Not so long ago, the talk about hedge funds was all about their money—some guy you’d never heard of buying an $80 million piece of art or a $25 million teardown in Greenwich, Connecticut, or paying himself $1 billion for a single year’s work. It was a spectator sport, absurd but entertaining, to a degree. Then the talk started to get serious, like, were hedge funds artificially bidding up the price of oil? What about that deal where a single trader ripped through $6 billion on a bad hunch about natural-gas prices—should that concern more than just the pissed-off people who entrusted him with their money? Or those two little bouts of panic the market has suffered this year already: Are hedge funds the virus that’s going to make the markets keel over? Are they an evil cabal?

Questions like this now come up in casual conversation, but those conversations run out of steam fast because, though plenty of people fake it, few know much about hedge funds, other than that they made George Soros so rich he can influence world events and then everybody else wanted in. But as for what a hedge fund actually does—the only ones who know work at them, and they don’t talk about it. Plus you never see them anymore because they’re either in their caves or scuba-diving off Bora Bora.

But really, it’s time you understood them. As of March, by one estimate, there was a staggering $2 trillion invested in hedge funds worldwide, up nearly tenfold from 1999. Today, there are more than 9,000 hedge funds, 351 of which manage $1 billion or more. Traditional investment firms are bleeding talent to hedge funds, and there’s a lot of room left for this thing to run: A recent study by consulting firm Casey, Quirk and the Bank of New York predicts that institutional assets in hedge funds could nearly triple by 2010. Last year, the average hedge fund was just 5.3 years old.

Lesson one: Just what is a hedge fund?

It’s only a vehicle for investing, albeit one that happens to be less constrained than most. Your run-of-the-mill mutual fund, for example, buys stocks and bonds, and that’s pretty much it. Most are not even allowed to employ short selling, a way of betting that the price of a security will fall. Hedge funds can employ whatever investing tools they want, including leverage, the use of derivatives like options and futures, and short sales. The New York Times decided years ago to incessantly refer to hedge funds’ use of these instruments as “exotic and risky,” thereby adding to their aura of mystery. The funny thing: Practically all financial institutions use these “exotic” instruments.

There’s a much simpler way of putting it, offered by one of the industry’s luminaries. According to Cliff Asness of AQR Capital, “Hedge funds are investment pools that are relatively unconstrained in what they do. They are relatively unregulated (for now), charge very high fees, will not necessarily give you your money back when you want it, and will generally not tell you what they do. They are supposed to make money all the time, and when they fail at this, their investors redeem and go to someone else who has recently been making money. Every three or four years, they deliver a one-in-a-hundred-year flood.”

Although the origin of hedge funds dates back to Alfred Winslow Jones and the fifties, it wasn’t until the late sixties that the category became a recognizable seedling of its current state: a group of highly skilled traders catering to a very wealthy clientele willing to gamble to get humongous returns. The first true stars of the hedge-fund universe—people like Soros, Michael Steinhardt, and Bruce Kovner—were experts in commodities and currencies and figured out how to exploit inefficiencies in those markets. Because they raised money privately—largely from friends and business associates—they avoided most of the disclosure requirements of U.S. securities laws. That meant they didn’t have to explain to anybody how much money they had or what exactly they did with it. The deal, in effect, was this: Rich guys could gather up money from other rich guys without oversight, so long as they agreed not to utter a word to the general public that could be construed as “solicitation,” including “communication published in any newspaper, magazine, or similar media.” Not that there was any point in soliciting the public anyway. To get into a fund, you had to invest $2.5 million. Managers were expected to have their own money in the fund, an informal check against reckless risk-taking.

A mythology began to take shape.

People in the financial world became enamored of investing superheroes. Some deserved it: Soros almost broke the Bank of England by shorting the pound. As Soros’s reputation grew, so did his power as an investor. Julian Robertson’s Tiger Management was another legendary outfit that nobody wanted to bet against. Their $1 billion or $2 billion portfolios seem quaint today—like Mike Myers’s Dr. Evil demanding “one million dollars!” to not destroy the world—but their ballsy moves inspired imitators. Of course, the more people out there tried to copy the Soroses and the Robertsons, the less well it worked out. John H. Makin, a principal at Kovner’s Caxton Associates, puts it this way: “The extraordinarily high returns earned by hedge funds during their golden age in the eighties and early nineties were not too good to be true. They were just too good to be true for everyone.”

