For journalists, bad news can be good news. And so, in the wake of the Lehman Brothers collapse last September, as the world’s economy teetered, an all-star roster of business journalists—Roger Lowenstein, Joe Nocera and Bethany McLean—raced to shop book proposals to chronicle the epochal events unfolding on Wall Street and in Washington, D.C. On the morning of September 23, 2008, Andrew Ross Sorkin, the New York Times’ then-31-year-old star financial reporter, made the rounds to publishers with his agent and his proposal, which he’d pulled together over a weekend. “It was like Paulson’s original tarp proposal,” Sorkin tells me, referring to the former Treasury secretary. “His was three pages, mine was three pages.”

We’re sitting at the Lyric Diner on Third Avenue on a Monday morning. Sorkin’s Tuesday Times column is due in a few hours, but, as usual, he’s way behind, and later I learn that he missed it entirely and his editors had to scramble.

His excuse is that he’s got a book to promote. Too Big to Fail, for which Viking paid a reported $700,000 and which debuted at No. 4 on the Times’ best-seller list, is a nearly minute-by-minute account of the financial crisis as observed through the eyes of the clashing Wall Street CEOs who drove their investment banks into the abyss and the government regulators who watched powerless from the sidelines. The book has become a kind of media sensation. In a review for the Financial Times, John Gapper declared that Sorkin had written this generation’s Barbarians at the Gate. Charlie Rose compared Sorkin to Bob Woodward. Vanity Fair published an excerpt and held a book party at Graydon Carter’s Monkey Bar (“Part of the package we put together for him,” Carter says). Three weeks ago, as the book landed in stores, Sorkin blanketed the airwaves, beginning with an October 19 appearance on the Today show, followed by multiple stops on CNBC and his second appearance in a month on Charlie Rose.

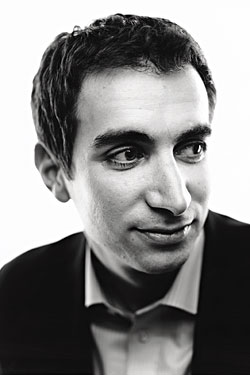

“I’m very surprised by the reaction,” Sorkin explains, as we sit over bowls of oatmeal at a rear table. “But it’s good! I can’t complain.” Despite the highs of the past week, Sorkin looks exhausted. He’s eschewed his usual Ted Baker suits—“You have to dress like them,” he says of his cast of sources—for jeans, a striped blue shirt, and a blazer. At a particularly loud moment in our interview, when he picks up my digital recorder and holds it to his mouth, he looks like a CEO dictating notes to himself.

Sorkin, who started at the Times as an 18-year-old intern, and who founded and edits the Times’ influential DealBook blog and writes a weekly front-page business-section column under the DealBook flag, has cultivated an A-list of Wall Street power players as his sources, a remarkable feat considering that many of these men are twice his age and he writes for a paper that has traditionally been a middle-of-the-pack player in business journalism.

It’s hard to overstate Sorkin’s centrality as an information hub on Wall Street these days. DealBook is a high-level Wall Street message board. By now, it’s a self-reinforcing cycle: Everyone on Wall Street talks to Sorkin, which makes everyone need to talk to Sorkin. “You never know when you need to go back to the favor bank,” one senior investment banker explained. “Why would a Hank Paulson or a Jamie Dimon or a John Mack pick up the phone and talk to him?” asks one head of communications for a financial institution covered by Sorkin. “They want to hear what everyone else is saying.”

The book party for Too Big to Fail was a window into Sorkin’s world. No one tends to love a journalist after a story is written, especially one about a failure with as many fathers as the financial crisis. But Sorkin, remarkably, avoided this problem. Attendees—Sorkin’s presumed unnamed sources—included Jamie Dimon, John Mack, Ken Griffin, Steve Rattner, and Barry Diller. Warren Buffett mailed in an Ed McMahon–size “colossal-gram” that read, “Andrew … Congratulations! Your book will be bigger than this telegram.” “It showed how powerful he is,” says Jeffrey Taufield, a partner at the Wall Street PR firm Kekst and Company. “What you noticed when you went was how many powerful Wall Street people were there to kiss his ring,” adds The New Yorker’s Ken Auletta, a party guest. “He’s a 32-year-old guy, and there were all these titans of Wall Street crowding around to say hello and make nice to Andrew.”

