Five years after the financial crisis, Wall Street banks are recovering splendidly. Record profits are becoming routine, and earnings are way, way up. Today, we learned that Goldman Sachs made $1.93 billion last quarter, or double what it made in the same quarter last year. Last week, we learned that JPMorgan Chase made $6.5 billion in the second quarter, or more than $72 million per day. And on Thursday, we’re expected to learn that Morgan Stanley — the last of Wall Street’s Big Three — made something like $900 million in the quarter.

The lesson of all this? When Wall Street CEOs and other prognosticators warn about the apocalyptic effects of new regulation designed to make the financial industry safer, the best response is to turn around and walk away.

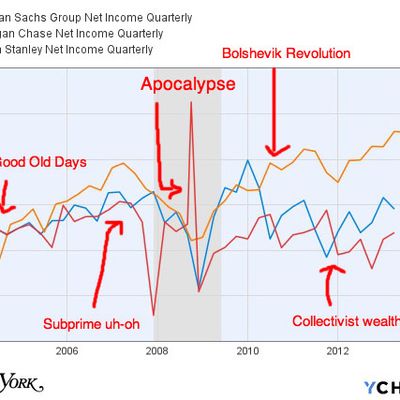

Inspired by Matt Yglesias, I made the above chart to show how wrong all of these doomsayers have been. As you can see, after the Dodd-Frank Act was signed in July of 2010, the biggest investment banks on Wall Street experienced no real setbacks when it came to their profits. They didn’t lose money in 2011 after shutting down their proprietary trading units to comply with Dodd-Frank’s Volcker Rule. (The dips on the graph in 2011 came mostly from the European debt crisis and political uncertainty over the debt ceiling.) And they didn’t suffer after the Fed announced in 2011 that it would implement Basel III, a set of international standards that raise capital requirements on banks.

All of these rules were met with crazed hysteria by banking industry lobbyists when they were introduced. We were warned that regulations on the banking sector would turn America into Sweden, take away Wall Street’s competitive advantage, and harm the economy by bogging down banks in compliance measures and box-checking. And none of that happened. In fact, as the chart shows, the biggest three investment banks are doing better than or equally well as they were before the crash.

Now, there’s a counterfactual caveat to all of this — were it not for these socialist regulatory advances, banks might have been even more profitable. But that’s not the claim opponents of regulation were making. They claimed new regulation would take a hammer to Wall Street, and they were wrong.

Wall Street’s profit model has proven to be incredibly resilient. You make laws preventing proprietary trading, and Wall Street figures out a way to label that same trading as market-making. You take away investment banking revenue, and firms compensate by boosting their private wealth divisions. Even if big banks were dramatically overhauled or broken up, à la Brown-Vitter, there’s no reason to believe that they wouldn’t return in some other, more profitable permutation.

On Goldman Sachs’s earnings call this morning, the bank’s CFO, Harvey Schwartz, said something crucial to understanding how Wall Street views new rules given to it by regulators. “We evaluate the rule, we give tools to our people, and in that context … we adjust,” he said. In other words, these new rules aren’t roadblocks — they’re just speed bumps.

So, sure, let’s make sure new financial regulations are smartly written and accomplish their intended goals. And let’s not assume that more regulation, period, equals a safer banking system. But let’s also start taking the wheezes and whimpers of regulation opponents with the world’s largest grain of salt. It’s Wall Street’s job to figure out how to make money in disadvantageous circumstances — let’s let them do it.