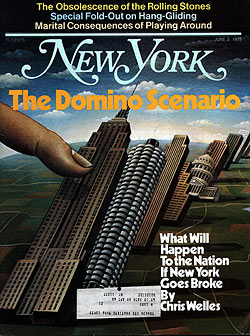

From the June 2, 1975 issue of New York Magazine.

This article went to press on Thursday, May 22. Between that date and when you read this, it is remotely possible that the federal, New York State, and New York City governments and the financial community will have come up with a dramatic, lasting solution to New York’s financial crisis, which has brought the city to the brink of defaulting on its obligations. If such a miracle has really transpired, you can skip to the next article.

It is far more likely that if anything has been done about the crisis it has been some stopgap “muddling through” measure—probably a combination of federal and state aid or guarantees, new city taxes, and modest expense cuts—which, while solving none of the city’s underlying problems, postpones the chance of a default a few months, perhaps a year. It is more likely still, as you read this, that nothing will have been resolved and that the various parties will still be lurching toward an arguably well-deserved apocalypse which could well be as serious as the one portrayed below, and which could come less than one week from now.

Considering the haste with which the operation had been arranged, it was incredible that things had gone so smoothly. Not until President Ford’s television address during the evening of June 1, 1975, did the public learn that Fort Knox was being closed down and that over the weekend all of the country’s 8,600 metric tons of gold had been secretly transported by truck to seaports and loaded on tankers which, even as he spoke, were steaming under navy escort to Saudi Arabia and Iran.

Giving the nation’s gold stocks to the Middle East oil producers was a drastic step, of course. But to government officials, some of whom had long sought to demonetize gold, it seemed a relatively small price to pay for the willingness of the oil producers to refloat the United States’ $200-billion municipal-bond market by guaranteeing all outstanding obligations and to provide the United States with a $100-billion, low-interest line of credit. The “muni” market’s collapse following the default by New York City the previous Friday on $220-million worth of short-term notes had thrown the financial structures of many large cities and states into chaos, had severely weakened the liquidity of the banking system, had aroused skepticism as to the ability of even the U.S. government to pay its debts, and had precipitated the beginnings of a run on Treasury securities.

How could it have happened? Those who had been involved were the country’s best and brightest political and financial leaders, well-intentioned men with every motivation to avoid such a debacle. Why had they been unable to prevent it?

Eventually, during agonizing postmortems, many ruefully came to see the events which led to the default as something like the game of chicken in Rebel Without a Cause, when several teen-agers one dark night drove old cars toward a cliff, the goal being to be the last to jump out before the car went over the edge. In this case, the parties were all so confident the others would jump first that none jumped in time and all fell to the rocks below.

The federal government and the government of New York State were concerned with beating New York City, which they felt had brought on the crisis. As they saw it, the city had been following a fiscally ruinous course for years by spending much more money than it was able to generate. Few had questioned philosophically the goodness of what the city was spending its money for. Who could argue against health care, education, and police and fire protection? The problem was that the city had been trying to do too much for too many with too little. During the last decade, the city’s expense budget—$11.8 billion during the 1974-75 fiscal year—had grown at an annual rate of 12 per cent, while tax revenues had increased only 4 to 5 per cent.

The difference between what came in and what went out created an annual budget gap. By state law, which governs all city affairs, that gap must be closed each year. Gap-closing had developed into an elaborate ritual involving complex political maneuvering and arcane accounting manipulation.

Five gap-closing options were employed in various degrees. One was new taxes. While very important, this option unfortunately had some counterproductive effects. Higher taxes eviscerated the city’s none-too-healthy economic base, driving out businesses and affluent residents resentful of the extent to which their wealth was being redistributed to the city’s less fortunate residents. An ever larger percentage of the city’s population thus had become dependent on city services, while the city’s financial resources to provide those services at accustomed levels had declined. Continual increases in all-important real-estate taxes, which account for a quarter of city revenues, increased abandonments and delinquencies.

