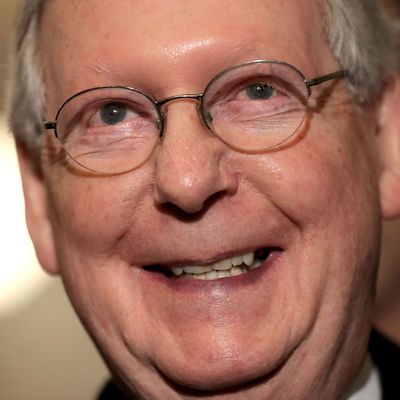

The Trump tax cuts are headed to the Senate floor — and all signs point to them passing when they get there. As of last night, it was unclear whether Mitch McConnell had the votes to get his tax package past the Senate Budget Committee. Republicans have a mere one-vote advantage on the panel, and two of its GOP members — Bob Corker and Ron Johnson — had both expressed objections to the legislation. But on Tuesday, Corker, Johnson, and every other Republican on the committee voted to send the tax-cut bill to the floor of the upper chamber — where McConnell plans to pass it by week’s end.

Meanwhile, Susan Collins signaled that she is now leaning toward voting for the legislation. Maine’s favorite “moderate” had previously objected to the inclusion of a provision repealing Obamacare’s individual mandate. But Collins now appears comfortable kicking out a pillar of our health-care system … because President Trump has promised to support the bipartisan, Murray-Alexander health-care bill if she does so. (This position makes little sense — Murray-Alexander is designed to mitigate the problems caused by the Trump administration’s sabotage of the law, not to compensate for the lack of a tax penalty for going without health insurance. In fact, it’s actually possible that passing Murray-Alexander — after repealing the individual mandate — could actually do more harm than good.)

The Senate leadership has also, ostensibly, agreed to meet Collins’s other core demand: The preservation of a $10,000 deduction for state and local property taxes. Previously, the Senate tax bill called for the complete abolition of all individual (as opposed to corporate) tax deductions for state and local income and property taxes.

Collins’s requested provision is already a part of the House’s tax bill. Thus, by adding it, McConnell should make it easier for both chambers to arrive at a consensus bill in conference. That said, adding the property deduction could also make it harder for Senate Republicans to keep their legislation’s price tag under the $1.5 trillion cap mandated by their budget resolution.

The price-tag issue is a big one: The Senate Majority Leader pacified Ron Johnson by promising to make the bill even more generous to wealthy business owners. Specifically, McConnell reportedly agreed to increase the bill’s proposed tax deduction for “pass-through” businesses from 17.4 percent to 20 percent. Johnson has proposed paying for this expanded tax break by eliminating the state-and-local tax deduction for corporations — but it’s far from clear that such a measure would generate sufficient revenue to meet his demands, let alone to meet Collins’s.

Finally, the Senate leadership won over their deficit hawks, by agreeing to add an amendment to the bill that would automatically trigger tax increases if the law grows the debt more than expected. This is a terrible idea. And if Corker’s “backstop” is anything more than symbolic, it will likely trigger opposition from other GOP senators.

As of this writing, there still aren’t 50 Republicans who officially support their party’s tax bill. But right now, it looks like there probably will be by week’s end — if McConnell has actually figured out a way to keep all of the promises he just made without going over budget, or losing any votes.