While Sorkin basks in Wall Street’s attention, his image at the Times is more conflicted. His rise at the paper was jet-propelled—he was a kind of legend before he was 20. And he was one of the first at the paper to realize the centrality of the web and also one of the first to realize that on the web, a journalist’s personal brand can sometimes be more valuable than that of the institution that employs him. With his DealBook e-mail, read by some 200,000 people, plus the blog, with 2.5 million unique monthly visitors, plus the weekly column, breaking news scoops, television appearances, and 60,000 Twitter followers, he is one of the Times’ most visible players. Media ubiquity is a strategic decision. In the cubicle jungle of the Times, he’s an entrepreneur. “All of it is self-reinforcing,” Sorkin says.

Still, part of Sorkin’s problem at the Times is that he’s a new sort of creature at an essentially conservative institution, albeit one that desperately needs new models. He’s not a Timesman, exactly. He’s his own creation, and he doesn’t genuflect to Times traditions.

In these dark days for newspapers, Sorkin, with his un-Timesian public face, unorthodox methods, and precocious success, has become a flashpoint for some of his colleagues. At bottom, they see him as far too cozy with his sources. In a profession that tends, with religious fervor, to draw bright lines and stay behind them, Sorkin seems to cross back and forth without a care. While he has written critically about the financial mandarins he covers, a fawning quality can ooze into his prose that some other Timespeople find unbecoming. “Over at the power table is Lloyd Blankfein of Goldman Sachs, or should I call you the man who can do no wrong?” (December 30, 2007) … “Trying to defend Stephen A. Schwarzman, Wall Street’s whipping boy of the moment, seems like a lose-lose proposition … But hey, somebody has got to go to bat for Mr. Schwarzman. Might as well be me” (July 29, 2007) … Or the second time the word subprime appears in his column, two months before Bear Stearns blew up, when credit and real-estate markets had already begun their steep nosedive. “I know many of you aren’t in a party mood,” Sorkin wrote. “Things were going great until summer, when the subprime mortgage thing really took us down a notch—and ruined more than a few golf games.”

(Detractors also mention stories Sorkin hasn’t written. Earlier this year, Sorkin was too busy to write a critical series on private-equity companies like Cerberus and the Blackstone Group, firms he championed during the boom and about which he had deep knowledge. The editors had to find other reporters to do it.)

Some of his antagonists in the newsroom wonder what, in the end, his privileged access is in the service of. “It’s the Jon Stewart question,” one senior Times staffer said, referencing Stewart’s memorable takedown of CNBC’s pre-meltdown boosterism. The squawking, which is loudest among the reporters on the business staff and not among higher-ups, has lately gotten louder, and meaner. As Sorkin’s career has burgeoned, he’s developed another audience of close readers: his colleagues, who comb the column for evidence of favor-trading. In conversations with me, several compared Sorkin’s relationship with the Wall Street elite to disgraced former Times reporter Judith Miller’s alliance with Bush-administration officials peddling bogus intelligence in support of the Iraq War. “She got too close to her sources,” a veteran Times staffer told me. “It was disastrously wrong and we let our readers down. This is the financial equivalent of that.” The analogy seems slightly strained. But certainly, Sorkin’s sources, the ones who have often been treated with kid gloves in his column, are the very actors in the executive suites who triggered the collapse, and closeness inevitably distorts reporting. Sorkin’s critics at the Times say that this effect weakened the paper’s financial coverage during the bubble. But access is one of the places where scoops come from—the career of legendary Times columnist James Reston, among many others, is testament to that. It’s a complicated balance in any newsroom.