Another option was more state and federal aid, which supplied the city with 44 per cent of its revenues. But as the Great Society drive to reorder society through government action waned, once-burgeoning outside aid to the city had leveled off. Further, city budget gaps had never elicited much sympathy from upstate politicians in Albany. And even Democrats in Congress found in their home districts growing bias against the capital of the Eastern intellectual establishment. After years of subjugation to New Yorkers’ haughty superiority and snobbery, many outsiders found the decline of New York deeply satisfying.

A third option was expense-cutting, but all available means of doing so posed difficulties. While the dispensing of city services was notoriously inefficient and wasteful, the system was so labor-intensive that it was relatively unresponsive to efforts to raise productivity. As the State Charter Revision Commission, which had studied the city’s financial problems extensively, recently put it, “Had the City the best conceivable management, budgeting, and personnel systems, it would still face a fiscal crisis. The City’s revenue base is simply inadequate to support all of its existing programs.”

Yet wholesale abandonment of city services was so hazardous politically that over the past decade not a single major city program had been significantly cut back. Many, on the other hand, had been added or expanded. Reducing swiftly escalating employee costs was no easier. Wages and fringe benefits in fiscal 1975 totaled $6.5 billion, 55 percent of the expense budget. The city’s very resourceful and vigorous municipal unions had been able to win such remunerative contracts through threats, job actions, and other displays of political power that city workers were paid an average of 25 per cent better than comparable workers in the private sector. Considering fringe benefits, the average first-grade policeman (five years or more on the force) made nearly $23,000 a year and could retire at half pay after just twenty years. Because of generous retirement benefits, pensions cost the city $1 billion a year. But no mayor in recent years had been willing to engage the unions in a major confrontation over wages.

“… How could it have happened? Those involved were the country’s best and brightest leaders. Why couldn’t they prevent it? …”

Drawbacks of the first three gap-closing options caused growing reliance on two others. Accounting trickery evolved into a refined art at City Hall. The techniques were abstruse and varied. But basically most involved time warps—specifically, pretending that expenses the city was incurring now actually wouldn’t be incurred until later and that revenues the city expected to receive later had already been received. Outgo, in short, was pushed forward in time, while income was pulled back. An illustrative example is water revenues. Prior to the 1973-74 fiscal year (July 1, 1973, to July 30, 1974), the city figured the amount of water revenues it received on a calendar-year basis. But during 1973-74, it switched the beginning of the water-billing year from January 1 to June 30. This permitted the city to consider as revenues during 1973-74 eighteen months of water revenues: the six-month period between January 1, 1973, and June 30, 1974, and the twelve-month period from June 30, 1974, to June 30, 1975. Result: $56 million more in revenues to help close the 1973-74 budget gap. Like other accounting gimmicks, this, of course, produced no new actual cash for the city, only the appearance of same.

The last, most popular, and ultimately fatal option was borrowing, principally through the sale of short-term notes. If the city, legitimately or through an accounting trick, could claim that taxes would arrive at some point later in the fiscal year, or even, in some cases, the next fiscal year, it would sell some “tax anticipation notes.” If some revenues were due later from the state or federal governments, it would sell some “revenue anticipation notes.” Over the years, the period and extent of anticipation had grown and the city had mortgaged itself further and further into the future.

The city had also been selling notes in anticipation of income it knew might never arrive at all. New York in 1975 was borrowing against $600 million in uncollected and largely uncollectible real-estate taxes. And about $460-million worth of short-term borrowing represented previous budget gaps which, despite state law, never were closed.

The consequence of all this had been a rapid expansion in short-term debt from $747 million in 1969 to $6 billion in the spring of 1975. Continuation of the current imbalance between revenues and expenses would have raised this figure by perhaps $500 million a year. Interest on the city’s more than $13 billion in outstanding debt was running close to $2 billion, more than was spent for police and fire protection, libraries, parks, recreation, and cultural activities.

Simply to “roll over” or refinance maturing short-term notes, the city had to borrow, on the average, $500 million each month by issuing yet another series of notes. For this task, it usually enlisted the aid of the major New York banks, particularly First National City, Chase Manhattan, and Morgan Guaranty. They underwrote the note issues by organizing syndicates of dealers who bought the notes from the city and sold them—mainly to institutional investors—at a markup. The New York banks also were important city-note purchasers themselves and owned an estimated $1.5-billion worth. The banks held perhaps another $1.5 billion in customers’ trust accounts.

