For a few seconds, the question hangs in the air.

“Would you just raise your hand?”

The congresswoman from California peers down through her spectacles at the eight men in front of her, their faces as dour as war criminals at a tribunal. It’s the congressional Finance Committee hearing in February, and Maxine Waters has demanded to know who among America’s investment-bank CEOs had the gall to take billions in federal bailout money and then raise credit-card rates on the very taxpayers who’d helped prop up their sorry companies.

Heads crane to look. Then the long, thin arm of Vikram Pandit, the chief executive of global banking conglomerate Citigroup, goes up in the air like a flag of surrender. When it drops back down again, Pandit’s shoulders slump, a weak smile of acquiescence on his face. Behind him, the Reverend Jesse Jackson glowers with righteous anger.

“Thank you,” Waters says curtly.

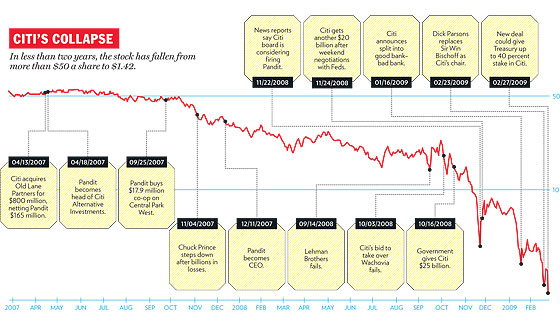

It’s a moment of withering humiliation for Pandit, but it’s only the latest disgrace: In the preceding months, he has barely clung to his job, as Citigroup’s board considered replacing him with a former media CEO and offered the government his head in exchange for the billions in bailout money. President Obama himself publicly rebuked him for ordering a new $50 million jet. Forced to break up Citigroup against his own strategic aims, he’s taken so much government aid that one i-banker jokes that Citi has become “the Wall Street version of the DMV.” The rank and file at Citi, their net worth destroyed, accuse him of cronyism and absentee leadership. He’s become a virtual corporate eunuch, his options narrowed to nil, making a $1 salary as a public display of humility.

Pandit is trying to keep his chin up. “Look, I don’t want to leave until the job is done,” he tells me late last week. “I don’t want to lose the opportunity to put this company in the right place, because I believe I can do it.” Not everyone agrees, of course, and the consensus is that he might already have been replaced at Citi if the government could find anyone willing to take the thankless job. (“The funniest blog was e-mailed to me by a friend,” he jokes wanly. “ ‘Pandit Gets to Keep His Crappy Job.’ ”)

It wasn’t supposed to be this way. When he arrived at Citi in late 2007, Vikram Pandit was the definition of the fabled “smartest guy in the room,” the kind of brainy financial engineer Wall Street invented—and rewarded richly—over the past twenty years, as complex instruments like derivatives fueled wealth creation. He saw hidden folds in complicated problems that others didn’t see, and when he spoke, which was not often and always quietly, people listened. But for all his brains, he never quite seemed to be in control of his own destiny. Fourteen months later, Pandit is the latest to be blamed for everything that is wrong with Wall Street, the smartest guy in a room full of idiots.

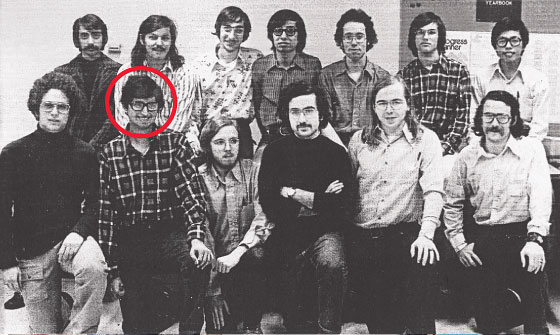

In the 1976 Columbia University yearbook, Vikram Pandit appears with the Institute of Electrical and Electronics Engineers: He’s a slight young man with huge black-framed glasses perched over a thin, aquiline nose and a sparse mustache, his thin neck poking out of a too-big plaid lumberjack shirt. He looks cheerful among the academic elite. Pandit had moved to Queens from a town in central India when he was 16, the son of a middle-class pharmaceutical executive. His family was of the Maharashtrian Brahmin caste, traditionally known as priests and scholars (Pandit, in fact, means “priest” or “learned person”), who frequently enter the business class in Indian society. When Pandit was born, an astrologer told his family that “whatever this boy touches will turn to gold.”

