cuomo hadn’t been honored. (Ironically, some at Treasury think that Cuomo, by complicating the political situation, had made their job much harder.) The FP COO was defensive. He said the pledges shouldn’t be an issue. “That’s a big problem,” Hsu said.

Around the same time, in late May, Liddy announced he would be resigning as CEO. The experience of the past year had taken its toll. Liddy was emotionally shaken by his time at AIG. Physically, he showed his age and had put on twenty pounds. He grew inward and sullen. “There were several times I saw Ed look like he would crumble,” a former senior AIG executive who worked alongside Liddy said. Liddy felt betrayed. He had accepted the job because Paulson had asked him and he thought of it as a public service. AIG’s previous CEOs, Robert Willumstad and Martin Sullivan, had been unable to manage the risks in the FP derivative portfolio. “Ed came in after two people threw in their cards and said, ‘Fuck, I can’t play this hand,’ ” the former senior executive said. He’d worked for a dollar a year and had been stripped of the dignities afforded an executive of his station. He was tired of commuting home to Chicago every Thursday, flying coach on the 8:23 p.m. United flight out of La Guardia. One former executive recalled that Liddy sometimes turned down frequent-flier upgrades because he worried someone might spot him riding in first-class and leak it to the papers.

While AIG’s board looked for Liddy’s replacement, AIG opened negotiations with Feinberg. Pasciucco’s hopes that the deal the Treasury had come so close to approving might be stamped by Feinberg were quickly dashed. In a series of tense conference calls with Feinberg and senior AIG executives, Feinberg indicated that he was taking his own approach and had a new set of terms. In addition to regulating the compensation for the top-25 executives, setting guidelines for the next 75 highest paid, Feinberg stated he wanted to cut the 2010 retention payments drastically to less than $100 million total. Feinberg also pressed Pasciucco to get his traders to fulfill the $45 million that had been pledged in March after Cuomo’s threat to name names. “He changed the goalposts,” one executive involved in the talks says. In one conference call in July, Pasciucco confronted Feinberg about the 2010 retention payments and offered a number around $115 million. “That’s not going to fly at the White House,” Feinberg said. (Feinberg denies he has any contact with the White House. “I have never once, not once, talked to anyone at the White House about any of this,” he told me.) By the end of the summer, Pasciucco grew so frustrated with Feinberg that the two stopped speaking.

“Tim got his head chopped off by the bonuses paid in March. He doesn’t want to go back there.”

On the morning of July 10, about 30 FP traders and executives in Wilton packed into a conference room to participate in a video conference with Feinberg. Employees in London and Paris also tuned in as Feinberg explained the reality of the situation and the forces he was managing. Feinberg was upset that news of his negotiations had leaked to the Times that morning. “I can’t believe this information was disclosed,” he said according to FP sources. AIG traders were infuriated because they believed Treasury was behind the leak. For the next 30 minutes, Feinberg explained his position. He wasn’t punishing the traders; he was trying to protect them from the fury that was out there and explained that they needed to recognize the political reality. “This is all political,” Feinberg said. When asked why he was trying to go after their preexisting contracts, he refused to answer the question.

To the traders, hearing this only confirmed their deepest, most paranoid fears. Inside FP, conspiracy theories have taken hold. Depending on who you talk to, there’s a feeling that Feinberg is a political puppet for the socialist politics of the Obama White House. “Who is truly controlling Feinberg? Our understanding is that it’s Rahm Emanuel,” one FP executive says. Another, more bizarre idea has it that Michelle Obama and Valerie Jarrett have convinced the president to redistribute wealth and make an example out of AIG. “Does Michelle Obama have a social agenda?” one FP employee asked.

The sense of us versus them exists within their own company. Many FP employees have come to distrust AIG headquarters in New York. They feel that the firm has conspired with the government to destroy FP as both a corporate and political strategy. They believe that since FP is going out of business, and the rest of AIG’s insurance assets will continue to operate or be sold to the highest bidder, it’s convenient to punish the one division of the company that caused the mess and is being dismantled. Many FP traders have retained their own lawyers, not trusting AIG to protect their interests. “We were easy targets, and we don’t even exist anymore,” one FP executive says.

O n the afternoon of November 17, Benmosche met with Feinberg in Washington to continue negotiations over a deal. A source familiar with the meeting described it as “constructive.”

The challenge for Geithner and the Obama White House in this fight is to extract maximum negotiating leverage and know what you can afford to lose. The stakes are higher, of course, because of what was surrendered earlier. On November 16, the TARP inspector general, Neil Barofsky, ruled that the Fed probably could have extracted concessions from Goldman Sachs and others but didn’t. It’s now clear that was one of the truly major blunders of the bailout. “If they had let us fail, it would have been game over for Goldman, Morgan Stanley, Merrill Lynch, Wachovia,” says a senior FP executive. “Not because they had exposure to AIG but because the market had no liquidity. You can’t survive in a world without leverage.”

It’s the moral-hazard problem writ on a truly gigantic scale: Goldman, Morgan, Merrill, et al., took risks—for what was dealing with AIG but a risk—and didn’t ultimately have to pay any of the costs. AIG should not be a place to get rich, after all that’s happened. But the AIG FP traders are right that, in some sense, they’re stand-ins for the sins of an entire class.

On Wall Street, there is a debate about just how fundamental Feinberg’s rulings will be in changing the culture of greed. At the non-TARP firms—Goldman Sachs, Morgan Stanley, JPMorgan Chase—there’s serious money to be made. “Bonuses will be up 35 percent this year over last year,” says Michael Karp, founder of the Options Group, a compensation consultancy. At the TARP firms, there is one view that an inability to pay will drive the big rainmakers away. “Any superstar like Andrew Hall is going be crushed,” one compensation consultant says. Adds Gary Burnison, CEO of the executive search firm Korn/Ferry International: “It’s a fair-market society; at some point, you’ll say enough is enough.”

Feinberg told me he doesn’t see binary choices. His job is to weigh competing interests and “come up with a fair number.” The problem is that fairness from a Wall Street point of view is very different from how most Americans think of the word. Part of Feinberg’s job is to bring them into harmony. “The companies will stay in business, they’ll thrive, and the taxpayer will get all, or some, of their loan back,” he says.

And for AIG, that question is a $180 billion gamble. The FP traders are well aware of their leverage in letting everyone know the stakes. “As a trader,” one senior FP executive says, “you’re only as good as the hand you have.”