On Monday, the CEOs of Apple, Amazon, Facebook, and Google will all appear before the House Judiciary Subcommittee on Antitrust, Commercial, and Administrative Law, most likely via Zoom. Though Tim Cook, Jeff Bezos, Mark Zuckerberg, and Sundar Pichai have all faced antitrust inquiries over the past few years, next week’s testimony could represent a new challenge to their near monopolies in the companies’ fields. In the most recent episode of New York’s Pivot podcast, Kara Swisher and Scott Galloway play Antitrust Subcommittee members for a day.

Kara Swisher: Okay, let’s go over each company’s antitrust issues one by one, starting with Apple. They’re in the strongest position because they’ve hired a very well-known antitrust economist who has been very anti- these big companies. When it comes to the App Store, I think they have the most flexibility, and that they can make changes and probably assuage the developers by making certain changes without getting broken up in any way. But I don’t know. What do you think?

Scott Galloway: We often refer to our larger economy as the app economy, but the app economy basically has two companies that control it: Apple and Google. Apple controls two-thirds of the app economy by revenue. They essentially get to pick winners and losers across the broader economy. If it’s streaming, everyone from Netflix to Hulu pays anywhere between 3 and 8 percent total of all revenues to Apple, and Apple can also, similar to what Google does, basically deprioritize you, or make you less discoverable, and put you out of business just with a flip of the switch.

Swisher: So what do you do here? What is the remedy?

Galloway: The most obvious one is regulation of the App Store. Elegant antitrust — it’s like how a good virus keeps the host alive. Elegant antitrust not only unlocks competition; it doesn’t impair. It doesn’t kill the host. In other words, the host goes on to be more and more valuable, as with the Baby Bells.

Subscribe on:

Swisher: So we know how to do this. This is a regulatory fix.

Galloway: We know how to do this, but this is antitrust. There is an antitrust action here, and it’s something I hadn’t thought of before. And that is, they could spin off their chip unit. They are now manufacturing their own chips and their own microprocessors. And people have talked about how that would be an easy one to spin, which would make the company more competitive, or make the market more competitive. I’ll be curious if anyone asks about that.

Swisher: I don’t think they know it exists.

Galloway: Yeah, I think you’re probably right. But anyway, that’s Apple. Let’s go to Google. That’s an easy one. “Mr. Pichai, can you name any industry globally that is larger than a hundred billion dollars in revenue where one player controls 93 percent?” That’s it. That’s all.

Swisher: And then what?

Galloway: “Doesn’t that imply that you have more control of this industry than any individual company has ever had that much control of an industry in history?” Which likely and logically leads to the following abuses. Google benefits from the fact that it’s actually quite complicated. They’re not only making a market with their old acquisition at DoubleClick; they’re on both sides of the transaction here. And it’s probably the most obvious case of something where if you own the market, you own the buy and the sell, and you know both the bid and the ask. It’s just not kosher.

Swisher: What if Pichai comes back and says, “Mr. Cicilline, this is how it works perfectly for all our many advertisers. What do you expect us to do? Split them apart? Or create separate companies, separate advertising companies? Or search companies.” Can you break up search?

Galloway: You could break up the components. I would leave the search intact. I would spin YouTube. I would spin their cloud business. And then there’s something around trying to figure out a way where they’re not on both sides of the market in terms of how they manage the marketplace for banner ads and digital advertising. There’s absolutely more opportunity there. Effectively every digital marketer, other than those two, has slowly but surely gone out of business because they can’t compete.

Swisher: Why spin off YouTube? What’s the point?

Galloway: For competition. YouTube is radicalizing young men and could stop it, but they don’t have any incentive to stop because they’re the only game in town. And if you spun YouTube, in the first corporate strategy meeting of an independent YouTube, they would decide, “You know, I’d really like to have a Gulf Stream, why don’t we get into text-based search?” And then an independent Google that no longer has YouTube would decide, “You know what? I want my second Gulf Stream, so we’re going to launch our own video-based search engine.” And overnight you have two viable competitors.

Swisher: What if the CEO of YouTube, Susan Wojcicki, says, “We’re going to hire Google for search”?

Galloway: You could make that a condition of the spin that they can’t do that. I also think new YouTube executives’ greed glands will get going, and they’ll say, “We can get into text-based search.” Both of these companies would have gotten into the other’s business if they were two separate companies. And competition would result in more innovation and an ability or a willingness to actually make changes. Some of the comments in YouTube are just so vile. And I just don’t buy that it’s the Wild West and we can’t control it and it’s worth it to bring in new videos.

But Google as three independent companies — in three years those three companies are worth more in aggregate than the company is now.