A hedge fund is a hedge fund is a hedge fund …

A persistent misconception in the general public is that all hedge funds act alike. Not true. On the one hand, you have the nerd brigade, with their fine-tuned software-driven investment strategies that are constantly refined by “rocket scientists”—Ph.D.’s who have decided they want more out of life (i.e., money) than the view from an ivory tower. They’re called “quants,” short for quantitative investors, and their current king is Long Island–based James Simons of Renaissance Technologies. He’s an academic at heart: Simons’s interview process is said to involve a presentation on some finding about the capital markets. At the opposite extreme, you have the table-pounding, executive-belittling activists such as Daniel Loeb of Third Point and Thomas Hudson of the imaginatively named Pirate Capital. (Argh! We be swashbuckling investors!) Tactics like theirs get the most press—and thus tend to define public perception of hedge funds—despite the fact that most hedge funds rely far more on brains than brawn. That said, some of the finest drama does come from public battles like that launched by Loeb on home-appliance maker Salton Inc., in which he claimed to have seen the company’s CEO “sipping chilled Gewürztraminer” at the U.S. Open on the company dime. (Real hedge-fund managers don’t drink German wine?)

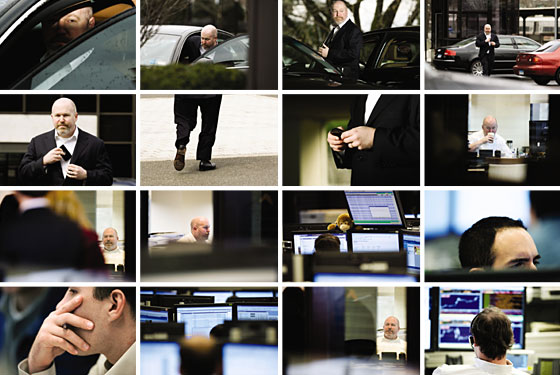

In the popular imagination, a hedge-fund trader sits at a console that looks like it could launch a mission to Mars and spends his whole day making rapid-fire decisions about what to buy and sell. There are definitely people like this (Stevie Cohen of SAC Capital, for one), but most hedge-fund offices are a lot quieter. A typical long/short firm sets up its positions and then might spend days or weeks doing nothing more than seeing what happens to them. Maybe one afternoon, they’d really throw down and have a tweedy professor in to pitch an arcane finance theory. It can be really, really boring to work at a hedge fund.

A brief psychographic portrait:

According to a survey of 294 fund managers with a net worth of $30 million or more by Russ Alan Prince, the author of Fortune’s Fortress, 97 percent of hedge-fund managers see their portfolios as themselves personified. And here’s what else they think about: failure. Fifty-four percent of them say they suffer from the Icarus syndrome, a fear of flying too close to the sun and crashing to Earth. They also think about staring down the barrel of a gun: Almost three-quarters believe their wealth makes them a target of criminals. This is the life we can’t stop talking about? (Yes, it is. And here’s why: Three out of ten of us think the average hedge-fund pro makes more than $10 million a year. He doesn’t, but he might as well for how much we already hate him for it.)

Hedge funds sometimes get confused with private equity, the financial specialty that’s gotten the most ink these past few months. Private-equity investors like the Blackstone Group or KKR differ from your typical hedge fund in that they tend to take more long-term, controlling stakes in companies—often taking them private in the process—in hopes of doing some financial engineering that results in a huge windfall. The luminaries in private equity—men like Blackstone’s Stephen Schwarzman (he of the $3 million, Rod Stewart–entertained birthday party in February) and KKR’s Henry Kravis—are more a product of the pin-striped, backroom, cigar-smoking ethos than hedge-fund managers, who generally wear khakis at their trading desks and shrink from attention.

You can think of them as products of the yin and yang of Wall Street’s traditional powerhouses. Private-equity people are “people people”—their ranks full of former pros of the relationship-driven investment-banking side of the business. Hedge-fund people are much more likely to come from the trading side: quicker to draw, quicker to shoot, and not inclined to spend a whole lot of time discussing the thinking behind it all. “They measure their performance every day. They wonder, ‘If I buy this today, will I look stupid tomorrow?’ ” says a private-equity professional. “A private-equity guy is sitting there thinking, ‘What will the world look like in three to five years?’ ”

Both industries share an addiction to leverage, which is to say, borrowed money. They use it liberally to maximize the return of a good deal or a good trade. From the very beginning, in fact, hedge funds were premised on the notion that they could exploit minute profit-making opportunities by placing big leveraged bets. The “hedge” in hedge funds originally referred to the downside protection a fund would simultaneously employ by, yes, hedging. Typically, that would mean buying one stock and shorting another. While many hedge funds still employ actual hedging techniques, the practice has gone out of vogue. But leverage hasn’t, and that means big bets with little or no downside protection. In a word, risky.

