Last month, U.S. inflation rose at its fastest pace since 2009. Over the past 12 months, the consumer price index spiked by 4.2 percent, a rate far in excess of economists’ expectations. When news of these price rises hit Wednesday, austerity enthusiasts collapsed into fits of self-proclaimed vindication: Uncle Sam had spared the liquidation and spoiled the economy. By providing households with trillions of dollars in fiscal support, and U.S. firms with cheap credit, American fiscal and monetary authorities had offended the market gods — and now a stagflationary pestilence was being visited upon the land. Wall Street traders gave credence to this narrative, selling off equities to prepare themselves for the high interest rates to come.

But the Federal Reserve didn’t blink. And on Thursday, markets regained the bulk of their losses.

The explanation for this is simple: April’s headline inflation number was higher than expected, but the overall report on consumer prices was in line with the central bank’s (dovish) expectations. For weeks, Fed officials said that they expect to see “transitory inflation” as the economy reopened, and would not tighten monetary policy unless those price increases proved durable. Under Jerome Powell’s leadership, the central bank has sought to make recompense for its decades-long de-prioritization of full employment. So it’s now reluctant to raise rates (thereby slowing economic growth and loosening labor markets, thus diminishing the wage and employment prospects of the most vulnerable in U.S. society) until doing so is absolutely necessary to prevent inflation from running at more than 2 percent, on average, for an extended period of time.

Nothing in April’s report gave Powell & Co. pause about this policy, which makes sense, since there are (at least) three reasons to believe that last month’s inflation will prove temporary:

1) Most of April’s inflation derived either from reopening sectors, or from temporary supply constraints in the used-car market.

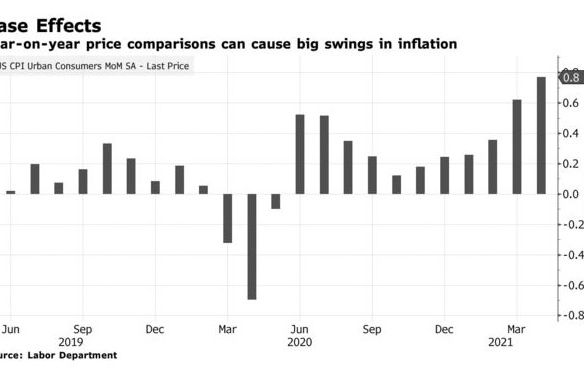

Nearly 60 percent of last month’s consumer price increase came from just five categories — used cars, rental cars, airfare, lodging, and food away from home. The airline, hotel, and restaurant industries were all hammered by the pandemic. Over the past few weeks, as public-health-conscious Americans have become vaccinated en masse, these sectors have gotten caught between surging demand (since travelers and diners are trying to make up for lost leisure) and inadequate supply (since it takes time to rebuild businesses decimated by a full year of depressed patronage). This has yielded price hikes, and the severity of those hikes has been exaggerated by the low base rates of 2020: Last spring, the price of flights and hotel rooms plunged to levels unseen outside of a world-historic catastrophe. So the year-over-year increases we’re currently seeing are tied to a bizarre baseline. In April, Powell warned that such base effects were likely to “contribute about 1 percentage point to headline inflation” in April and May.

Meanwhile, rising prices for used cars and rental cars are, similarly, artifacts of the pandemic economy. Between February and May 2020, car-rental prices plummeted by 23 percent. In response, major companies sold off much of their fleets for cash. Now, as demand ramps back up, car-rental firms are raising prices on their limited inventory, while trying to refill their lots by buying up used cars. At the same time, a global shortage in semiconductors is hobbling the production of new automobiles, pushing consumers toward the used-car market. As individuals and rental companies bid against each other for a limited supply of used vehicles, prices have soared.

This is not what durable, economy-wide inflation is made of. It may take several months, but the kinks in reopening sectors will get ironed out eventually. And in the rest of the economy, price growth remains tame, as Matt Klein of Barron’s illustrates:

2) The labor market is still weak.

It is possible for high unemployment and high inflation to coincide. But historically, this has been rare. Generally, for sustained, economy-wide inflation to get off the ground, workers need to have enough bargaining power to secure higher wages (which, under inflationary conditions, prompt price increases, which prompt higher wage demands, which prompt higher price increases, in a vicious cycle).

It’s possible that federal unemployment benefits are currently increasing the bargaining power of low-wage workers; there is evidence that wages are rising rapidly in the fast-food sector, and that companies are passing some of those costs onto consumers. If you believe that working people should not live in poverty, then this is a good thing. But even if you fear high inflation more than you value low rates of child malnutrition, current labor-market conditions should be of little concern — enhanced UI will expire in a few months. Meanwhile, only 76.9 percent of prime-age workers are employed, down from more than 80 percent before the pandemic.

3) The disinflationary pressures of disorganized labor, technology, and demographics are likely to persist.

Finally, the developed world has been stuck in a disinflationary rut for more than a decade now. Before the pandemic, many former inflation hawks were warning that the world had entered into a period of “secular stagnation” — an economic epoch defined by persistently low demand. Following the 2008 crash, central banks had kept interest rates near zero percent and still found inflation coming in below target. Even nations with loose fiscal policies, like the U.S., failed to engineer a robust level of price growth.

By scarring the supply side of the economy — and inspiring unprecedented levels of fiscal stimulus — the COVID pandemic just might pull the U.S. economy out of this rut for a little while. But the structural forces that were dampening inflation before the pandemic will still be with us in its aftermath. If we achieve full employment, U.S. workers will see an increase in their bargaining power. So long as organized labor remains moribund, however, wage growth is likely to be limited. Progressives must not regard labor’s global decline as inevitable or irreversible, but an imminent revival appears improbable.

Further, the digitization of the economy and the spread of industrialization (and thus, manufacturing capacity) across the globe, will continue to put downward pressure on consumer prices in the coming years. And the same can be said of America’s demographic trend: As the nation grows older, the number of households that already have the bulk of their desired consumer durables will go up, and demand will go down.

None of this means that sector-specific inflation isn’t a major economic problem in the U.S. The costs of housing, higher education, and medical care are all too damn high. But rising rents, tuition rates, and premiums reflect specific, supply-side policy failures, not a general surplus of consumer demand. The Fed cannot resolve our economy’s durable inflationary pressures, and the central bank shouldn’t try to resolve its temporary ones.