Swisher: All right. Amazon. I think this one’s easy. I think it’s about the marketplace, right?

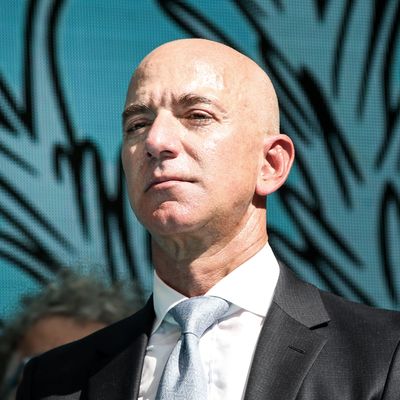

Galloway: Yeah. But I would have some more fun with Bezos. I would first start off by saying, “Let’s look at the wealthiest men throughout the 20th century: Carnegie, Mellon, Carlos Slim, Bill Gates. What do these people have in common? Oh, I know: They all made their money by ownership in what was ultimately deemed a monopoly. How are you any different? You now control more wealth than the defense budget of Britain, Germany, Russia, Canada, and Australia combined. Is that healthy for the economy? When you have monopoly power and this type of soft power, including the Washington Post, do you not have too much power as a function of your monopoly abuse?”

And I’d ask, “Mr. Bezos, Haven’t you in the last 12 weeks gained 4 percent market share of U.S. retail? Has any company in the history of business ever gained 4 percent of market share of U.S. retail in a decade, much less 12 weeks?”

Swisher: Bezos might say, “The retail market is a lot larger than you’re talking about, congressmen. It is this many trillion and it represents all these stores. And we’re just but a wee part of that. It also depends on what you consider the market. I’ve heard that from executives. I’ve heard it from Uber executives, Apple executives; the market is a lot bigger than you’re saying and we are just a small part of it. So if you want to look at it in aggregate, we are not a very big player.”

Galloway: “Mr. Bezos, that’s a fair point. In terms of market share of gross revenue, you’re right. You’re only about 4 percent to 6 percent and Walmart is bigger. I acknowledge that. But if we talk about competitive power, if we talk about an economy, if we talk about taxation, if we talk about an ability for other companies to make investments to pay their employees and support middle-class households, it really comes down to market capitalization. And that is the market sense of how much power you have. And over the last three months, since your March lows, you have added more value to your market cap than all of specialty retail, all of department stores, and let’s throw in Walmart too. So the top line gross market share number is irrelevant. What’s relevant here is power, and power comes down to economic might and shareholder value. And you, sir, are garnering 120 percent of all economic shareholder value, and everybody else is leaking oxygen.”

Swisher: Facebook. Last one. Make it brief.

Galloway: “Three and a half billion people are on your platform. The key attribute of power — sociologically, economically — is control of the media. Three and a half billion people are on your platform, one and a half billion people are on it every day. More people are subjected to the information your algorithms decide they should see than any religion, country, philosophy, economic system in history. Haven’t you demonstrated over and over that you are a threat to the general well-being of Western democracies? Aren’t you, in fact, the greatest menace of the last 100 years?”

Swisher: How do you break them up? What’s the remedy?

Galloway: The remedy for Facebook is easy. If they can acquire Instagram and WhatsApp, they can divest them.

Swisher: And advertising. Let’s not forget advertising. They have an enormous say over advertising and publishing.

Galloway: Yeah. The big victory for Big Tech is that there is safety in numbers. But what you’re going to see, the dynamic that’s going to play out here, is that the majority of the IRS is going to go after Zuckerberg because he’s the least likable, he’s the most offensive, he’s the most awkward. The one that will be what I’d call institutionalized fellatio will be Bezos. They’re all going to talk about how wonderful he is and, by the way, wink, wink, please invite me to your cool party in Kalorama. And by the way, you just may want to talk about what a good Republican I am in the Washington Post. He has more soft power than China right now.

Swisher: This is all probably going to be on Zoom.

Galloway: That’s the problem. The medium is the message. And because we’re going to lose that moment for electricity, lawmakers need to do what Katie Porter, AOC, and Elizabeth Warren are just genius at — and that is treat the CEOs not as witnesses, but as props. And they need to do the following: Show a dramatic graph highlighting the CEOs’ abuse or their monopoly power. Share the screen. Ask a question. Unshare the screen. Look for two seconds at their reaction. Let them answer for three. Show a new graph. Ask a new question and just keep going. Because the only thing you have as a questioner on Zoom is that you can better leverage visual aids.

Pivot is produced by Rebecca Sananes. Erica Anderson is the executive producer.

This transcript has been edited for length and clarity.