Rarely has one auction season had everyone so excited, and so nervous. Sotheby’s, Christie’s, and Phillips de Pury’s twice-yearly sales of Impressionist, modern, and contemporary art begin next Tuesday, and the estimated take could, for the first time, crack $1 billion. Moreover, it all opens on a giddy note, following a series of blockbuster purchases of items ranging from the spectacular to the very silly. There’s a new record for a Barbie doll ($17,000), another for American folk art (Polo Ralph Lauren executive vice-president Jerry Lauren paid $5.8 million for a weather vane), and a brave new benchmark for postwar painting, as Jasper Johns’s False Start sold to Chicago hedge-fund king Kenneth Griffin for $80 million. At contemporary-art sales in London earlier this month, more than 30 records were broken. And wealthy Chinese, Indian, and particularly Russian buyers are underpinning the market (“The Russians,” they’re called, as if they passed through the art world in one black-coated blur).

Still, not everything is moving so fast. Raging prices for late-period Picassos have brought too many out to be sold this season, so that particular bull market may be over. Early paintings by the so-called German Leipzig School artists, a recent flavor-of-the-month, stalled conspicuously in London, but Phillips is still putting a couple of later ones on the block. And though six months ago buying almost any piece of contemporary art seemed like a good idea, now there’s real concern that the frenzy there may have peaked. Here’s an overview of what to look for in New York.

Ronald Wants Another?

The fireworks, of course, surround the Gustav Klimts. Four works by the Austrian master will be sold at Christie’s on November 8. They’re from the family that sold Ronald Lauder the most expensive painting in the world, Adele Bloch-Bauer, for a reported $135 million. And he’s still likely to be interested: In August, Lauder sold a 49.7 percent stake in Central European Media Enterprises for $190 million, so he’s got a lot of cash on hand. Some of that could go toward, say, another portrait of Klimt’s mistress, Adele Bloch-Bauer II (estimated at $40 million to $60 million), to hang in the Neue Galerie. Other potential bidders could be the Getty Trust, perhaps paired with the Los Angeles County Museum of Art, where the works have been on loan, and casino magnate Steve Wynn, who may raise his paddle (but should watch his elbow). Don’t count on the market’s biggest spender, SAC Capital Advisors hedge-fund billionaire Steven A. Cohen, to be too active: He’s more of a Picasso man.

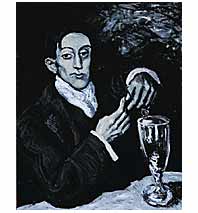

Pablo’s Revenge

Beyond the Klimts, all eyes are on a blue-period Picasso. Andrew Lloyd Webber’s art foundation is selling a portrait of the painter’s Barcelona drinking buddy Angel Fernández de Soto at Christie’s, estimated at $40 million to $60 million. Proceeds go to charity—but the foundation paid $29.2 million for the painting eleven years ago, and Christie’s has a new team running its Impressionist wing this year after some high-profile defections. Will they be able to talk the sales talk? Probably. While Angel’s snarky expression isn’t seen as Picasso’s best work, blue-period Picassos are the Honus Wagner baseball cards of this world: They hit the market so rarely that traditional considerations of relative quality go out the window. Moreover, don’t count out the Lauder Effect. Some collectors are really peeved that a Klimt holds the record, thinking the artist undeserving of the top spot. There’s an off chance that the Picasso bidding will go very high just to correct the snobby art-history balance. “I don’t understand” that kind of competitive bidding, says Ronald Lauder, reached in Zurich, but “whenever there’s a new record made, it gives people the courage” to bid more.

Contemporary Grows Up

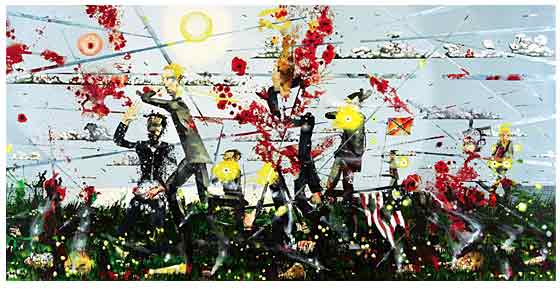

Remember when collectors were trolling grad-school art shows for buys? It seems like just yesterday—and in fact, it was just last year. But now collectors are more interested in building up the work of the young artists they’ve already invested in, and a lot of the hottest “new” names—Kehinde Wiley, Barnaby Furnas, Christian Schmidberger, Carsten Höller (who just installed giant working theme-park-style slides in London’s Tate Modern)—are the ones who broke out a couple of years ago. Pay attention to Furnas’s huge candy-colored battle scene, from 2002, at Sotheby’s for an estimated $400,000 to $600,000. It’s called Heartbreak Ridge , and it should go higher. Another group getting buzz is Chinese contemporary artists, who’ve been selling so well that they’ve been added to the mix at these auctions, no longer segregated into their own national sales. Political Pop artist Wang Guangyi is on the block at Sotheby’s at $70,000 to $90,000. Meanwhile, Christie’s dovetails two trends—the rise of Chinese contemporary art and the still-strong passion for Pop—with its giant sky-blue portrait of Chairman Mao by Andy Warhol. It’s estimated at $8 million to $12 million.

The Bargains

Are there any? Well, at Sotheby’s, Sir Sean Connery is parting with a Vuillard scene of an actor’s backstage dressing room. Because it’s a pastel, the price is comparatively low (estimate: $700,000 to $900,000), but it has the polish of an oil. A 1993 snow painting by Peter Doig, Bob’s House, also at Sotheby’s, doesn’t look cheap at an estimate of $1 million to $1.5 million, but MoMA felt so strongly about this British painter’s atmospheric works that it picked up two of them for its grand reopening in 2004. And, if there can be a bargain at $16.5 million, there’s one at Sotheby’s Impressionist sale. A classic Monet seascape, The Beach at Trouville, would have been the star of an auction fifteen years ago, when sun-dappled Impressionism was considered the height of painting. But, given the changeability of art tastes, this view of a French beach could look like a great buy decades from now. Just don’t tell the bid-happy Russians.