And why are they so rich?

One thing hedge-funders uniformally agree on is that they are worth what they are paid. Running your own hedge fund is the fastest way to make a fortune known to man. The typical fee structure is known by the vernacular “2 & 20”—most funds take a 2 percent management fee and 20 percent of any profits. (Some take far more. James Simons, for example, charges a nominally obscene 5 & 44.) The result: A $1 billion fund posting a 30 percent return delivers a $78.8 million payday for its managers. A $1 billion fund posting a zero percent return can still spread around $20 million to its employees. The best managers do a lot better than breaking even, mind you, and as a result, a handful of hedge-fund kingpins take home more than $500 million in annual compensation. Although hedge-fund people tend not to advertise their wealth to the world, those in the community are hyperaware of who among them is hot and who is not. Consider that David Einhorn of Greenlight Capital, a widely respected manager, has lately been the talk of the hedge-fund town for his big losses in a subprime-lending stock. Hedge-funders go in for Schadenfreude as much as the next guy.

In a sign of hedge funds’ growing clout in other spheres, in late January, Senator Chuck Schumer called twenty or so of the top hedge-fund managers and invited them to the Upper East Side Italian restaurant Bottega del Vino. It was supposed to be a friendly chat—Schumer’s message was, you talk to us about what’s going on, and nobody has to worry about too much interference from regulators. It’s chilling to think of all that secret power assembled in one place, like the Cosa Nostra Apalachin summit in 1957. Attendees included Jim Chanos of Kynikos Capital, Rich Chilton of Chilton Investment Co., Stevie Cohen, Stanley Druckenmiller, Paul Tudor Jones II of Tudor Capital, and David Tepper of Appaloosa Management. The combined assets under management of those attending had to have been $200 billion.

Byron Wien, one of the most popular commentators in the history of Wall Street, left a cushy job at Morgan Stanley in 2005 in order to join Pequot Capital, a hedge fund, as chief investment strategist. He apparently wasn’t forced to take the industry’s vow of omertà. When asked to explain the staggering growth of late, he puts it quite simply: “One of the main reasons is that it became legitimate for institutions to invest. In the early days, you signed up in a dark alley with a flashlight. Today, a typical institutional portfolio now has about 15 to 25 percent in such alternative investments.”

There’s no need for flashlights anymore, but the industry still has its critics, who voice everything from concern about leverage and lemminglike rushes that could threaten the stability of global markets to disgust at the astronomical fee arrangements. No less an authority than Warren Buffett has accused the industry of selling hokum, calling the typical compensation structure a “grotesque arrangement.” But whom did Business Week suggest as “the next Warren Buffett”? That would be Eddie Lampert, a hedge-fund manager.

The big are getting colossal.

A year ago, there were only four $20 billion–plus outfits; now, there are seven—JPMorgan, Goldman, Bridgewater Associates, D.E. Shaw, Farallon Capital, Renaissance Technologies, and Och-Ziff Capital. The first U.S. hedge fund to offer its stock to the public, Fortress, gained 67.6 percent on its first day of trading. There will be more firms taking that path.

They’re suffering from wandering eyes.

Among the big players, it is now almost impossible to find a pure hedge fund—meaning one that sticks to a specific investing style or niche. When you have so much money to invest, you can be forced out of your own specialty, lest you end up trading with yourself. SAC Capital just joined KKR, for example, in a $3.8 billion bid for an education company. Some funds are going so far as to invest in the movies.

They’re searching for a needle in a very large haystack.

Ask any hedge-fund manager, and he will tell you that the easy money has already been made, and there are no “obvious trades” sitting around. A recent report by the European firm Dresdner Kleinwort points out that if 4 percent of assets under management go to fees, and another 4 to 5 percent is spent on trading commissions and interest, hedge funds would need to pull in 20 percent annually to justify their costs. That forces them to take ever greater risks.

The club is no longer taking in as many new members.

Believe it or not, it’s harder to start a hedge fund now than it was a few years ago. According to Hedge Fund Research, in 2006, 1,518 hedge funds launched, compared with 2,073 in 2005. Robert Merton, a Nobel Prize–winning economist, couldn’t raise enough to launch a fund last year and abandoned his effort. Not that it can’t be done if you have the right team and a prior track record. Don Morgan, the former head of high yield at MacKay Shields, left in 2006 to found Brigade Capital. Because of non-hire agreements, he waited a year to launch a long/short credit-focused hedge fund so that most of his former team could join him. The result: At a time when you need at least $100 million in committed investor funds as table stakes, Brigade earned a seat at the table on day one.