For years, the banks had tolerated the city’s fiscal practices with only occasional complaints. Underwriting city debt was a lucrative business; the more debt the city issued, the more money the banks made. “Bankers have even shorter time horizons than politicians,” said one City Hall financial expert. “As long as the shit moves off their shelves, they don’t want to know anything.”

In the fall of 1974, however, the shit began to pile up. Analysts for institutional investors became alarmed at the rapid increase in New York short-term debt—in part the result of inflation and the recession—and the absence of significant economy moves by City Hall. The budget deficit in fiscal 1974-75 was projected as high as $370 million. Preliminary figures put the 1975-76 deficit at $1.68 billion. Despite interest rates as high as 9.5 per cent, underwriters found city notes harder and harder to sell. (Since the interest on city debt is exempt from federal, New York State, and New York City taxes, a 9.5 per cent note offers affluent local investors yields comparable to 18-20 per cent on taxable investments.) In some cases, the underwriters had to unload city paper for even less than they paid the city. Distress sales of a $475.6-million bond offering last October cost underwriters $15 million to $20 million. After unloading city notes during sales last February and March only with great difficulty, the banks refused to bid on a proposed $450-million note issue in early April.

Thus commenced the game of chicken. In order to pay bills and redeem maturing note issues through June 30, the city needed over $1 billion more than it expected to receive in revenues. When a note issue matures, note-holders are supposed to be paid off. Absent outside assistance and the willingness of the banks to “roll over” the expiring debt by underwriting new issues, the city had only two choices. It could renege on payrolls or other bills. Or it could default on the expiring notes, i.e., refuse to pay off their holders.

The city appealed to the federal and state governments for more aid and to Albany for permission to raise city taxes. Washington declined. Albany gave the city a $400-million advance on welfare payments due the city later in 1975 but, with its own budget deficit at $500 million, refused further help. The city then appealed to President Ford and Congress for a federal guarantee of a city note issue. That request was denied also. Accommodating New York, federal officials said, would elicit a spate of similar requests from other financially strapped cities.

But the most important reason behind the federal and state refusal was to put pressure on the city to engage in a painful but necessary exercise in serious budget-cutting. If the city refused, federal officials were certain the state, which after all had direct legal responsibility for the city, would ultimately come up with enough money to tide the city over. State officials were certain that if the city refused, the federal government, which after all had rescued Lockheed and Penn Central, would come up with a guarantee or the necessary aid. No one believed the city would actually default. As part of their strategy against the city, administration officials publicly argued that a default, much as they hoped the city would avoid it, would have only “negligible” national impact. Privately, though, they were far more anxious, and they were certain city officials were even more so. Not since the Depression had a major municipality defaulted on its debt, and such an act by a city like New York, they thought, would be unthinkable.

The reasoning of the banks, which continued to decline city requests for financing, paralleled that of Washington and Albany. Basically antiunion and antiwelfare, the banks were even less tolerant of the swollen city expense budget and the exorbitant union contracts than the federal and state governments. Pressed on the point, some bankers actually believed that a city should behave fiscally just like a corporation and finance itself solely through its own resources. They were certain that unless the city could eliminate the projected deficit in the 1975-76 expense budget—reduced in April to $641.5 million—always-cautious institutional investors would refuse to buy any more city notes. And the gap would have to be eliminated by genuine expense-cutting, not accounting tricks or confiscatory new taxes. Like everyone else, the banks dismissed the chance of a default. If it came down to that, they believed, the federal and state governments would rescue the city.

The city, of course, saw everything much differently. Equating cities and corporations, they felt, was ludicrous. The unalterable economic realities of all large cities made true budget-balancing impossible. And in addition to a heavy load of conventional services, New York City had many unique financial obligations. No other city, for instance, had a tuition-free, open-admission university, or paid much of its own welfare costs and most of its correctional and court expenses. The federal and state governments, city officials believed, had an obligation to make up city deficits. The officials wondered how the federal and state governments could lecture the city on its budget gap when they faced huge deficits of their own. When Washington had a deficit, it could simply print more money.