Sorkin has heard these charges of access journalism before, and he dismisses them. “I think to the extent I’ve been able to get inside the room, it’s a function of hopefully coming to the table and being fair and open,” he says, “but also coming to the table and being sufficiently skeptical, but not cynical.” He adds that many of his sources hate what he writes.

Two weeks ago, these tensions spilled into public view in an article in the New York Post that reported that Sorkin had failed in his book to credit an August 9 front-page article by veteran investigative reporters Don Van Natta Jr. and Gretchen Morgenson, a pair of journalists long known for their aggressive style. Morgenson is an especially fierce critic of Wall Street’s excesses and often draws the ire of Sorkin’s high-level cast. Van Natta and Morgenson, according to sources, suspected Sorkin of piggybacking on their reporting, perhaps after being tipped off by business editor Larry Ingrassia, who is a Sorkin champion, and following their tracks in order to obtain crucial details for his book. Executive editor Bill Keller and managing editor Jill Abramson moved to quell the dispute, but it still simmers. Keller is effusive in praise of Sorkin, while acknowledging some of the issues. “Andrew may seem like a new phenomenon,” he wrote in an e-mail, “but at heart he’s a classic beat reporter. He develops real inside sources, he works them relentlessly, and they tell him stuff because a) they regard him as essential reading, and b) he treats them fairly.”

The sniping over Sorkin is partly petty inside baseball, a matter of professional competition and jealousy of the kind that come with the morning coffee at the New York Times. But it’s happening at a particularly dire moment, one that gives it added resonance. The Times just announced that it was cutting another 100 newsroom jobs, and no one is completely certain which employees—or indeed, which journalistic values—will survive the ongoing migration to the web. Sorkin has already created a profitable business with DealBook on the web. And he’s a star, certainly—the brightest one the Times has produced in a while. Is he the journalist of the future? Some of his colleagues hope not.

To write about the game, you have to know the game. Sorkin has a deep and highly particularized knowledge of the deal-making landscape, a pressurized beat populated by PR advisers, bankers, lawyers, where information translates into dollars and everyone has a financial stake in an outcome. Sorkin communicates with his sources as an equal. “Oftentimes when you talk to reporters you have the sense they don’t understand what the deal is about. You don’t have that problem with Andrew,” says Jonathan Knee, a senior managing director at Evercore Partners, a boutique investment firm. There’s also serious shoe leather at work. He’s often up at 6 a.m., working the phones, sometimes fielding 200 calls in a day. “I get such a high off the day-to-day, moment-to-moment,” Sorkin says. “I love being at that sort of nexus of knowing where the deal is and what’s coming next and how it’s going to work and the structure of the deal.”

He’s open about the fact that he’s not adversarial. “I don’t come to the table with an ax to grind—that helps me,” Sorkin says, sipping an iced coffee. He has another crucial advantage in the world he’s traveling in: He gives good son. “There’s something about his boyish, Jimmy Stewart charm that the older men he deals with find incredibly winning,” Graydon Carter says.

“When did you get the Paulson waiver?” Van Natta asked. “Is this an inquisition?” Sorkin replied

In March 2006, when the Times launched the DealBook blog on the paper’s website, it vastly expanded Sorkin’s footprint at the paper. The blog, one of the Times’ most ambitious new-media ventures up to that point, featured commentary on breaking financial news. Sorkin now manages a staff of eight DealBook contributors. Three years ago, he was also promoted to management, which meant he could be paid far above the Times’ strict union-mandated salary scale. Sources say he earns $250,000, including a bonus that is based, in part, on the financial performance of the various DealBook properties (Sorkin disputes the number, but won’t be more specific). He is among the highest-paid staffers at the paper.

In January 2008, Times business editor Larry Ingrassia promoted Sorkin’s column from Sunday, where it appeared inside the section, to the front business page on Tuesday. A former Wall Street Journal editor, Ingrassia joined the Times in 2004 and is known inside the paper as an editor who drives his staff hard to break news. In this way, Sorkin is an indispensable asset on the hypercompetitive deal beat, where the Times used to lose more often than not. “If we hear something is happening, editors turn to themselves and say, ‘Where’s Andrew?’ ” Ingrassia tells me. “It’s amazing; he’ll say, ‘Let me make a couple of calls,’ and within fifteen minutes, he’ll find out if there’s a deal in the works. He’s become a go-to guy helping us break stories.”

