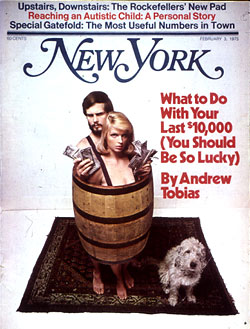

From the February 2, 1975 issue of New York Magazine.

But first a joke.

This broker calls his customer in 1970 and puts him into Penn Central. In ‘71 he calls and they go into Levitz Furniture, “for the long pull.” In ‘72 it’s Rite Aid at 54¼. And in ‘73 he calls to tout Equity Funding. In 1974, the customer calls the broker and says, “Look: I don’t know about all these stocks we’ve been buying—I think maybe I’d be better off in bonds.” “Yeah, sure,” says the broker, “but what do I know about bonds?”

So it has finally happened. A year ago you switched your last thousand shares of U.S. Steel, at $40 apiece, into a thousand shares of Chase Manhattan’s real-estate investment trust, also at $40 apiece, for the yield. (I know of a man who actually did that.) Chase Manhattan, for crying out loud. And now, with the Chase trust down around 6, plus what you have left in Pan Am and a credit at Saks, you are down to your last $10,000. (Some of us should be so lucky.) What should you do with it?

Granted, this is a highly individual question. It depends on things like your age, your tax bracket, the number of dependents you have, your financial sophistication (which obviously wasn’t all it might have been), and so on. Largely it depends on what the business schools call your “risk profile”—the trade-off you choose between “eating well and sleeping well.”

It is also very important to establish which last $10,000 this is. If it’s really your last $10,000—all you have—then you should almost certainly put most or all of it into your local savings bank. You may need it. Only if you were quite young, with no dependents, and with a slush fund to fall back on if necessary, such as parents, could you prudently consider investing your last $10,000 in something much more aggressive than a savings bank or (read on) a money-market mutual fund.

But assuming one already has what he considers to be adequate savings, adequate life insurance, a secure job, and a mortgage he can handle—and that this $10,000 is what’s left of money he had set aside for long-term investment rather than for year-to-year operating expenses—what should he do to try to build it back into something meaningful? Should that $10,000 go into the savings bank also?

We asked 21 people for their advice, and every one of them, amazingly enough, told us to buy stock in Shoney’s Big Boy Enterprises!

No, scratch that. (I just picked the name at random from my stock guide.) As you would expect, we came up with a wide range of conflicting advice:

First, there was the point of view of those who felt, as Henry Rice, a respected real-estate consultant, put it, that “$10,000 just ain’t money anymore. It’s not a big enough chip for an investment program.” What’s a meaningful chip? “I think you would have to raise it to $100,000.” You could put $10,000 in the market, he says, but he thinks you would probably be better off in a savings bank. As for real estate, he says, there is no reasonable way for you to invest just $10,000—unless you are the mechanical type that wants to run a tenement. Even then, he says, you would make money not so much from the investment of your capital as from your own skills and labor. “Saving on plumbers’ bills by coming around at night in your overalls, and that sort of thing.” My friend Laura Sloate, who heads her own small brokerage firm, agrees about the size of the chip. “I don’t believe in investing anything less than $100,000 at risk. I would put the $10,000 in an income trust. Fidelity Daily Income Trust, probably [in Boston—800 225-6190].” You can invest as little as $1,000 or $5,000 in most such trusts, also known as “money-market mutual funds.” They buy the high-yielding securities denominated in hundreds of thousands or millions of dollars that small investors cannot afford. The money you invest is not insured, but except in the grimmest of circumstances is quite safe.

NBC economic correspondent Irving R. Levine, the only network reporter with a middle initial, agrees with this approach. “Even though inflation is going to keep eroding the purchasing power of money,” he says, “it nevertheless seems wise to me in a time of economic uncertainty to keep a sizable portion of your money in money. I like the money-market funds. They pay interest on a daily basis, and you can pull your money out just about as quickly as from a savings account, which pays less interest, or even from a checking account, which pays no interest at all.”

Of course, after taxes, the difference of a couple of percentage points on $10,000 just isn’t worth a great deal of trouble, which brings us back to the fact that we’re not talking about very much money.

