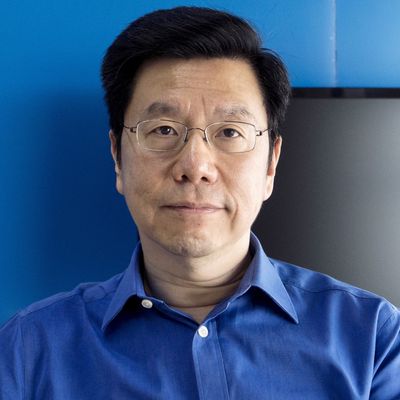

Kai-Fu Lee believes China will be the next tech-innovation superpower and in his new (and first) book, AI Superpowers: China, Silicon Valley, and the New World Order, he explains why. Taiwan-born Lee is perfectly positioned for the task: He has a Ph.D. in computer science from Carnegie Mellon, specializing in artificial intelligence, and he went on to executive positions at Apple and Microsoft. He ran Google China until just before Google decamped in 2009; he has been a venture capitalist in Beijing ever since. Here, he talks about how China encouraged entrepreneurship, and the unique perspective on artificial-intelligence development within China.

You talk in your book about how Chinese premier Li Keqiang’s 2014 speech on “mass entrepreneurship and mass innovation” transformed China’s innovation ecology. How can one speech do that?

The way the Chinese central government works is that they basically set the tone. Then it is up to each individual city or province to respond. Not everybody has to respond; you have to evaluate your own situation. But the entrepreneurship message received tremendous response. Each province and city has a fair amount of leeway over its budget to do entrepreneurship or subsidize start-up companies or start new funds or help poverty or build new buildings.

Every year the central government sets a couple of tones, maybe three or five such top-level priority things. This one seems to have resonated with a lot of cities as they built up accelerators and incubators. So a total of about 8,000 have been built. That is a tremendous number. It’s not that the central government put aside tens of billions of dollars, it is that each individual city said, “Given that the central government wants entrepreneurship, we should make sure that we have good space for it.”

I think an average household would see this on TV and see the incubators come out and, at the same time, see role models, like Jack Ma, become very, very successful, despite having humble beginnings. So I think it sends a message across the country that in the past it may have been preferable to work for a top branded foreign multinational or a domestic company or a state-owned enterprise or become a government official. Now it is equally good to become an entrepreneur if you want.

The government basically said, “Hey it’s okay to give it a try. If you fail there will probably be ways that you are looked after,” and I think it is sending a message to employers that look, if someone tried to start a company and failed, you should not count that against them and still hire them. To the parents, it sends a message that if your son or daughter wants to start a company, that it’s a pretty reasonable choice. So it is a dissipated message across society that this is okay and everything will be okay if you do it. If you fail, that is okay, if you succeed, that is great. Then there are role models to go along with it. I think that is the primary thing.

Let me ask you about WeChat, because you devote a fair amount of attention to it, both as a company and as a phenomenon, then as laying the groundwork for China’s surge in artificial intelligence. WeChat basically took the approach of being an app of apps, incorporating multiple functionalities in a single app. Why was WeChat so decisive and would any of this have happened without WeChat?

It would have been significantly weakened [without WeChat]. WeChat basically helps many startups get going. They became the entry point for shared bicycles, shared vehicles, take-out orders, and for paying loans, borrowing money, paying taxes, and paying utilities. Everything was done there. It became a hub. It changed users’ habits to depend more on mobile computing and depositing more of their data, therefore enabling WeChat and other companies to be a part of this AI movement. So I think it’s significant.

Imagine, if you will, that Facebook acquired Visa and Mastercard and integrated everything into the functions, as well as invested money into Amazon and Uber and OpenTable and so on and so forth, and made an ecosystem that once you log into Facebook, all these things are one click away and then you could pay for them with another click. That is the kind of convenience that WeChat brought about and its true worth is the gigantic data set of all the user data that goes through it.

So if WeChat, or rather WeChat’s intake and structuring of data, is fairly decisive in making Chinese AI advances possible, are WeChat or its structuring of data replicable outside of China? Say in India?