The banks also had an obligation to help, as city officials saw it. New York banks earned millions of dollars in underwriting city issues, which totaled $7.4 billion in 1974-75. They made millions more as depositories of city funds and investment managers of the city’s $7-billion pension fund. In imposing what Mayor Beame came to call a “cash boycott” of the city, the banks, the city felt, were acting irresponsibly. The city could not understand the banks’ evaluation of the note issues exclusively in terms of investment merits. At a briefing in March of the New York congressional delegation, an official of the First National City Bank, the most outspokenly critical of the New York banks on city fiscal policies, remarked that unless New York cut expenses, “the city’s fiscal situation might not be viable and New York City paper would then be suspect, regardless of interest rate.” When the comment was leaked to the press, Beame called up Citibank president William Spencer and witheringly excoriated him for displaying “bad faith” and undermining public confidence in the city. The city reportedly also made its displeasure known by removing some pension money from Citibank’s trust department. “Those fellows live in ivory towers,” said Beame. “They run home every night to the suburbs. They don’t know what is really going on in the city.”

While some pruning could be done to the expense budget, the city believed massive cutting on the scale demanded by the banks and federal and state governments would, as Beame put it, “cripple the city” and create “social instability.” Large layoffs, one city official noted privately, would have an impact mainly on lower-echelon and lower-income workers, especially blacks and members of other ethnic groups, and would lead to demonstrations and perhaps even rioting. The layoffs could also bring on a confrontation with the unions, which in the past had starkly demonstrated power to disrupt the city. As late as May 15, the city had not dismissed a single city worker. City officials remained convinced that in a crunch the federal or state government or the banks would come through. Nobody wanted to risk a default.

“… Pressed on the point, some bankers actually believed that a city should behave fiscally just like a corporation …”

The unions agreed with the city on the obligations of Washington, Albany, and the banks. They saw their salaries as justified and hard-won. They did not see why city employees should be out of work while bankers grew fat on the city’s financial business. Victor Gotbaum, executive director of District Council 37 of the State, County, and Municipal Employees Union, said: “The people we represent are in pain, and we don’t see any bankers jumping out of windows.” The unions knew someone would come up with enough money to get the city through.

And so it went. As the city staggered through the month of May, its meager cash reserves being rapidly eaten away by payrolls, no one wanted to risk being called chicken. The federal and state governments felt the city would slash expenses sufficiently to balance the 1975-76 budget and thereby persuade the banks to end the cash boycott. The banks also believed that the city would act, and that if not, Washington or Albany would come up with aid. The city and the unions were determined to resist the pressure.

The events which were leading inexorably to the nation’s worst financial panic came down to Friday, May 30. Two days earlier, Comptroller Harrison Goldin had asked again for bids to underwrite a long-delayed $280-million note issue. City officials made it clear to the press that if no one bid on the issue, the city would have to default on $220-million in notes expiring that day.

Chase Manhattan strived during Wednesday and Thursday to assemble a syndicate of all major New York banks and other underwriters to bid on the issue. But the bank soon discovered that due to the city’s refusal to balance the budget, buying interest among institutional investors, even at interest rates well above 10 per cent, was nonexistent. With their own portfolios already bulging with city paper, the major banks had no interest in eating the issue themselves. And even if they did, they knew they would soon be faced with trying to unload future, probably unsalable, issues. Some $752-million in notes were due to mature on June 11. Another $249 million were to expire on June 25 and another $375-million worth on June 30. The banks couldn’t eat everything.

There was a brief discussion, during a meeting of senior bankers Thursday evening, about a large outright loan to the city by all the major banks. In 1932, when New York faced a similar cash-flow crisis, the city’s banks had extended just such a loan. To protect their investment, the banks the following year required the city to sign what came to be known as the Bankers’ Agreement. Under it, the banks maintained tight supervision over city finances for four years and forced adoption of austere budget cuts. (For their trouble, the banks had the city drop proposed business taxes they opposed.)