One typical reaction in that respect was that of a friend of mine at First National City Bank, the decimation of whose own net worth over the last few years has been presided over by the Old Colony Trust Company, in Boston. With his hypothetical last $10,000, he says, he would buy a sailboat. “It’s just about the right amount of money, and if I’ve lost everything else, I may as well invest in something I can enjoy. And it’s bound to be more expensive next year, so it may not be such a bad investment.” Others suggested exotic vacations or a last big day at the races.

But by and large the advice was divided into the camp that saw unprecedented investment opportunities, even for $10,000, in the end-of-the-world price tags that have been affixed to most securities, versus the camp that saw the end of the world, or something a little less harsh, as a real enough possibility that it should be hedged against as far as possible. If we are in the middle of a severe recession, then this should be a great time to invest. If we are entering a decade that is to be a modern version of the thirties, then this is a good time to keep one’s money in federally insured bank accounts.

James Dines, Harry Browne, et al., of course, say you should put all your money into gold and silver of one sort or another (coins or wafers or stocks), and await the apocalypse. Farmland, a machine gun, and a library of do-it-yourself books are also recommended.

“…’No investment market,’ cautions Janeway, ‘not stocks, bonds, gold, or art, is going to be safe for civilians in the coming year’…”

But you don’t have to be a gold bug to be cautious about investing right now. Eliot Janeway, the columnist, advises our hypothetical investor to “keep his money in the bank, keep it in a federally insured savings account, and just be grateful he’s even got ten left. Don’t try to invest it this year,” he says, “because with $10,000 you don’t have the resources to average your losses. No investment market in the coming year—stocks, bonds, gold, art—is going to be safe for civilians.”

Similarly, our own Dan Dorfman “wouldn’t buy any stocks right now.” He thinks the Dow Jones Industrial average will dip into the 400’s. He too would put the $10,000 into a bank or a money-market fund, “something like Dreyfus Liquid Assets, which yields around 8.5 per cent now,” because “if that’s not safe, what is?”

Robert W. Wilson, a savvy private investor, expects an up-and-down market over the next few years “like the English market has been, or like the U.S. market in the thirties.” He sees the small investor getting whipsawed in such a market, and likely to lose the little he has left. “If you know an astute broker, fine.” Otherwise stick with the money-market funds.

To get a good grip on why the bears are so bearish—it goes beyond the unemployment figures in Detroit and the slump in gross national product—I would recommend The Coming Credit Collapse, by Alexander Paris. The book’s depressing analysis is more responsible than its inflammatory title, and is suitable for anyone age nine to 91—so long as he has a decent grounding in business and economics and a reasonably strong heart.

In a word, Mr. Paris sees ever worsening cycles that go something like this: a credit crunch that leads to a recession, which leads to reflation of the monetary supply to pump up the economy, leading to even higher inflation leading to controls, leading to a burst of superinflation when the controls are lifted, leading to an even more severe credit crunch to try to restrain the inflation, leading to an even more severe recession, leading to even more massive reflation (like a big tax cut) … and so on, ad disastrum. His book was written a year ago and “So far,” he notes gleelessly, “things seem to be right on schedule.”

As you would expect, Paris, a Chicago-based officer in the investment firm of Spencer, Trask, thinks this is the time to aim for survival rather than capital maximization. He suggests dividing your $10,000 among “cash equivalents,” like Treasury bills or savings accounts (that can be quickly converted to cash); gold coins, like the South African Kruger Rand (which gold enthusiasts agree are more practical for the little investor than investing in gold itself); and stocks in gold-mining companies. Or, if you are trying to maximize capital, he suggests buying only high-quality stocks to try to catch what he expects will be the temporary updrafts in the market. “You had some great rallies in the thirties,” says he.

Not everyone is so grim.

The bullish case was most ebulliently set forth for me by a professional investment adviser who said: “The time for prudence has passed. There is a time to be prudent. Polaroid at $140 is a time to be prudent. But Polaroid at $17 …” Of course, this man was getting a little carried away by what in normal times could be described only as dreamlike opportunities—like a child who finds himself in a toy store where everything is selling for a dime on the dollar. But, besides the fact that one should always be “prudent,” and that it was “conservative” he meant to say—these clearly are not normal times. Those toys may not work when the child gets them home, because we are having a little trouble with the batteries. Which isn’t to say you shouldn’t take the risk—or even take it on margin, buying $20,000 worth of stocks with your last $10,000—but only to say beware.