A spectacular student, Pandit studied summers and earned an undergraduate degree in electrical engineering in only three years. He then turned to finance and earned a doctorate after publishing a dissertation involving a crushingly complex financial puzzle. After teaching economics at Columbia, he moved to Bloomington to take a job as a professor of finance at Indiana University. This was a time when lowly professors at midwestern schools were suddenly being offered entry into the world of high finance. Wall Street needed so-called quants who could understand sophisticated investment structures like derivatives. Pandit saw an opportunity. He started as an associate at Morgan Stanley in 1983, among the first Indians to be employed at the firm.

Almost immediately, his colleagues recognized his sharp mind. “Whenever we had a tough problem, whatever the complex structuring was, we’d send Vikram to do that job,” recalls Anson Beard, an advisory director at Morgan Stanley and a veteran of the company’s seventies vanguard.

“There were probably only five or six people who really understood the balance sheets and the trading positions,” says Barton Biggs, a former colleague at Morgan who now runs Traxis Partners. “And none of those people were members of the executive committee. Vikram did understand it and could explain it.”

He was consistently prescient on sophisticated trends in financial theory. “He was talking about fat-tailed risks fifteen years ago,” says a former colleague from Morgan, referring to the concept eventually popularized in Chris Anderson’s 2007 book, The Long Tail. Others described Pandit’s uncanny ability to “see around corners,” predicting, for instance, the rise of hedge funds in the late nineties.

Pandit may have been Morgan Stanley’s resident genius, but he was nobody’s idea of a natural-born leader. He lacked charisma, detested glad-handing, avoided confrontation, and generally struck people as awkward and uncomfortable. The guy who seemed to have everything he didn’t, Pandit couldn’t have helped but notice, was John Havens.

Born to wealth and married to an heiress of the Doubleday book-publishing fortune, Havens hunted birds, played golf, smoked cigars, and knew his way around private clubs and charity dinners. His unusual looks—he was hairless owing to the rare skin disease alopecia universalis—were offset by his flashy ties, suspenders, and meticulous tailoring, “a walking advertisement for a bespoke clothing store,” according to one of his former colleagues at Morgan. His status among the elite members of the firm, old-line executives like Anson Beard and Parker Gilbert, was high. He played the part to the hilt, carrying himself with a martial bearing and once standing on a desk in the trading floor and exulting: “I bleed Morgan Stanley blue!”

Havens and Pandit had an unlikely but natural affinity. As a sales trader in the equity division, Havens sold clients the complex securities Pandit crafted. When Pandit came up with a new investment instrument, Havens wasn’t afraid to say “this is a shitty product you’re coming up with,” says a mutual colleague of the men. “[Pandit] came to appreciate Havens’s abilities not only to sell things but to help with the creation of the product.”

But Havens wasn’t just a business partner; he was also a kind of social prosthetic for Pandit. In exchange, Havens found Pandit’s brainpower useful in attaining higher corporate ground. By the late nineties, they had risen through the ranks of the equity division. When Neal Garonzik, the head of equities, left in 1997, both were up for the job. “There are two kinds of generals,” says Beard. “Some generals who can fire up the troops and take any hill, and some generals who sit in a tent and figure out which hill. Vikram is a terrific strategist. John is a leader.” In this instance, the strategist won out. Pandit was named Garonzik’s replacement, and Havens became Pandit’s No. 2. “I know John was disappointed, but he never let it affect his relationship,” says a colleague of the two men. “In fact, it grew stronger.”

His closest friends describe Pandit as quietly backing into power, too meek to grab for it directly, never ambitious in the pejorative sense of the word. To them, Wall Street was a meritocracy and the best and brightest mind, however passive and un-Gekkolike, had simply risen to the top in an orderly and natural fashion. After all, for every hard-charging trader who broke phones and kicked in doors, you needed a Vikram Pandit who could hedge against overzealousness. “Many people wanted to see him get his chance in the sun,” says Paul Kimball, a former Morgan colleague.