Sorkin’s shift to Tuesday was certainly a promotion, but for Ingrassia, it’s also a way to distance Sorkin from Sunday business editor Tim O’Brien, a former investigative reporter who was frequently at odds with Sorkin and who, according to Times sources, chafed at Sorkin’s blown deadlines and his erratic writing. Sorkin told me he clashed with O’Brien only because O’Brien wanted him to turn in his columns a whole two days before the section went to press. O’Brien told me he needed the extra time to clean up Sorkin’s messes. “When Andrew had a Sunday business column and he’d drop a thinly reported or loosely written piece on the desk at the last minute on Friday night,” O’Brien explained, “it made us concerned about our production schedule and, occasionally, about the credibility of our page. So, yeah, there were frequent tugs-of-war with him.”

Sorkin’s favored-son status with Ingrassia has been a source of consternation inside the business section. Last year, Ingrassia intervened in a newsroom dispute between Sorkin and reporter Julie Creswell concerning a story they were collaborating on about private-equity mogul Henry Kravis. Creswell wanted details about Kravis’s lavish lifestyle and art collection in the article. Sorkin wanted them pulled. Ingrassia sided with Sorkin. When both Portfolio and Vanity Fair tried hiring Sorkin away with mid-six-figure offers, Ingrassia asked Bill Keller if Sorkin’s compensation could be bumped up, according to a source. Keller balked.

The war over Sorkin’s role at the Times escalated when the publicity rollout for his book began, stoked by a Keith Kelly story in the New York Post. On the book’s website, Sorkin included scanned copies of a “secret” ethics waiver Secretary Paulson obtained in order to negotiate with his former employer Goldman Sachs during the AIG bailout. The waiver became a locus of Goldman-Paulson conspiracy theories. To some staffers on the business desk and the paper’s investigative team, it seemed as if Sorkin were claiming credit for breaking the news of the waiver, whereas it had been first reported in an August 9 piece by Van Natta and Morgenson.

On the afternoon of October 22, Van Natta e-mailed Sorkin, who called him back. Both Van Natta and Sorkin declined to comment on the exchange, but according to multiple sources familiar with the events, Van Natta pressed him on where he first found out about the Paulson waiver and why he didn’t credit their reporting in his book. “When did you get the Paulson waiver?”

“Probably sometime in June?” Sorkin answered.

“Probably?”

“Is this an inquisition?” Sorkin asked. “Don’t you trust me?”

“No, I don’t trust you,” Van Natta said. “I’m a reporter. I don’t trust anyone. When someone tells me something, I check it out.”

“Look,” Sorkin replied, “I’m sorry you feel that way. If it means that much to you, I’ll change it in the next edition.”

About 45 minutes later, Sorkin called Van Natta back from his cell phone.

“I just have to say, that was a really strange call.”

“I’m old-school,” Van Natta said.

Van Natta and Morgenson had obtained the waiver and call logs through Freedom of Information Act requests in June, according to Times sources. The issue is whether Sorkin had learned of the waiver through his own reporting or somehow found out from Van Natta and Morgenson and pursued their leads himself.