The notion of a 1975 Bankers’ Agreement, though, was soon dropped. For one thing, the dimensions of the city’s problems were far greater now than in 1933, when short-term debt was only $500 million and only a $131-million loan was required to permit the city to meet its immediate obligations. Second, unlike 1933, the banks now had an alarming amount of their money already out at risk in city loans. Finally, the sort of control exercised by the banks over the city during the 1930’s would now be politically impossible. Saving New York, the bankers concluded, was the responsibility of Washington and Albany, and the bankers remained confident that, in the end, that responsibility would not go unmet. Though publicly proclaiming they were still assessing market conditions, the banks privately agreed not to bid.

Informed of the decision by Ellmore Patterson, chairman of Morgan Guaranty and head of the mayor’s financial liaison committee, Mayor Beame called Treasury Secretary William Simon. Simon said the administration’s position remained unchanged: it was up to the city to restore investor confidence. Congress, Simon added, concurred.

Frantically, Beame called Governor Carey. A late sounding of Albany’s legislative leaders, Carey told the mayor, indicated no chance of an aid package without massive city budget reductions.

Though it was now close to midnight, Beame summoned the city’s top labor officials for an emergency meeting at Gracie Mansion. His message was blunt: unless they agreed to a complete freeze on wages and hiring for the next fiscal year and to layoffs of at least 25,000 existing workers—measures which would close the 1975-76 budget gap—the banks would not bid on the note issue the following morning and the city would be out of money. Speaking for the unions, Victor Gotbaum was equally blunt. The unions had not caused the crisis, he said, and he saw no reason why they should be the ones to suffer. If the mayor went ahead with the freeze and cutbacks, he threatened, every city employee would walk off his job within an hour.

After the labor leaders had left, the mayor and his aides gathered to discuss their rapidly dwindling options. Slowing bill payments would buy only a few days of time. A large purchase of notes by the city’s pension fund, which already owned $588-million in city paper and whose fiscal soundness had been under attack by the State Pension Commission, seemed certain to subject the fund’s trustees to lawsuits. And, again, it would only buy time until the next note issue had to be rolled over. Under Chapter IX of the Federal Bankruptcy Act, the city could conceivably file for bankruptcy, which would permit it legally to abrogate existing labor contracts. Yet the procedures under Chapter IX, which was enacted during the Depression and has been previously used only by small municipal organizations, were cumbersome for a large city. Merely filing a bankruptcy petition, for instance, would require approval of holders of not less than 51 per cent of the city’s total outstanding debt. Approval would have to be obtained from thousands of bond and note investors.

The last option was a default. Not long before, city officials had angrily upbraided reporters who even brought up the idea. In recent months, the officials had used it as a threat. But privately, as all of the other players in the chicken game well knew, they had always regarded it as unconscionable.

Yet now, as they talked about it, default came to possess some allure. If the threat of a default could not move Washington, Albany, and the banks, the fact certainly would. Nothing, indeed, could more graphically dramatize the city’s financial plight and need for more outside aid. The $220-million worth of notes coming due the next morning were “general obligation” issues backed by the “full faith and credit” of the city. As an expected surge of lawsuits by debt-holders would point out, the state constitution decrees that holders of such notes have “first lien” on all city revenues. They must be paid off, if necessary, even before the city pays salaries and other bills. The actual dimensions of the responsibilities of issuers of municipal paper in the case of a default, however, have never been firmly established. And courts have often held above other obligations a municipality’s duty to preserve its “police power” and maintain local order. No court, the mayor’s aides figured, would order payment to well-heeled institutional-note holders while payrolls went unmet, city workers walked off their jobs, and city services collapsed.

The next morning, Friday, May 30, 1975, a few minutes after the nine o’clock deadline for submission of bids in a small green tin box in the comptroller’s office, Mayor Beame called a press conference in City Hall. By the expression on his face as he began reading a statement in front of the cameras, experienced City Hall reporters knew no bids had been received. Unable to obtain any money from Washington, Albany, or the banking community but unwilling to abandon the city’s obligation to meet the needs of the people of New York, the mayor said in a wavering voice, the city had no choice but to default. The city would continue, he added, to meet payrolls and pay other bills.