Alan Abelson, managing editor of Barron’s, is without question the cleverest man on Wall Street. That is, of course, an outrageous statement to make, but there are many who would agree with it (including, possibly, Alan himself). How would he handle the $10,000? “I suppose at this point,” he says, “after a three-, or, depending on how you figure it, a six-year bear market, I might be tempted to buy stocks.” Which ones? “Look at it this way. There are scores of stocks selling under $10, at the same time earning money. A lot of them have decent balance sheets, and even more importantly, a lot of them are selling under book value—considerably under book value. So I’d look for something like that.”

But which ones? Abelson says he sees tremendous value in the insurance group. Some big companies have already had good runs (19¼ to 32 for I.N.A., for example); but many of the smaller ones and the peripherals are selling at two to three times earnings, over the counter. Then there are the food wholesalers, “the accursed middlemen” everyone talks about, as Abelson puts it, who have managed to keep a low public profile, but for whom business is very good. Companies like Bozzuto’s and Flickinger sell over the counter at four or five times earnings, have “great growth records,” he says, and deal in a product that is likely to move off the shelves no matter what.

One more, Alan, give us one more! So he mentions Cluett, Peabody at 4—down, like so many companies, from a high around 40—a half-billion-dollar apparel company which he calls “a viable company in a viable business.”

Of course, it takes very little buying activity to push these stocks up to levels where they are much less obviously bargains (assuming they are even bargains at these prices). And after they rally briefly on a burst of publicity, they are all too likely to sink back to their rock-bottom levels, or lower.

“I’ve been whittled down to my last $10,000 and what should I do? The first thing I would do,” says investment adviser Marty Zweig, “is change brokers.” He would then buy low-multiple stocks that had some insider buying over the last six months, and no insider selling. He figures that the insiders—corporate officers and major stockholders—know what’s going on in their own firms.

“Brutus,” whom I last saw on a Boston TV show wearing a bull’s mask over his eyes and a ring in his nose—and who, under his real name, John D. Spooner, reviewed his own book, Confessions of a Stockbroker, for The Boston Globe—thinks there are some great opportunities in the market at these prices. “I would not buy the big blue chips that have been knocked down,” he says. “What I’m interested in are a list of companies that will survive, that are financially viable, that were $20, $30, $40 a share, but are now selling from $12 down to $5, paying 8 to 10 per cent dividends that are well covered by earnings.” He names companies like Gerber Products, Hershey, Papercraft, Coca-Cola Bottling Co. of Los Angeles, General Cinema (the largest theater chain in America and the largest bottler of Pepsi-Cola), Keyes Fibre (“the premier manufacturer of paper plates, an old New England company”), and Triangle Pacific. Unfortunately, most of these are already more expensive than they were a few weeks ago. “If you’re already in stocks like these,” he says, “then sit tight and add to your position wherever possible.”

“If this hypothetical investor has a strong stomach,” suggests Malcolm Forbes Jr., son of the balloonist and heir apparent to Forbes magazine, “he could look over the New York Stocks Exchange list, pick out 40 or 50 companies selling at $2 or $3 or $4 each, and either buy 100 shares of each or put $100 in each, and over a period of a few years he would probably do extremely well. [As would his broker.] A lot of those companies are probably going to fall by the wayside and never return to health; but a goodly number probably will. So, you know, he could have plenty to do each day figuring out the prices of his 40 or 50 stocks, he’d collect plenty of certificates, and if worse came to worst he could make doilies out of them and sell them as antiques. “Now,” Forbes continues before I can decide whether to cancel my subscription, “if he’s the kind who either doesn’t have the stomach or thinks that’s a frivolous way to go about it, he might do the same thing in the bond market. There are substantial numbers of corporate bonds selling at severe discounts, and, again, if he gets a diversity of a dozen or more different bonds, he’s probably going to get wiped out on some, but he could do very well overall. Because as long as the company stays alive he could get 15 or 20 per cent on some of those things; and if the company does return to health, well then, he’s going to have a huge capital gain as well.

“If you’re a more traditional investor you could put half your money into I.B.M. and I think do very well. And then go to the other end of the spectrum and buy a really depressed stock such as American Airlines, which at $5 or $6 a share is selling at a virtual bankruptcy price. If you look at their balance sheet, you’ll find that they have a very healthy cash flow, even though they’re not making much money these days. And if the economy recovers someday, and with it air travel, I think you could do extremely well by that.”