On October 30, Gawker reported that Sorkin said he had previously submitted requests for the calendars and the waiver, but they had been denied. Sorkin told me on November 4 that Gawker misquoted him and that he had submitted a request only for Paulson’s calendars, not the waiver. According to copies of Sorkin’s communications that I obtained through the FOIA, Sorkin submitted a request for Paulson’s calendar on June 1 but made no mention of the waiver. He identified himself in his letter to the Treasury Department as a “reporter for the New York Times” and requested the calendar for “news media purposes,” but did not mention he was writing a book. The June 1 request was denied because Sorkin had failed to offer to pay the processing fee. The records show that Sorkin didn’t submit a request for the Paulson waiver until the afternoon of July 28, after he had learned from O’Brien earlier that morning that he would not be able to borrow Paulson’s call logs from Morgenson and Van Natta, who had just completed a draft of their story for the paper. O’Brien happened to mention the waiver, and told him about the story Van Natta and Morgenson were working on. “I also told him that my reporters on the piece, Don and Gretchen, would probably be uncomfortable simply handing over documents to him that they had spent a lot of time and energy to find, analyze, and report on,” O’Brien told me by e-mail. Sorkin told me on November 4 by phone from London, where he was promoting Too Big to Fail, that he didn’t learn of the waiver from O’Brien, but that a source he wouldn’t name—presumably Paulson or his flack Michele Davis—had first told him about the waiver in early June, and that in the course of reporting his book, he had gotten access to the information in Paulson’s calendars and the waiver, and the later document request was simply to confirm what he already knew. The accusation that Sorkin would essentially steal information from more-traditional reporters for what would become a best-selling book—and that he would counter the charge by claiming that he got the information from one of his vaunted high-level sources—cuts to the heart of the tension.

Sorkin’s allies dismiss the flap, saying his talent is just what the paper needs in this tough new world for newspapers. “He’s a reporter, he breaks stories,” Times business columnist Joe Nocera says. “I feel strongly he’s providing a good and valuable service to the newspaper, and whatever is going on at the Times, he doesn’t deserve it. It ain’t right.”

Sorkin told me that, in his mind, the matter is resolved. “I thought the argument didn’t make sense from the moment I heard it,” he said. “It’s not an accurate argument.”

Sorkin is where he is today, the most famous financial journalist of his generation, in large part because of his herculean work ethic. “He’s a tireless newshound,” Ingrassia told me. “I’ve seen few people in this business who work as hard.”

Sorkin grew up in Scarsdale, in the same milieu as that of his future Wall Street sources and readers. His father is a partner at the corporate-law firm Cahill Gordon and his mother is a playwright and librettist with a law degree. Before he fell for journalism, Sorkin loved business, especially the glamorous world of Madison Avenue. “I thought I wanted to be a copywriter,” Sorkin tells me. “As a kid, I used to watch the Super Bowl for the commercials.” He developed an entrepreneurial streak. At Scarsdale High School, Sorkin started a sports magazine and lured national advertisers like Champion and Wheaties to buy pages. He religiously read the Times’ advertising columnist, Stuart Elliott, to follow the ad business. In 1994, as a senior, he wrote Elliott a fan letter and asked to shadow him for five weeks. Officially, the Times didn’t have a high-school-internship program, but Sorkin persuaded them to let him in the door anyway. “They sort of were sneaking me in the building. I was the guy who would Xerox and staple things. I thought doing that was the coolest job in the world,” he says.

Sorkin impressed Glenn Kramon, then the Times’ deputy business editor, who allowed him to stay on at the paper through the summer. He wrote his first Times piece, a 400-word article on why dial-up modems make that ear-piercing screeching sound. At the Times, Sorkin schooled his elder colleagues in the new world of the web. “He helped several people start using their e-mail,” Elliott remembers.

When the summer ended, Sorkin left for Cornell, where he majored in communications. He continued to string for the Times and desperately hoped to land a full-time job at the paper. The Times didn’t have any openings but offered him contract work in the London bureau. It was the height of the dot-com boom, and London was a hive of deal-making. Sorkin started writing business stories for the Times. “In the beginning, I’d cold-call people,” he recalls. Sorkin found reporting easier in London than in New York. “It was the Wild West; it was a gossipy town,” he says. “I could leverage the expats who were there who wanted to show off back in New York. Every single Sunday, I worked the phones. I would not go to sleep unless I talked to 30 people in the day.”

Part of Sorkin’s problem at the ‘Times’ is that he’s a new sort of creature—entrepreneurial, web-friendly—at an essentially conservative institution.

After sixteen months in London, Sorkin was offered a job by a rival paper. The Times counteroffered with a full-time position back in New York. He was assigned to the paper’s mergers-and-acquisitions beat. He was 23. Immediately, Sorkin was covering major stories, including Chase’s acquisition of J. P. Morgan in a $30.9 billion deal.

