For years, we’ve thought that Goldman Sachs was the only Wall Street bank whose employees made horrible jokes among themselves about the mortgage-backed securities they sold — the toxic CDOs they privately referred to as “shitty deals” and “monstrosities” before pushing them out the door to investors.

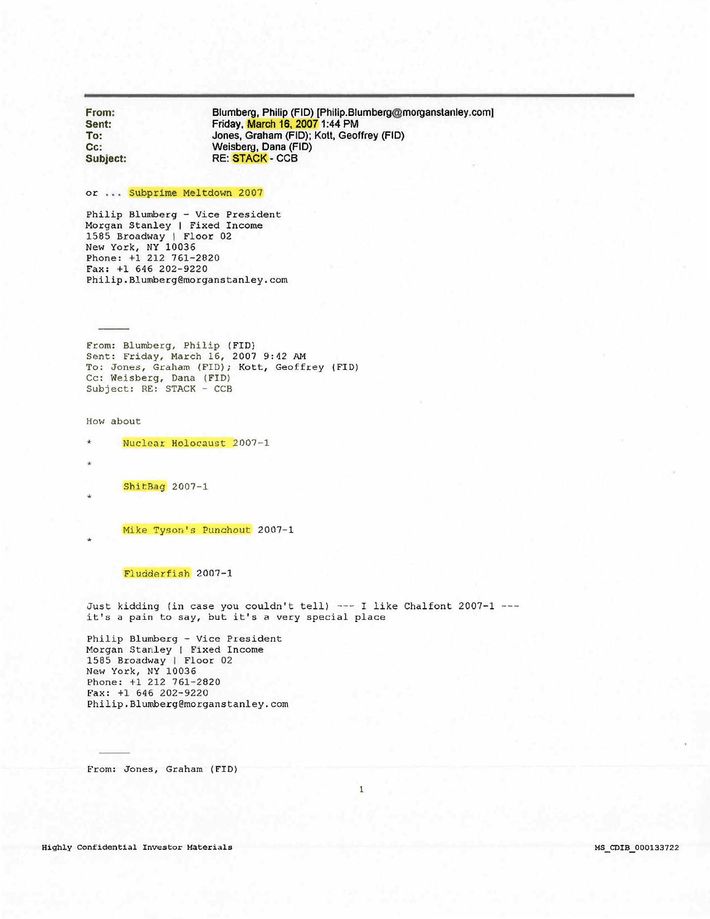

But Morgan Stanley has gotten into the closed-door-mockery game several years late, with some recently unearthed e-mails from a lawsuit brought against the firm by a Taiwanese bank in which Morgan Stanley employees are shown e-mailing each other in March of 2007 about possible names for a collateralized debt obligation they were preparing to sell. The names being tossed around included “Subprime Meltdown,” “Nuclear Holocaust,” “Mike Tyson’s Punchout,” and “Shitbag.”

Jesse Eisinger at ProPublica has the documents from the case brought against Morgan Stanley over its role in selling a $500 million CDO called Stack 2006-1, most of which became worthless when the housing market collapsed. As with all good financial lawsuits, part of the Taiwanese bank’s legal strategy involved digging up incriminating e-mails from the bank’s fixed-income executives, who didn’t disappoint:

Now, debate all you want whether Morgan Stanley’s crisis-era deals contained adequate disclosure to investors (Morgan Stanley says they did, and adopts the old Goldman “our clients are sophisticated investors and should have known better” strategy), or whether the e-mails in the case amount to more than the musings of a bunch of morons on the structured-credit desk who are bored with their jobs and scrounging for gallows humor.

What is truly tragic is that unlike Goldman, Morgan Stanley didn’t even make money on its shitbag derivatives. Eisinger reminds us that Howie Hubler, the Morgan Stanley trader who headed up an internal hedge fund to bet against the housing market, instead lost $9 billion when his strategy backfired. This failure plays a prominent role in how the bank is fighting the Taiwanese allegations:

Another of Morgan Stanley’s main defenses is that it couldn’t have thought the investment it sold to the Taiwanese was terrible because it, too, lost money on securities backed by subprime mortgages. As the Morgan Stanley spokesman put it, “This deal must be viewed in the context of a significant write-down for Morgan Stanley in 2007, when the firm recorded huge losses in its public securities filings related to other subprime C.D.O. positions.”

As for the guy who came up with the incriminating CDO names — former Morgan Stanley lawyer Philip Blumberg, who has since moved over to JPMorgan — he is now being reduced to a bit player. Morgan Stanley said of Blumberg’s ill-fated e-mail: “While the e-mail in question contains inappropriate language and reflects a poor attempt at humor, the Morgan Stanley employee who wrote it was responsible for documenting transactions.It was not his job or within his skillset to assess the state of the market or the credit quality of the transaction being discussed.”

(Although, to be fair to Blumberg’s skillset, calling a mortgage-backed security a “shitbag” in the spring of 2007 was probably a more accurate review of credit quality than whatever Moody’s and S&P were doing at the time.)

Meanwhile, Morgan Stanley’s CEO, James Gorman, told Bloomberg TV today (unrelated to the 2007 e-mails) that the financial industry will need to repair its trust with the public. He said, “The heart of it is that the financial crisis destroyed a lot of confidence and trust and there has been a lot of misinformation since then … I think the trust is coming back, but it will be a multi-year journey.”

Reminding executives to impose some self-control over e-mail would be a start.