But with his newfound power came critics and rivals who saw Pandit’s dry, quiet ways as hubris and political cunning rather than shyness and humility. When he became president of investment banking at Morgan Stanley in 2000, “that’s when he said, ‘I am a king,’ ” says a former Morgan executive who is critical of Pandit.

Pandit was exceedingly cautious in his leadership role, always looking for ways to make money with a minimum of risk. When hedge funds came along, his idea was not to invest directly but to sell brokerage services to them. He would often avoid acting on a problem until he felt he’d perceived every possible risk involved—and the delays would frustrate his subordinates (“analysis paralysis,” they called it). He rarely expressed strong opinions in meetings, instead chiming in with a single Socratic question. “A lot of people were a little afraid of him,” recounts one former colleague. “He was so smart, and they didn’t want to look dumb.”

While Pandit observed and listened, Havens would execute Pandit’s strategies while another close aide, an outgoing and socially connected marketing man named Don Callahan, would sound out underlings and keep tabs on political machinations. To critics, it seemed that Pandit was merely trying to avoid risk to his career. “His attitude was all about, ‘I am not going to do anything, decide anything, that’s going to get in the way of an upwardly mobile career trajectory,’ ” says one of his Morgan Stanley antagonists. But his critics couldn’t deny the power of his intellect, and his superiors were beguiled by it.

Pandit made gestures toward the trappings of Wall Street success, buying a house in Greenwich, Connecticut, next to former Lehman Brothers CEO Dick Fuld and sending his children, Maya and Rahul, to Trinity School on West 91st Street (Pandit eventually joined its board of trustees). In most ways, however, Pandit remained a cultural outsider: While he paid dues to the exclusive Country Club of Purchase, part of Morgan Stanley’s unofficial social agenda for managing directors, a friend says Pandit never actually saw the inside of the club. His parents lived with him for part of the year in his Manhattan apartment, and Pandit drove the extended family around in a minivan. A fellow executive who once saw him at a movie theater was shocked to see Pandit out of his usual C-suite suit and tie, wearing an oversize anorak, stonewashed jeans, and white sneakers. He looked like “a nerd in the computer faculty,” says the onlooker.

Pandit was of two worlds, and the subtle cultural bias at Morgan Stanley didn’t make it easy to fit in. His wife, Swati, was frequently invited to Morgan Stanley events in which wives were expected to appear, but she never did. “Nobody has seen her at one work function,” says a former colleague at Morgan Stanley. Her absence didn’t help with the perception among some at Morgan that Pandit had a bias against women. A female executive who once worked for Pandit says he was uncomfortable having women in anything other than supporting roles. In 1998, one of Pandit’s female underlings filed a legal complaint against Morgan Stanley that resulted in a $54 million sex-discrimination settlement.

Pandit also took heat over his alliance with an Indian equities trader named Guru Ramakrishnan. Pandit and Ramakrishnan had come from the same Brahmin caste in India and had both gone to Columbia before seeking their fortunes on Wall Street. But that’s where the similarities ended. Ramakrishnan was outwardly confident and even arrogant—he once bragged that an astrologer told him he was going to be the head of sales and trading at Lehman Brothers. Many at Morgan considered him unpleasant and prickly. When he lost money, he had a habit of insisting “why he was right and the market was wrong,” says a person who worked with him. Some suspect that Pandit abided Ramakrishnan because he was a useful henchman for the conflict-averse president. “When Vikram wanted to browbeat somebody, he didn’t want to do it himself. He’d send Guru to do it,” says another former Morgan Stanley executive. It also didn’t hurt that Ramakrishnan was worshipful of Pandit: He once cried when he thought he would be unable to fulfill an order Pandit gave him. “Guru was very well protected by Vikram,” says a former colleague. Non-Indians at the company privately referred to Pandit and Ramakrishnan, along with two other Indian executives, as the “Indian Mafia.”

In 2001, John Mack, Morgan Stanley’s charismatic CEO, was edged out by Phil Purcell, the Dean Witter CEO who had merged his company with Morgan. Pandit was not bothered by the change at the top. Former colleagues say he told a group of people that it wasn’t a big loss because Mack wasn’t that smart. (Pandit denies saying this.)