When Sorkin arrived back in New York, the Times’ M&A coverage was sleepy. The bursting of the tech bubble had put an end to the furious wheeling and dealing of the nineties, and the Times, which had long trailed the Journal’s M&A coverage under the legendary reporter Steve Lipin, wasn’t a must-read in the deal-making world. Sorkin plunged into the beat. The universe of mergers and acquisitions is a tight constellation of some 200 elite bankers and lawyers. Sorkin, as he had done in London, set out to meet every one of these players. Sources at first didn’t take the Times seriously. “They made it clear that they left the Times at home with their wives and took The Wall Street Journal on the train in. That was an awakening to me,” Sorkin tells me.

Sorkin realized that to get sources, he needed to get his byline in front of the right people. In 2001, he came up with the idea for DealBook, an online newsletter he would e-mail to a list of Wall Street executives and other major players every morning with a roundup of all the major merger news of the day. “If I could get inside their e-mail box every morning, that would enhance our ability to break news,” Sorkin says. It would also enhance his brand.

It was a radical idea for the Times. The paper had never aggregated outside news under its flag before, and Sorkin had to convince his skeptical bosses that the paper could point its readers to competitors. He pitched DealBook to Martin Nisenholtz, who now oversees the Times’ digital operations. Brooks Brothers signed on as the inaugural sponsor. Initially, Sorkin anticipated an audience of 30,000 potential DealBook subscribers. Within a few months, they had attracted 80,000.

Sorkin imagined DealBook as one part of a larger franchise. It would consist of special DealBook sections in the print paper, a blog, conferences, even a $5,000-per-year premium subscription—just the kind of gift horse journalists love to look in the mouth. At the Times, Sorkin has become something of an in-house entrepreneur, pitching revenue-generating ideas at a time when the paper desperately needs new sources of cash. “Maybe it was uncouth, but I was always the guy who was pushing these plans and prospects on people,” Sorkin says. “I’ve had so many cockamamy ideas I would love to have been able to do.”

Sorkin’s original concept for Too Big to Fail was to chronicle the fateful week of September 15 after the government let Lehman go bankrupt, but soon, he widened the interlocking narrative to tell the story of the first year of the financial crisis from the eyes of his CEO sources. The structure of Too Big to Fail is “modeled almost shamelessly on the movie Crash,” Sorkin says. “I thought you could sort of structure each of these various story lines, which seemed to be happening in this almost autonomous, semi-independent way, sort of like Crash does. And of course as the story progresses, they cataclysmically come together and you start seeing the connections between things.”

Sorkin’s golden Rolodex of Wall Street power brokers surely helped his proposal sell. But when he pitched the book, he hadn’t gotten agreements from his sources that they would cooperate. “I had ambitions to do the thing on the record,” Sorkin says. “But someone told me early on that ‘this is not the way Bob Woodward or Jim Stewart would ever do it. You’re not going to get very far, and if you’re trying to get the intimate details of what they said to their wives, you’re going nowhere fast.’ Once I said ‘I’m not going to identify you as a source,’ people were more open than I expected them to be.”

For both Sorkin and his publisher, the project was a high-stakes risk, given that so far, books on the meltdown have failed to become mass-market hits, and Sorkin had always been a short-form writer. According to sources on the paper’s business desk, Sorkin’s writing was often dashed off—understandably so, given the pressures of reporting merger deals on deadline. Earlier this year, Nocera chipped in to edit his column. “He’s my writing god,” Sorkin says.

Sorkin told me that the idea of writing a book initially seemed daunting. “I thought it would be a 350-page book. I didn’t think I could write 350 pages,” he said. Too Big to Fail ended up at 600 pages. Producing the manuscript turned into a collaborative sprint. With only ten months to conduct interviews and produce a 160,000-word draft, Sorkin hired two researchers to compile exhaustive timelines of virtually every newspaper and magazine article on the crisis, as well as prepare detailed dossiers on each of his central characters. In addition to his editor at Viking, Rick Kot, who edited Barbarians at the Gate, Sorkin asked three freelance editors to work on different portions of the book, including former New York Times Sunday business editor Jim Impoco, now at Reuters, and Hugo Lindgren, New York’s editorial director (who had no involvement in this story). Impoco, in particular, heavily edited the book’s opening three chapters.