And then there are the steels and the utilities and … in short, if we can ever restore a semblance of economic health to the country, then just about any selection of stocks and bonds is likely to do very well. That’s not news to many people, but it’s very pleasant to contemplate. Wishful thinking?

“This is more than a recession,” says Sylvia Porter, of W.I.N., “it’s a slump. But I’m still optimistic about the long-term economic growth of our country.” Ms. Porter would split the $10,000 between high-quality basic-industry stocks, on the one hand (not the glamours), and highest-grade short-term fixed-income securities on the other. That means savings certificates at savings banks for the unsophisticated investor, she says, and certificates of deposit or federal-agency bonds for those who can afford them and can remember to roll them over when they mature. In a high tax bracket, of course, she would recommend high-quality tax exempts instead. And she believes that many investors don’t realize what a high tax bracket they’re actually in.

She would steer clear of gold (“a dead investment and expensive to own, even though I think it will probably go higher”), land (“terribly illiquid,” though in areas of obvious future growth like her own Pound Ridge, it’s “bound to appreciate”), and second-grade securities of any kind ("Whenever I’ve invested in them I’ve gotten burned”). If we were talking about more money, she says, she would want to discuss hobby/investments like rebuilding antique cars, collecting lithographs, and collecting copies of fine antiques. Why do I have the feeling I’m talking with the Happy Homemaker when I’m talking with Ms. Porter?

… Says one investment adviser. The time for prudence has passed. Polaroid at $140 is a time to be prudent. But Polaroid at $17’ …”

Warren Buffett, a very successful money manager turned private investor, “has no idea what stock prices will do,” but thinks our hypothetical investor should “buy some marketable security that represents a good business that he understands, at far below its value to a private owner.” Private-owner value, he says, is where the businesses would trade between two well-informed private businessmen who are under no compulsion to deal. This varies from industry to industry, and tends to be based on multiples of likely future earnings. “There are businesses trading hands rather frequently, like banks, TV stations… . Business is done, and the prices in that world of private ownership are enormously different from what little pieces of paper [stock certificates] change hands for. Where it used to be that public companies were selling way above their private-owner values, now just the reverse is true.”

Private-owner value gives you a benchmark of reality in the approach to securities, says Buffett, instead of trying to decide whether they’re going to go up next month. “It’s standard Graham-and-Dodd [the classic text], but all I can say is that if you’re not in a hurry, it works.”

Jeff Tarr, who spawned the computer-dating craze when he was at Harvard, and who calculates the angles on a complicated arbitrage situation as easily as most people figure change from a dollar, would “buy high-quality long-term bonds selling at a discount. You can probably get double-A bonds yielding over 9 per cent. If interest rates go down, you would have a capital gain. If they go up or stay even, at least you are getting a good, safe return.” If your tax bracket were high enough—and it’s pretty hard not to be in a fairly high tax bracket if you live in New York—then you could do the same thing with tax-free municipal bonds.

(It’s surprising how many people don’t know what their tax bracket is. To get an idea of how much you pay in tax on your last few dollars of income—which is what counts in making investment decisions, not the average tax you pay on all your income—calculate how much in federal, state, and city tax you would have saved last year if you had earned, say, $1,000 less. A saving of $430 in taxes means you are in the 43 per cent bracket. And that means that a tax-exempt bond yielding 7 per cent is equivalent, after taxes, to a regular bond yielding 12.3 per cent.)

Convertible bonds are also an obvious play. The interest they pay is more certain than the dividend (if any) on the underlying stock; and should the stock move close to or above the conversion price, the bond will move up apace. Of course, many converts are so far out of the money that it’s hard to see their ever coming back.

Burton G. Malkiel is chairman of the economics department at Princeton and author of A Random Walk Down Wall Street, which is coming out this month in paperback and is easy, worthwhile reading. He strongly recommends buying shares in “closed-end investment companies.” These are mutual funds that accepted only a predetermined amount of money at the outset—say 1 million shares at $30 each—and then closed the sales window. You would expect each share of such a fund to sell at one-millionth of the total value of the fund’s portfolio—but they don’t. They sell at a discount.

Malkiel sees the economy getting worse, but thinks a tax cut and expansionary monetary policies could send the stock market higher. And, he figures, why pay $1 for $1 worth of stocks when you can get them for 20 or 30 per cent off? Granted, the managers of the fund might not have what you would consider the optimal portfolio, or might make poor investment decisions in the future. But it is Malkiel’s basic acceptance of the “random-walk theory” of stock price movements that leads him to think no one is much better than anybody else in choosing which stocks to buy, anyway. It’s largely luck.