In principle, Pandit and Purcell were aligned on the crucial subject of how much risk to take—neither was entirely comfortable with excessive leverage. By contrast, Zoe Cruz, the president of the fixed-income division, felt the credit markets were ripe for bigger bets and more leverage—and she was bringing in more money than Pandit. Pandit and Cruz jousted for influence with the CEO.

Meanwhile, in 2005, eight veteran former Morgan Stanley executives, known as the Group of Eight, made a run at Purcell’s power, co-opting disgruntled senior executives—including Pandit’s No. 2, Havens—to plot against him. To recruit Pandit, the G8 dangled before him the CEO job at Morgan Stanley—if Purcell was driven out, Pandit would eventually take over. It was a risky move: There was no guarantee that the coup would work. But when Purcell asked Pandit for his loyalty, Pandit refused, betting his chips on Havens and the G8. “He does not like conflict and does everything to avoid it,” says a person involved in the Morgan Stanley battle. “But this was an irreconcilable conflict and he acceded to Havens as he almost always does.”

Given Pandit’s coy style, Purcell was shocked when he learned Pandit had turned against him. “I don’t understand. Vikram was my guy,” he told a friend. “I saved his job three times.” When he learned of the betrayal, Purcell promoted Cruz, ousting Havens and Pandit.

On his way out, Havens walked through the trading floor to standing ovations, but Pandit left the building alone, taking only his raincoat into a cold March drizzle. “It was the most upsetting thing that ever happened to him,” says a friend and former colleague. Morgan Stanley, says another, “was his soul, his identity—home.”

The year that followed was difficult for Pandit. He was out of a job. And his mother, Shailaja, died of breast cancer, a blow that cracked his otherwise cool façade. He nearly broke down while telling a fellow executive the details, pausing to collect himself before he could speak again. In her memory, Pandit started the Maina Foundation for Raising Breast Cancer Awareness.

That same year, 2006, Pandit regrouped by forming a boutique hedge fund called Old Lane Partners with John Havens, Guru Ramakrishnan, and several other Morgan Stanley refugees. The name gave it the air of a Waspy clubhouse, but during a charity roast for Pandit in 2007, an Indian colleague joked that it should be called “Brown Brothers and Havens” because of all the Indians working there. Ramakrishnan, the only one with hedge-fund experience, was named CEO. He spearheaded $500 million in infrastructure projects in India.

Early on, Pandit and Havens went looking for investors and arrived at the door of Citigroup. Pandit had a friend in Robert Rubin, the company’s director. Rubin first saw Pandit at a private panel discussion in 1999 that was hosted by former SEC chairman Arthur Levitt. He was so impressed by Pandit’s intellect he asked to meet him. The two men struck many as kindred spirits. Like Pandit, Rubin favored intelligence over less quantifiable assets like charisma. In their views, such retail-business talents were secondary to cool analysis. “Vikram,” says Barton Biggs, “is an Indian version of Bob Rubin.”

Citi executives vetting Old Lane refused to stake client money on the investment, feeling Pandit’s team didn’t have enough experience. If they wanted Citi to invest, then Citi’s top executive, chairman and CEO Chuck Prince, would have to personally approve the deal. And Prince did: Citi invested $100 million in Old Lane.

Old Lane was performing poorly, earning only a net 3 percent return in 2007, worse than a money-market account. It was clear to everyone who knew him that Pandit was unhappy managing a hedge fund. He was restless and dissatisfied. “He wanted his shot at running something really big,” says Biggs.

Rubin and Citigroup were eyeing Old Lane as an acquisition—not for high-yield returns, but for Pandit, a potential candidate to one day run Citi. In April 2007, Pandit sold Old Lane to Citi for $800 million, a price tag that boggled the minds of Wall Street observers. Pandit personally reaped a huge bounty, what amounted to $165 million in cash. With his windfall, he bought a ten-room, $17.9 million co-op apartment on Central Park West, the former home of the late actor Tony Randall. Rubin made little pretense about why Citi had spent so much money: He publicly called Pandit “a genius.”