It appears not. In developed countries, there is already well established infrastructure. And there are probably trust issues with a Chinese application that is this powerful. In developing countries, things are very fragmented and WeChat’s earlier efforts to go outside China were not as successful. One of the reasons was they didn’t have that many properties to aggregate. They invested in a bunch of companies: the top e-commerce, online to offline, shared-vehicle companies. They also essentially own China’s YouTube and Spotify. So Tencent [WeChat’s owner] owns half of, maybe a third of, China’s key consumer properties and all the gains and social networks and half of the payments, as well as invested in pretty much the rest of the ecosystem. So it is a complete ecosystem without ever going to the browser and that, I think, is very powerful. They have not been able to do that outside of China. I doubt they will because even in developing countries, the user habits are still starting to form.

American tech companies have also faced problems with localization. What would make a company like Google or Facebook succeed there?

Should a Google or Facebook put developing countries as a high priority and decide to lose money for a while in order to gain market control, the game is not at all over. I mean, China is just barely entering these countries. So I think American tech giants do have a chance. Their earnings per share will suffer for a couple of years but eventually they will make money from it. It’s just whether they choose to put money into these developing markets. These developing markets will need technology, and if an American company basically advertises and markets its products and puts an effort to get it to be very easy to use locally, working with a local payments [service], working with local merchants, getting advertising, getting good content, there is no reason why the U.S. cannot have a decent percentage of the developing countries’ share. It is just that the companies choose not to because it is not immediately profitable.

European companies have not really developed artificial intelligence projects to the degree that you see in either China or the U.S., and at the same time, through the Belt and Road Initiative, China has been working to increase trade ties with European companies and governments. Is it possible that China would, whether through technology transfer or other ties, actually become a major AI player within Europe?

I don’t think so. I don’t think so. I think the Europeans are very much used to the American technologies. As I mentioned, the China and the U.S. are two parallel universes. Once you completely buy into one of them, it is really hard to switch. Just imagine if someone suggested JD.com as really good for you to use for e-commerce; there is no way that you would switch from Amazon, because of your habits, trust, data, etc. So the same is true in Europe. Also, I think Europe will have increasingly strong demands on data compliance, with GDPR and rules like that. American companies have, reluctantly, but nevertheless, complied with those laws. I think for Chinese companies to go through the trouble to comply with GDPR and whatever laws that follow, despite having no share, it seems like a double challenge. For American companies, they make all this money from Europe, so they put up with this new law, which they don’t like, but they have to do it. For Chinese companies, they make no money, they have no share, and they have to [adjust to] compliance. All the reasons are the wrong way.

And what about in Russia?

Russia kind of has its own ecosystem. It is possible for China to have some penetration but I think Russia … There are a few countries that are fairly independent from the rest of the ecosystem. Russia is one of them. They have their own search engine, video site, mail, website, social network. It is separate from both China and the U.S. and it is quite a small ecosystem, so it is not worth very much. But I think they want their own so I don’t imagine either U.S. or China will get in, and I also don’t imagine they can get out because they just don’t have the scale. Their companies are worth one-twentieth of a U.S. or Chinese company, so they just don’t have the capital to expand, or the ambition to expand, beyond Russia.

You kind of embody the Chinese-American duopoly that you are describing in the book. You really have been at the heights of the most innovative and often the most profitable parts of the economy for both nations, which is a very unusual position to be in. When you look to the future, do you see yourself ultimately choosing one place over the other? Or to ask it a different way, do you feel a division within yourself between these two major players?

Someone who can travel between the two parallel universes is in a small group of people and also has some unique skill sets. If I were younger, I could take my Chinese skill set and start a company in the U.S., or the U.S. skill set and start a company in China, and that would give me very unique advantages. Cross-country stuff won’t work, but if you embody the knowledge and apply it locally, that does work. I am interested someday in helping American entrepreneurs use what I know from the Chinese approach and ecosystem, but the current trade dispute may make that a little bit difficult.

This conversation has been edited and condensed for clarity.