He does recognize that different portfolios may have different degrees of risk, however, and so he mentions the Lehman closed-end fund, when selling at around a 25 per cent discount, for the less aggressive investor; Baker Fentress, selling at around a 50 per cent discount, for the more aggressive investor; and one of the “dual-purpose” funds, also selling at discounts, for the even more aggressive investor. These last, such as Scudder Duo-Vest and Putnam Duo Fund, have both “capital shares” (which are the ones Malkiel is talking about), and “income shares.” All the dividends from the fund’s portfolio go to the holders of the income shares, and all the capital gains (or losses) go to the holders of the capital shares. Thus the income shares get twice their share of the income and no part of the capital gains or losses; and the capital shares get twice their share of the capital gains or losses and none of the income. It’s called leverage, and is great when things are going up.

The added advantage of the dual-purpose funds, Malkiel points out, is that within seven to nine years they will definitely return to 100 per cent of their book value, when, by their charters, they become “open-ended” funds.

For a more patient explanation of this investment strategy, either read Malkiel’s book or call a broker.

Notice that for all the variety of advice, no one suggested entrusting the $10,000 to a bank trust department.

Even if there are unprecedented values about now, there is no “quick way,” that’s prudent, to multiply your money. That leads one of my hotshot friends to recommend betting the $10,000 on the Chicago Board Options Exchange, in the hope that you might hit it big, which you might. Last year he suggested I buy World Wide Coin, at 15, which I didn’t, but which he did to the tune of 1,000 shares, last quoted at 2.

The really hard thing to do with $10,000 is to choose some sensible investment strategy and then stick with it as long as it continues to make sense. Next to your ace personality, patience could be your greatest asset.

Torn though I am between visions of sugarplums and financial nightmares —as greedy and frightened as the next guy—I will keep most of my own money in a ridiculously diversified (it keeps me interested) portfolio of unglamorous securities, many of which, if we muddle through this economic mess, as we eventually muddled out of the Vietnam mess, can double and triple without getting back to half their former highs. I sell a little on market rallies; buy a little more when the market dives. In the meantime, I get dividends that range from 6 to 12 per cent. And if the world does end, and I lose my last $10,000—well, that won’t be the end of the world.

Read This and Save Big!

The chances are good you qualify for a big tax deduction you are not taking. If you are not currently covered by a pension plan, the new pension law allows you to set up one of your own. It’s called a Keogh plan, and it has great advantages that have just been significantly liberalized.

Basically, the plan allows you to take money that you earn now and, without paying any taxes on it, put it away for retirement. The interest and dividends it accrues each year are tax-free, also. Then, come retirement, you do pay regular income taxes on the money you withdraw from the fund you’ve amassed. But by then you are likely to be in a lower tax bracket; and in the meantime, all those deferred taxes have been working for you.

It used to be that only self-employed people qualified for Keogh plans. (Ask your dentist.) Now anyone who is not already covered by a pension plan qualifies. And even people who are covered by a pension plan, if they earn extra income on the side, qualify.

Self-employed taxpayers may contribute up to 15 per cent of their income each year, up to a maximum of $7,500, to their Keogh plan. Taxpayers who are not self-employed may contribute up to $1,500.

The easiest way to set up a Keogh plan is to go to a savings bank. It is just a matter of signing a few forms and depositing your money before December 31 of each year. You get a savings-certificate passbook that looks just like any other. If you prefer a more speculative investment, such as stocks or a mutual fund, call your broker. Even the money-market funds which are currently in vogue can set up a Keogh plan for you.

You can have several different Keogh plans at different places; and, over the years, you can switch your money around from one place to another.

What you can’t do is withdraw your money before age 59½. If you do, you pay an immediate 6 or 10 per cent penalty off the top (it is not yet sure which), and then regular income taxes on the amount you withdraw. This withdrawal restriction is one of the main reasons people pass up the Keogh plan. (Simply not knowing the plan exists is another.) But consider: are you planning to have any investment assets by the time you are 59½? If so, they may as well be in a Keogh plan. What’s more, if you did have to liquidate your savings for some emergency, 10 per cent would not be such an awful penalty to pay, especially when you consider the extra interest your tax-free dividends have been earning along the way.

—A.T.