Pandit was made chief executive of Citi Alternative Investments (CAI), the hedge-fund arm of the company under which Old Lane now resided. At a company town-hall meeting, Rubin stood by him beaming, as Pandit announced that he would double the company’s hedge-fund business over the next few years. Havens, Pandit’s de facto No. 2, explained to their new underlings at CAI that “we need good DNA in here”—which meant, says one former Citi staffer, purging their colleagues and bringing in “a bunch of rejected Morgan Stanley guys.” Citi executives bristled at what they considered Havens’s swaggering leadership style. “He made it very clear he thought they were all morons,” says the former Citi executive. Pandit rarely showed up at CAI, instead spending time in Citi’s corporate suite near the top brass on Park Avenue. The hedge-fund wing was just a place to park until the real opportunity presented itself.

Six months later, Pandit was asked to investigate the bank’s books and discovered what would turn out to be billions in subprime losses—leading Chuck Prince to step down as CEO. Rubin immediately lobbied to have Pandit replace him, but there was unexpected resistance from a number of board members, including Alain Belda, chairman of Alcoa, and C. Michael Armstrong, the former AT&T CEO, who did not believe Pandit was ready to lead and thought Citi had overpaid to get him in the first place. Meanwhile, Citigroup founder Sandy Weill was advocating for Tim Geithner, a former protégé of Rubin’s then working for the New York Federal Reserve (and now, of course, Treasury secretary). Rubin began telling board members that Pandit might leave if they didn’t give it to him, making a mockery of the $800 million they’d paid for his hedge fund—a claim that detractors took as explicit arm-bending.

Rubin sold Pandit as the consummate problem-solver and a man who could see around corners—the sorts of descriptors that were often applied to him. Pandit’s pedantic style and reputation for risk-aversion dovetailed with the going mood, a balm for the go-go era of high risk that was battering the investment banks. After all, hadn’t Pandit resisted the leveraged risk favored by Mack and Cruz at Morgan Stanley?

Rubin ultimately prevailed, and the board of directors at Citi agreed to make Pandit CEO in December 2007. A confidant warned Pandit that he should think twice about taking the job. Citigroup was an unwieldy monster: A so-called financial supermarket built by Sandy Weill out of the merger of Travelers Group and Citicorp in 1998, Citi had a global reach that, in theory, was supposed to give it extraordinary leverage. But with the credit markets collapsing, the bad parts could start bringing the good parts down with them. The conversation over whether the business model was still relevant was reaching a fever pitch.

“Vikram, this is impossible,” the confidant said. Pandit replied, “No, this is a terrific opportunity.”

Pandit would be the leader of the biggest bank in the world, what amounted to a small country, population 350,000, and he would have at his disposal four airplanes, a helicopter, cars and drivers, chefs, dozens of aides, and the ear of the White House. Better still, running Citi would be his chance for redemption after missing his shot at Morgan Stanley. Once the deal was done, Rubin personally went from division to division praising Pandit to staffers.

Pandit laid out an ambitious three-year plan for Citigroup’s future: centralizing management, restructuring, selling billions in assets, and raising capital as a buffer against further credit collapse. (Rubin personally cruised a golf course with Prince Alwaleed bin Talal in Abu Dhabi to procure a $7.5 billion investment.) Pandit studiously read books on Citibank history, hoping to divine a common thread running from the company’s roots as City Bank of New York in 1812 to its present incarnation and perhaps gain an inkling of the pride he’d felt for Morgan Stanley. He brought in long-retired Citi executives to talk about the old days and reanimated the company’s seventies ad campaign, Citi Never Sleeps, to try to recapture its past glory.

“The funniest blog was e-mailed to me by a friend,” jokes the Citi CEO. “ ‘Pandit Gets to Keep His Crappy Job.’ ”

The main issue on the table was whether the “supermarket” model could be maintained. One trusted associate advised Pandit that he had to break up the company to make it work. Consultants from McKinsey & Co. offered the same suggestion in a report. Pandit rebuffed those suggestions. Some say that breaking up Citigroup was never truly an option. A senior executive at the company suggests Pandit had an implicit directive from the board of directors, especially Rubin, to keep Citigroup together, thereby preserving the legacies of founder Sandy Weill and Rubin himself. Rubin and Weill had been friends since the late nineties, when Rubin served in the Clinton administration. It was Rubin who helped push through the Gramm-Leach-Bliley Act that effectively allowed the merger of Travelers and Citicorp. A year later, Weill made Rubin a board member at the company he helped create, paying him a salary of $17 million a year.