Obscene fees are becoming … wait for it … even more obscene.

Hedge funds are one of those unlikely industries where the newcomers charge more than old hands. In one sense, this is crazy: The most lopsided arrangement in finance—you win, I win/you lose, I win—is getting even more perverse in its tilt. But it can’t go on forever, can it? It’s likely that fees will come down if only because of competition itself, but it won’t be anytime soon. At least not while institutional investors continue to throw money at this bandwagon. Cliff Asness of AQR Capital puts it this way: “We often hear in hedge-fund circles that institutions are coming to the hedge-fund world, so fees must fall, as institutions are fee-sensitive. Can this be the world’s first example of predicting that massive demand for a product will lower fees?”

The government is getting nosy.

In 2004, the SEC required hedge funds to register with the agency, which was kind of like getting 19-year-olds to register for the draft. It didn’t have any immediate consequences, but it could lead to something serious. The courts then threw that rule out, and regulatory talk died down until the Connecticut-based fund Amaranth lost about $6 billion on natural-gas futures last year. It’s died down yet again, but is only one meltdown or scandal from flaring back up. All the big hedge funds have bulked up their lobbying budgets of late.

Investment banks are morphing into hedge funds.

If you can’t beat ’em, join ’em, right? More and more, Goldman Sachs and its ilk are making their money from proprietary trading, which means, simply, the managing of their own assets rather than, say, yours. These operations now dwarf many traditional investment-banking practices, like mergers and acquisitions. Goldman Sachs produces hedge-funders like the Dominican Republic produces shortstops. About one in five of the world’s top hedge-fund managers used to work at Goldman. So, hedge funds really are something of a cabal.

Given hedge funds’ uneven performance of late, why has the flood of money not tapered off?

Well, for one, the appetite for risk among investors seems to be at some kind of historical high. But paradoxially, it’s also a desire for downside protection. The popularity of hedge funds still has a lot to do with how they performed five years ago. Seriously. During the bear market of 2000 to 2002, when the market fell 40 percent following the dot-com collapse, the average hedge fund didn’t lose money. With severe losses still fresh in their memories, pension-fund managers and other institutional investors are perfectly happy to shave a little off the top for that kind of downside protection. The question is in how many funds it still exists.

The limelight awaits.

Many successful managers are doing what anyone with a newfound fortune does: trying to get close to political power (via donations) or the social elite (via philanthropy and art-world involvement). Marc Lasry of Avenue Capital recently hired Chelsea Clinton as an analyst.

And now for the doomsday scenario.

The only year that assets under management declined in the history of hedge funds was in 1994. Why? Rising interest rates and the digestion of the massive growth of the previous few years. Sounds familiar, doesn’t it? A sharp spike in interest rates could be devastating to an industry that relies so heavily on borrowed money. Citadel, for example, had balance-sheet leverage of 11.5x last year—meaning it had borrowed more than eleven times more money than it actually had at the time, ballooning its gross-asset exposure to some $150 billion. This level of leverage adds tremendous risk. One prominent hedge-fund manager told me that any single hedge fund, other than three he could think of, could blow up and not really have any effect on the broader markets. But if one of the three did—and he named Citadel in that group—then the dominoes could start to tumble.

So, in the end, when someone blurts out, “Hedge funds are a venal get-rich scheme that we’ll all end up paying for,” should you nod solemnly like you agree? No, don’t do that. Try instead to crib the argument of an actual hedge-fund manager: “The proliferation of hedge funds has both decreased volatility in the market and increased the long-term risk of a systematic collapse. In the first case, it’s because hedge funds are more nimble than traditional long-only funds and can swoop in and correct market mispricings before they can get extreme. But it also means opportunities become fewer. And because hedge funds need good returns through the cycle, this reduced opportunity forces them to take more and more risk, increasing their exposure to risky investments, which, in the long term, will increase the likelihood of a systematic panic in the market.” In their report, the Dresdner Kleinwort analysts had their own term for just such a panic; they called “the great unwind.” You’ll know when it happens because in addition to dire headlines and more histrionics than usual on CNBC, the value of your Manhattan apartment will suddenly drop by half.

Don’t worry too much, though.

While the Dresdner analysts termed the likelihood of it inevitable, they concede that it’s not exactly predictable. Which means that it will happen, but it could be tomorrow or it could be in 100 years, when all of Manhattan will be underwater and your apartment won’t be worth anything anyway.