Within minutes after the news appeared on the Dow Jones and Reuters news wires, the huge and growing $2.7-trillion superstructure of government, corporate, and individual debt which supports the U.S. economic system began to crack. The stability of what Business Week recently termed our “debt economy” depends on faith: confidence by lenders that their money will be paid back on time. The system easily tolerates occasional bankruptcies as long as they are regarded as isolated faults in an otherwise sound structure. But just as public order is occasionally revealed as a surprisingly thin veneer over a propensity toward panic and violent self-protection and assertion, so also is the nation’s credit system, as the near panic that followed the collapse of the Penn Central showed, susceptible to dangerous losses of confidence from events judged to be indicative of pervasive weakness. To participants in the financial markets, New York City’s default seemed an ominous harbinger of much more trouble to come.

First to be hit was the municipal bond market. States, cities, and towns all over the United States live off continual access to the credit markets. If it could happen in New York, investors asked themselves, why not anywhere else? The unthinkable had become only too possible. Debt obligations of such debt-ridden upstate communities as Rochester, Syracuse, and Buffalo, then such large Eastern cities as Newark, Boston, and Pittsburgh, then such states as Pennsylvania, Massachusetts, and Michigan were dumped in such large blocks they became unsalable at almost any price. Officials of several small cities, who had expected to roll over maturing debt the following week, indicated they also would probably have to default. Hundreds of small communities began preparing bankruptcy petitions. By late morning, some $200-million in municipals had been reduced to little more than pieces of paper.

“… The last option was a default. Not long before, city officials angrily rejected the idea. Now, they used it as a weapon …”

With alarming speed, the panic moved to the banks. The widely publicized collapse of Franklin National and several other major banks over the past year or two has highlighted what many analysts, including officials of the Federal Reserve, feel to be a serious overextension by the banking community. At one time, banks financed most loans with deposits. But to meet booming corporate loan demands, the large banks resorted to issuing their own paper debt, mainly certificates of deposit (C.D.’s). Bank liabilities soared beyond often meager capital reserves. And a major share of those reserves was invested in municipal obligations.

It did not take long for investors in C.D.’s to calculate that the $1.5-billion in city debt held by the large New York banks not only exceeded the banks’$2 1974 net earnings, but constituted perhaps 25 per cent of their total equity capital, which recently had been depleted by loan losses on real-estate investment trusts and other ventures. Total municipal holdings by the banks are nearly as large as their equity capital. Corporate treasurers rushed to sell their C.D.’s in New York banks and withdraw their deposits. Other large money-center banks, who also hold large amounts of debt issued by local municipalities, came under pressure. Arab money managers, who had invested billions of dollars in C.D.’s and had billions more in demand deposits, hurriedly withdrew their funds.

By midafternoon, the dimensions of the panic were becoming clear. On the New York Stock Exchange, some 47 million shares changed hands and the Dow Jones Industrial average dropped 85 points before trading was suspended at 11:30 A.M. Despite massive infusions of cash by the Federal Reserve, several large banks, their liquidity exhausted, closed their doors. Fresh cash investments to help the Chase Manhattan Bank remain open were reported to have been possible only through personal guarantees by the Rockefeller family. A number of large corporations, dependent on a steady flow of bank credit, seemed headed for insolvency. In the foreign-exchange markets, the dollar plummeted despite Treasury support efforts. Treasury issues, which are held by many wealthy foreigners, including Arab money managers, came under fierce selling pressure. Some $10-billion, Federal Reserve analysts estimated late in the afternoon, had left the United States for safer havens.

The idea of giving our gold to the oil producers came from Henry Reuss, one of the most informed congressmen on international monetary affairs. Reuss, who had long urged that gold be eliminated as a monetary medium, and who was concerned over a possible breakdown in the foreign currency markets, called Treasury Secretary Simon at his home Friday evening.