Pandit chose to embrace the challenge of Citi in the only way he knew how: He elevated his Old Lane team to positions of power, bringing in Don Callahan, who had been working in marketing at Credit Suisse, to be his chief administrative officer and promoting Havens to head of investment banking. (Ramakrishnan opted to remain in the offices of Old Lane.) Perhaps the most powerful member of Pandit’s circle of lieutenants—which became known as the “Gang of Five”—however, wasn’t a Morgan Stanley alum but Lewis Kaden, a loyal Rubin associate. Kaden, a lawyer who’d worked for the powerful DC firm Davis Polk & Wardwell, had been friends with Rubin since the eighties, when Rubin was head of Goldman Sachs. Now he was involved in everything from the $400 million Citi Field naming project to negotiating with government officials, in addition to penning Rubin’s correspondence. A common internal joke at Citi was, “If Bob Rubin turns a corner too fast, Kaden breaks his nose.”

Pandit often stayed in his corner office on Park Avenue for hours, Kaden and Callahan serving as his links to the outside world. When one senior executive finally met with Pandit, both Kaden and Callahan afterward gave opposing takes on what Pandit had meant. At a time of duress, Pandit appeared disconnected from his staff. On Pandit’s trip to Baltimore last year with the head of Citi’s investor relations, there was a third passenger onboard the company helicopter to whom Pandit didn’t say a word. When the investor-relations man finally asked which division of Citi he worked in, they learned that he was a stranger who had accidentally boarded the wrong helicopter.

To Pandit’s mind, traditional morale-building leadership had always been an ephemeral concern. He knew he was no inspirational leader, instead seeing his mission as keeping the troops at bay while he spent his time making sense of what was happening to the banking industry. Messy human affairs were best outsourced to his trusted soldiers. But the perception that Pandit was hunkering down with select lieutenants gave way to accusations of cronyism by people who felt he was not taking advice from longtime Citi executives, including Michael Klein, Citi’s vice-chairman, and Sallie Krawcheck, the head of wealth management.

Pandit’s problems with Krawcheck—onetime CEO candidate and, incidentally, the top female executive at Citigroup—came to a head over how to handle Smith Barney, the brokerage arm of the company. There was a major fire to put out. Clients were suffering extraordinary losses on Citi’s alternative investments and so-called auction-rate securities, causing brokers to exit Citi in big numbers. E-mails from Smith Barney staffers poured in expressing dismay that Pandit wouldn’t reimburse clients who had lost money under Citi’s management. By this time, Krawcheck was already considered a thorn in Pandit’s side for continually arguing that the risk to clients had been higher than advertised and giving back a portion of the proceeds would protect the franchise. She was met with resistance from Pandit’s team: Havens was against reimbursing and yelled about it in a telephone conference. But the board sided with Krawcheck, asking that Citi take action with clients.

By September, Havens told Krawcheck that two major components of her division, research and the private bank, would now be under Havens’s management in the banking division, ostensibly part of overall restructuring. Krawcheck felt they were stripping her of power and essentially forcing her out. She announced her departure in September, leaving the company without an exit package.

During all this, Sandy Weill, who had originally hired Krawcheck, was breathing down Pandit’s neck. Concerned about the company’s stock price, Weill personally asked Pandit to buy back shares along with him, in a show of public confidence. Pandit agreed, according to a person close to Weill. But when Weill started buying back stock and Pandit didn’t do it right away, Weill complained loudly to friends. Pandit stopped returning Weill’s calls altogether, referring him to Callahan. (According to two people close to the situation, Pandit and Weill have spoken exactly twice since Pandit took over Citigroup; Pandit has since bought $8.4 million in Citi shares, although at a lower price than Weill did.)

Even within the ranks of his own lieutenants, there was infighting. Old Lane Partners was on the skids, and Ramakrishnan rushed to Pandit to secure a large capital infusion to keep it from going under. Pandit promised him $2 billion. When Havens found out about Pandit’s promise, he was furious, demanding to know how Pandit could have done such a thing without consulting him. Caught between two old friends, Pandit listened to Havens, as he usually did in the end. The Wall Street Journal published a story about the end of Old Lane, featuring Pandit’s stippled headshot and calling the event a “blow to CEO.” Feeling betrayed, Ramakrishnan threatened to sue Pandit for a better exit deal. The men reportedly no longer speak. “I think Vikram is more upset about it than Guru,” says a mutual acquaintance. “He’s disappointed in Guru.”

