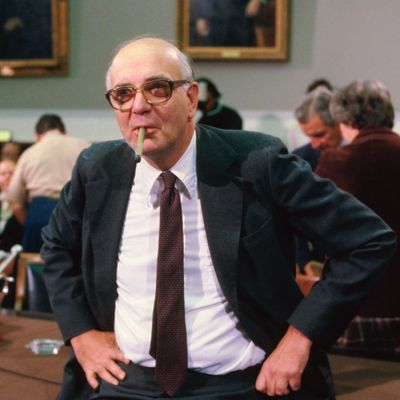

Paul Volcker, the former Federal Reserve chairman who died on Sunday at age 92, was most famous for two things: sharply reducing inflation, especially in the early part of his tenure running the Fed from 1979 into the early 1980s; and the Volcker Rule, a regulation under the Dodd-Frank law that followed the financial crisis, which aims to stop banks from taking undue risks with their federally insured deposits.

In recent years, the Fed has been excessively worried about inflation. That’s a critique you hear most often from people on the left, but also from the president. And it’s something Fed chairman Jay Powell has been hearing on Twitter from a heterodox set of economics wonks who have become more influential on Fed policy by tweeting than they might have reasonably expected a few years ago.

Because of what a lot of people (including me, to be clear) perceive as the Fed’s recent errors — errors that have prioritized inflation-fighting at the expense of full employment and wage growth — it’s become fashionable to say maybe the inflation-fighting part of Volcker’s legacy wasn’t so great. My colleague Matt Yglesias from Vox says Volcker “ushered-in an era of anti-worker monetary policy.”

But while a lot of Fed policy-makers (and even more CNBC commentators) have overlearned the lessons of the 1970s inflation, Volcker’s detractors have under-learned them. Volcker did what the economy needed at the time. That others have taken his approach too far is a separate matter.

It’s important to remember that the high inflation of the 1970s wasn’t just a problem for fat cats who were worried about what inflation would do to their extensive capital holdings, or for business owners who didn’t want to have to pay ever-increasing wages. As the economist David Beckworth points out, Gallup polling from the 1970s routinely found a majority of respondents — sometimes as high as 80 percent — saying inflation was the most important problem facing the United States. High and unpredictable inflation caused real problems in ordinary workers’ lives, and people were crying out for a solution.

The inflation had been caused in large part by Federal Reserve policy that was frequently too loose, overheating the economy: the opposite of what we have often seen recently. When Volcker became Fed chair, his high interest-rate policies broke the trend at significant cost (two recessions) but the new expectations Volcker set about Fed policy made it possible to finally end double-digit inflation. And recoveries out of those downturns were much faster than the one after the Great Recession.

Since Volcker’s tenure, the Fed has let the desire to never let the 1970s happen again take it too far in the opposite direction. It has also erred by taking the inflation target too low, to 2 percent, and by failing to consistently hit that target. That has meant that recovery from recessions has often been painfully slow, with unemployment staying too high and wage growth too slow for too long.

Even here though, Alan Cole from the congressional Joint Economic Committee is right to point out that some of the current problems with a 2 percent inflation target were not easily foreseeable in the 1980s. Over the last few decades, slowing population growth and disappointing increases in productivity have meant that the Fed more often needs to produce negative real interest rates in order to give the economy the support it needs. Since nominal interest rates generally need to be positive, inflation is what gives the Fed space to push real rates into negative territory (if inflation is 4 percent and nominal interest rates are 1 percent, that means a real interest rate of negative 3 percent) and persistently low inflation has meant the Fed sometimes hasn’t had as much room as it’s needed.

That didn’t look so likely in the 1980s, but it’s something the Fed needs to adjust for now — perhaps with a higher inflation target, and certainly by hitting the one it currently has on average. The Fed is now debating changes to its approach that would help in this regard, by allowing inflation to run above target more often.

Cole is also right to emphasize data-dependency. Roughly, the Fed should be making the policies that the data say the economy needs, instead of always being terrified of inflation. But data-dependency also doesn’t mean the Fed should never be terrified of inflation. Volcker’s medicine isn’t what the data call for today. But it was what we needed in 1980 and could be again in the future.