Last week, German investor Adolf Merckle, a multibillionaire who lost a fortune on shorted Volkswagen stock, threw himself under a train. Two weeks earlier, Rene-Thierry Magon de la Villehuchet, an heir to French aristocracy and the co-founder of an investment fund whose money vanished in Bernie Madoff’s alleged pyramid scheme, told the cleaning crew at his Madison Avenue office to clear out, sat behind his desk, and slashed his wrists with a box cutter. Five days before that, in London, a hotel worker entered a $750-a-night suite at the Jumeirah Carlton Tower to find the body of Christen Schnor, HSBC’s head of insurance, hanging by a belt in a closet. This spate of financier suicides is already the second such wave in a year: The first commenced with Bear Stearns research supervisor Barry Fox’s 29-story plunge in Fort Lee, New Jersey, on May 22, and was quickly followed by at least two more cases in June and July.

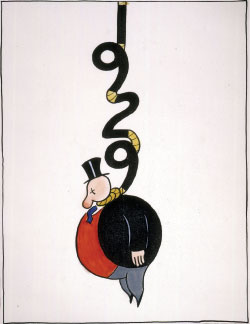

Reports of financial professionals taking their own lives after suffering steep stock-market losses are as old as trading itself. On May 24, 1881, a trader named Attilio Guinio drank poison after losing $200 on Delaware and Lackawanna Railroad shares; another victim of wall-street, read the Times headline. Such deaths inevitably fuel talk about mass banker suicides—a story line that formed after 1929’s Black Thursday and has gotten an airing-out after every Black Weekday since. Now, once again, newspapers and TV anchors fret about it. Pundits from Peggy Noonan to Stephen Colbert joke about it. It’s the subject of Schadenfreude-tinged watercooler talk. But are bear-market banker-suicide epidemics real or apocryphal?

National suicide statistics by occupation have been kept only sporadically over the years, and the studies that have been done aren’t especially comprehensive. That said, the available data appears to suggest that bankers are no more or less likely to kill themselves, in good times or bad, than anyone else. According to Occupation and Suicide, a 2001 work by Dr. Steven Stack of Wayne State University, the riskiest groups are dentists, artists, and certain laborers (physicians also rank high in some studies, perhaps because of their ready access to fatal substances). Even then, occupational stress is only one of the four factors known to contribute to suicide risk, the other three being demographics, “preexisting psychiatric morbidity,” and “differential opportunities for suicide” (e.g., doctors’ access to drugs). There is some demographic overlap between American suicide victims and bankers (both groups are largely white and male), but that’s a correlative, not a causal, relationship. Bankers don’t appear to be any more prone to preexisting psychiatric problems than other groups, nor do they have any special ease in procuring poisons, guns, and the like. They do tend to have access to tall buildings, but judging from newspaper reports and a statement by New York’s chief medical examiner at the time, the immediate aftermath of 1929’s Black Thursday produced fewer suicides than the same period of time in 1928—and just four were high-rise plunges. Black Monday in 1987 also failed to trigger any significant statistical uptick.

When it comes to suicide statistics for the general population, the picture is clearer, if less cheery. The rise and fall of the Dow isn’t the key factor here; the health of the overall economy is. “We’ve been studying suicide cycles for over a century, and there is a nearly linear relationship between the national suicide rate and GDP,” says Dr. M. Harvey Brenner, a professor at the Johns Hopkins School of Public Health. The overall cycle of suicides, he says, “mirrors the economy.” It does so, it bears noting, with a time lag. While there was no nationwide rash of suicides in 1929, rates peaked in 1932, by the time the Great Depression had set in. Just as the crisis itself takes a while to spread through the system, so does individual misery. Worse, experts fear that the current financial upheaval could cause more suicides than other downturns. Stack and other researchers suspect that it may be the size of the status change, the mental whiplash, that triggers suicidal behavior. In other words, it’s not where you wind up; it’s how far you fall (Adolf Merckle was still worth over $8 billion, for instance, after the Volkswagen disaster). Given the record number of people who bought homes for the first time and the historic amount of wealth built in the nineties, there could be more mental whiplash than ever this time around as once-fat portfolios thin out and an unprecedented number of people lose their homes.

Not sufficiently depressed? Let’s go back to bankers. Stack recently chanced upon an obscure piece of government research from 1910 (“I found it a week ago; I’m a connoisseur of dusty papers”) that seems to contradict the idea that bear-market banker suicide rashes are a myth. It’s just one study, a century old, but it did break down U.S. suicide statistics, for the year 1908, by the victims’ occupations. Contrary to the since-established patterns, the study found that a group defined as “bankers, brokers, and officials of companies” was at the top of the list, with twice the average rate of suicide. Stack first dismissed the research as a fluke. Then he learned there was a massive Wall Street panic in October of 1907.

Have good intel? Send tips to intel@nymag.com.