In September, the markets plunged along with the collapsing credit markets, and the foundation of Citigroup began to crumble. While Pandit had managed to accrue $60 billion in capital to shore up finances, it wasn’t near enough. Pandit was smart enough to know what needed to be done: He had to secure more access to cash, lots of it. As banks began to fail, he bid $1 a share for the commercial bank Wachovia, which the government was hoping to quickly marry off and save from dissolution. It was a cheap way to get access to cash deposits that could shore up Citi’s credit problems. As a deal drew near a close, Pandit appeared confident that he had achieved a much-needed victory.

Perhaps a little too confident. Pandit and Citi had relied on what amounted to the legal version of a handshake to secure the deal with Wachovia. And they dragged out the process while trying to separate Wachovia’s wealth-management division from the rest of the company, feeling it had too much overlap with Smith Barney. (Lew Kaden told a private group, “We’ve got 15,000 complainers, we don’t need 15,000 more.”) Pandit left just enough room for Wells Fargo to swoop in with a bid for $7 a share and snatch the bank out from under Citi.

Pandit was beyond infuriated. After learning of the coup during a middle-of-the night phone call, he angrily demanded to senior executives at Citi that they pull Wells Fargo’s credit lines. “Pull their fucking lines!” he screamed. “Pull their fucking lines!” A senior executive in the room calmly explained that Citigroup had no business with Wells Fargo. There was nothing they could do. Ultimately, Citi filed a lawsuit against Wells Fargo for breaching what Citi considered an exclusive deal.

What no one had realized at the time was that this was effectively Pandit’s last stand before the markets would lay all previously made plans to waste. The failed bid for Wachovia was a major blow to investor confidence, and Citi’s stock tumbled as the markets buckled and Lehman Brothers folded. Within a week, Pandit was lined up with the other banking CEOs to meet with then–Treasury Secretary Hank Paulson. With the government fearing massive bank failures and a wider financial meltdown, Citi accepted $25 billion in federal bailout money in exchange for issues of preferred Citi stock.

Increasingly, Pandit was acting out of character, barking profanities in the hallways. One former Citi executive says that the head of human resources expressed concern about Pandit’s expletive-laced outbursts he’d had in the C-suite. (Pandit denies any such outbursts.) The Wachovia incident, says one longtime friend, “was the first time I have ever seen him go nuts.”

Citi’s stock declined week after week. During a town-hall webcast meant to quell concern on November 17, Pandit forecast massive layoffs and felt the need to explain in his usual academic fashion what exactly a bank did (“A bank takes deposits and puts them to work”), which baffled the closed-circuit audience of veteran bankers. As Pandit flailed, the stock declined nearly 50 percent in four days, dipping below $5 a share, the trigger price at which pension funds would sell en masse and the bank would collapse completely. When Pandit took over, the stock had been at $52.

That Friday, November 21, reports surfaced that Pandit’s job was in the balance. According to a person familiar with the discussions, the name of former Time Warner chief Dick Parsons, a Citi board member and onetime head of Dime Savings Bank, was floated as a possible replacement. News of Pandit’s possible ouster furthered the stock’s fall. A team of Citi executives led by Ned Kelly, a seasoned negotiator who had been friends with Havens for many years, began talks with then–New York Federal Reserve chairman Tim Geithner’s team to ask for more money. Kelly’s first question to Geithner’s people was whether they wanted Pandit out. Federal officials reportedly concluded that the number of candidates willing and able to replace him was now next to zero.

Instead, federal officials encouraged Citi to start off-loading more properties and consider breaking up the company—even as the separate pieces were clearly worth less than they had been a year ago. The following Monday, Citi announced that it was receiving another bailout, this time $20 billion. (A month and a half later, Citi would merge Smith Barney with Morgan Stanley, giving Morgan a majority stake.)