Sorkin’s editors clearly had a lot of material to work with. Indeed, he achieved remarkable access to the actors at the center of the financial storm. Beginning last fall, Sorkin filled his days with interviews, both for the book and his regular Times work. “I’d had breakfasts before work, some lunches, a lot of weekends. Constant weekends,” he says. “It was talking to people on the phone, in their homes in the city; Greenwich, Connecticut; and all over.” In part, he positioned himself as both therapist and historian. “For some people it was like history,” Sorkin says. “A CEO I sat with came with notes from a Federal Reserve meeting. These notes were better than any reporter’s notes I’d seen in my life … He had drawn out, on the paper, a picture of the table and written on it where everyone had sat. People like that were extraordinary. I had a guy who sat with me, his PR person and lawyer, we did an interview for an hour and a half that was awful. It was going nowhere fast. But I was peppering him with questions, he clearly knew that I knew. There is an inflection point when they know that you know, and you know they know. The CEO calls me back 45 minutes after the meeting and says, ‘Can you come to my house on Sunday?’ I sat with him, and he just spilled the beans. Here he is in front of the lawyer and everyone else doing one thing, and then completely opens the kimono when no one’s there.”

It is a popular parlor game inside the Times whether Sorkin, who has gained the trust and respect of the most powerful men on Wall Street, might join them. Twenty-five years ago, Steve Rattner, then a 30-year-old reporter in the paper’s Washington bureau, left to join Lehman Brothers and went on to found the Quadrangle Group, earning hundreds of millions in the process. I asked Sorkin if he would follow the Rattner route. “I don’t know if I should say it’s flattering or not given that he just got involved in that other situation,” Sorkin says, referring to Rattner’s recent entanglement in the New York State pension-fund scandal. “I like Steve, and he’s done very well. Over time, people have said you should go do something like that. I don’t know if that’s for me or not. Years ago I thought more about it than I do now.”

No matter what Sorkin decides to do, he has options, which is more than many a Timesman can claim these days. “We have a standing invitation,” Graydon Carter said of his ongoing campaign to recruit Sorkin to Vanity Fair. “I’ve never seen this kind of talent.” Three weeks ago, New York Observer owner Jared Kushner reached out to Sorkin to see if he was interested in running the paper, but the talks went nowhere. Observer sources speculated that Kushner would have had to offer Sorkin an ownership stake in the paper, but a source close to Kushner said salary terms weren’t discussed.

Inside the Times, Sorkin’s glittering future preys on the anxieties of those who see an uncertain road ahead for journalism, with jobs disappearing and the paper’s long-term survival at stake. Some staffers wonder if Sorkin would team up with one of his Wall Street sources to start a DealBook of his own. Sorkin says he has received offers from investors, but so far hasn’t taken anything seriously. “People have been kind,” he told me. “I haven’t done it yet.”

And, despite the concerns, Sorkin is too valuable a brand for the paper to let go. “Undoubtedly, Andrew has built himself (and DealBook) into brands of their own,” Keller acknowledges. “But he and others who have done that successfully—think David Pogue, Mark Bittman, Tara Parker-Pope, some of the op-ed columnists, et al.—built their brands on a pretty mighty platform, namely the New York Times. The benefits are reciprocal.” Whether Sorkin’s brand can stand independently of the Times is a question to which no one yet knows the answer. The first step is mending some fences. “I clearly have some work to do,” Sorkin says.

On November 3, when Warren Buffett announced he was buying the Burlington Northern railroad, Sorkin picked up the phone and got the legendary investor on the record for the paper’s front-page story. (A DealBook colleague had done most of the legwork.) It was just one more reason why, for the Times, the Sorkin brand is too big to fail.