Initially skeptical, Simon liked the idea the more he thought about it. The attack on the dollar and Treasury securities was irrational, of course. The immense economic resources of the American economy far overshadowed the problems of New York City and the municipal bond market. Yet for all their statistical trappings, money markets are creatures of psychology, and the effects of a loss of confidence can quickly become mindless. As holders of such a large portion of the world’s assets, the oil producers had become a highly visible symbol of financial strength. A $100-billion line of credit and guarantee of the municipal market seemed the only way that order and reason could be expeditiously restored to the markets. Giving them our gold, though an extreme step, seemed a far more palatable quid pro quo than such political concessions as removals of U.S. support for Israel.

The deal was in place by Saturday morning and fleets of trucks and tankers began moving to their assigned locations. The members of the Organization of Petroleum Exporting Countries were very attracted to the plan. Many Middle Eastern nations had recently become interested in gold and had already been accumulating it quietly as a hedge against their investments in foreign currencies and other ventures. In guaranteeing the muni market, they stood to incur losses on defaults. And the interest rate on the line of credit to the United States was several points below rates on comparable loans. But they figured the $45-billion market value of the gold would more than offset conceivable losses.

President Ford’s TV announcement of the arrangement Sunday evening buoyed the market the next day as dramatically as New York’s default had battered it on Friday. The dollar and Treasury issues rebounded and bank liquidity, thanks to several billion dollars in Federal Reserve discount window loans and other measures, was restored. All important potential corporate insolvencies were averted. Even the stricken muni market had by midweek achieved a semblance of normality. Federal officials congratulated themselves on their success.

On Wednesday, June 4, Mayor Beame called a joint meeting of representatives of the federal and state governments, the banking community, and the unions to explore new solutions to the city’s financial problems. It soon became clear that the past few days had had a quite sobering effect. There was a conscious avoidance of the name-calling and backbiting that had characterized earlier negotiations. On the other hand, though, while everyone agreed on the need for an immediate accommodation, everyone knew it was important not to permit the rush of events to cause a loss of proper perspective.

At a City Hall press conference on Thursday attended by all the participants, it was announced that a bipartisan bill was being introduced in Congress providing for a federal guarantee of sufficient short-term note issues to finance the city through the end of the fiscal year. The banks indicated their readiness to market the notes at anticipated interest rates considerably below what the city had been forced to pay earlier in the year. New York State announced bipartisan support for legislation to permit a $500-million increase in city taxes and a $1-billion advance on state aid due the next fiscal year. With the concurrence of the unions, Beame announced a one-year freeze on hiring and wage increases for city employees. The 1975-76 budget, the mayor said proudly, would be in balance and might even run a slight surplus.

“The federal government stands ready to continue to assist New York City in its effort to regain its financial health,” said Treasury Secretary Simon. “But it is important that the city realize that it cannot spend more than the people of New York can afford.”

“The state is anxious to help the great city of New York restore the confidence of the financial community,” said Governor Carey. “But as I’m sure Mayor Beame understands, it is the city’s responsibility to put its own affairs in order.”

“Speaking for the underwriters,” said Ellmore Patterson of Morgan Guaranty, “I want to say that we are eager to continue to serve as money-raisers for the city. We are confident that as long as the city maintains a prudent degree of financial restraint and avoids counterproductive taxation that might weaken the city’s economic backbone, investors will be eager buyers of city bonds and notes.”

“We greatly appreciate the assistance of the federal and state governments during the last few traumatic days,” said Mayor Beame. “As I have been doing since I took office sixteen months ago, I will strive to reduce city expenditures to a minimum. But as I’m sure President Ford and Governor Carey realize, the city government still has an obligation to meet the legitimate and growing needs of the people of this great city.”

“Speaking for the other municipal union leaders,” said Victor Gotbaum, “I can say that we were pleased to help in solving the city’s financial trials, even though it will involve great sacrifices on the part of our members over the next year. But we hope that in return the city will understand that its employees cannot be asked to bear the entire burden for restoring New York’s financial health.”

Whereupon everyone smiled, shook hands, and went home. Nothing had really changed, of course: No one had really compromised his position. But at least the city of New York had been saved—perhaps even for as long as a few months.