Meanwhile, colleagues told Pandit he had a problem with morale at Citi, but he insisted his problems were bigger than that. “Pandit said, ‘I can give all the internal motivational speeches to the troops; it won’t matter if I don’t deliver,’ ” recounts the friend. “Rightly or wrongly, he was very dismissive of his traditional leader role, the ‘Hey, you’re a statesman’ role. The problem is much more serious, and fixing the problem will change everybody’s mind both inside and outside.”

How had Citigroup come to this? Blame began to circulate, with Rubin targeted as the alleged architect of the company’s high-risk investments. Before the spotlight could find him, Pandit, under pressure to defend Citigroup and give investors confidence that he was running the company, finally agreed to come out of hiding and appear on Charlie Rose. The performance was a slightly uncomfortable tap dance. The message: No one could have predicted this, no one is to blame, and there would be no further need for government bailouts. “We moved really fast,” Pandit told Rose. “What this market tells you is one should have moved even faster. And I keep thinking about it, is there something else I could have done sooner than what I did … But the most important thing, Charlie, is that it’s very, very important to look forward from where we are … We need to do a lot of hard work to figure out how to get from here to there.”

“And you are confident that we can get there?” asked Rose.

Pandit tried on his best inspirational-leader voice: “We, as a country, have no choice. We, at Citi, will get there.”

Last week, Citi was back before the government with its hat in its hands. After $45 billion in federal aid, the company was desperate for more. The negotiations went on for over a week—although the word negotiation might be overstating it. “You don’t negotiate with the government,” says a Citi executive involved in the talks. “It’s not like there’s a give and take.”

In the end, the Treasury Department agreed to convert up to $25 billion in preferred shares to common stock, shoring up Citi’s capital base. The deal is expected to give the government up to a 40 percent stake in the company—and influence within the board of directors. Pandit’s position, according to an internal memo to Citi staffers, is that this is “not a nationalization by any definition.” But while the Citi deal may not be nationalization in the strictest sense, it is a stunning turn of events for the U.S. government to own nearly half of one of the world’s largest banks. What that means in terms of the operations of Citi is anyone’s guess at this point. Federal officials seem reluctant to issue directives to Pandit, hoping to avoid the appearance of a true government takeover of the company. On the other hand, the consensus among Citi’s newest shareholders is that the “supermarket” model is untenable and the company needs to be broken up into smaller, more manageable entities. It’s a move Pandit has resisted from the beginning.

But Pandit isn’t calling the shots anymore. The Wall Street Journal, which has been particularly harsh in its depiction of the CEO, had him literally begging the government for his job last week: “Don’t give up on us,” he reportedly pleaded. “Give us a chance to execute.”

“He’s playing defense all the time,” says a longtime friend from his Morgan Stanley days. “This is just grinding these people down to nothing.” Another friend calls him “tragic,” a government “charity case.” Says another, “Would I have advised him to take the job? Yeah. Would I feel bad in retrospect? Yeah.”

Pandit has very little time to use whatever power he has left to try to turn things around at Citi—news of the Treasury deal sent the stock plunging to a historic low. A friend jokes that the CEO is the “MacGyver of the private sector banking system,” out to “save Citi before the timing device runs to zero.” But Pandit has never seen himself as the hero type. He looks at the problem with the eyes of an engineer: “My job is to figure out which pipes go where and which pipes have to be cut off, which pipes have to be unclogged,” he told a close associate. “It’s going to take me a year and a half to two years and then the water will flow, and when the water will flow, the stock price goes up. The stock price goes up, everybody will come around.”

The night before the government deal is sealed, Pandit finally comes to the phone, after weeks of resisting an interview, to put rumors of his demise to rest. He seems amused, slightly giddy. He has survived, for now.

He brushes off Journal reports that depicted him as powerless, running Citi under the heel of his “federal masters.” “We all have a master,” he says. “It’s not about that … It’s a tough time. There is adversity out there. If I don’t step up and do what I’m doing, take what is thrown at me and get this company going, I would have been the wrong choice of CEO.”

In conversation, he comes across as assertive, even a little cocky—bold in a way his critics don’t believe he can be. “I have complete confidence in my plan,” he says. “That’s what gets me here every morning.” Then again, what choice does he have?