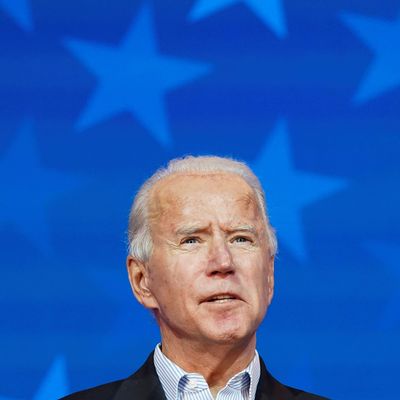

Americans owe a collective $1.7 trillion in student-loan debt. That’s a crisis by any definition, yet debtors still wait for relief. Their best hope is President Biden, who allegedly wants to help. He just doesn’t know how, according to recent reports. People close to the administration’s decision-making process told the Washington Post that the president is considering income limits on debt relief, which could restrict eligibility to individuals who earned less than $125,000 or $150,000 a year. The White House is also reluctant to cancel more than $10,000 per debtor and may exclude postgraduate loans from relief.

In practical terms, this means debtors are in purgatory. Their payments are on pause thanks to an order Biden keeps re-upping, but deliverance is not at hand. Biden could free them tomorrow if he chose. Instead, debtors linger, waiting hopefully for any sign of relief. Politically, the situation is untenable; morally, it is indefensible. The longer the White House allows them to suffer, the more feckless it looks. Biden can ill afford such a hapless reputation. Debtors deserve better, from Biden individually and from the country as a whole.

To grow up in America is to live with clichés. Here, anything is possible – with a bit of effort. Study hard, go to college, and jobs will materialize. Like millions, I once believed this to be true. Like millions, I learned otherwise. The economy collapsed while I was still in college, and by the time I graduated, it was still in recovery. I received one job offer. As I recall, it paid less than $30,000 a year. A postgrad program looked like the better option, so I took it and went into debt. Now, almost a decade after I finished school and started making monthly payments, I owe nearly $50,000. My husband is in debt, too. With our loan payments on pause, we’ve achieved something just short of true prosperity; it’s something normal, even basic, a regular life with more room to breathe. There are many like us. Together, we are the truth behind the cliché. The promise of America is for many a mirage.

Today’s debtors are the victims of policy decisions made before many of them were even born. As professor Elizabeth Tandy Shermer of Loyola University Chicago observed in a 2021 piece for the Post, lawmakers “purposefully crafted the Guaranteed Student Loan Program to jump-start a student loan industry” in the 1960s. That made sense at the time, but tuition increased while public investment in universities decreased. Loans, she wrote, “took on an outsized — and ever-increasing — role” in higher education. The burden of student debt falls heavily on Black borrowers, which means the student-loan regime reinforces the racial wealth gap. “For communities of color, where many families saw their net worth cut nearly in half during the recession, we have added high costs and debt to family balance sheets that have not recovered from the crisis over a decade ago,” the Century Foundation reported in 2019.

As a candidate, Biden once promised debtors relief. It was a half-measure, far less than the relief pledged by Senators Bernie Sanders and Elizabeth Warren, but it was something. Now there’s nothing in evidence, and debtors must wonder: Is the White House about to capitulate to the right? Republican senators have introduced a bill that would stop Biden from canceling student debt. “This decision would not only be unfair to those who already repaid their loans or decided to pursue alternative education paths, but it would be wildly inflationary at a time of already historic inflation,” Senator Mitt Romney claimed in a statement. The mirage trembles back into view. Romney is concerned with fairness; such an American idea, yet the entire situation is unfair. It’s as unfair to debtors as it is to people who have paid off their loans. Relief is the recognition that the game was always rigged. To get there, however, we have to discard a few myths about the way America really works, and Romney is unwilling to cooperate. Inflation is an excuse.

If Biden forgave debt, he’d not only fulfill a major campaign promise to voters; he’d correct a great wrong. He’d offer millions the chance at a reasonable life, at buying a house or affording to raise a child — the markers of adulthood that have become so difficult to attain. At minimum, Biden owes debtors an answer. The payment pause can’t continue forever, and it’s impossible to plan for the future without knowing if $540 must once again come out of my pay every month. I did what I was supposed to do. I studied and went to college, and then I went to more college so I could get a good job. I survived the recession, though barely. The psychological toll of debt, and economic collapse, once proved nearly too much for me to stand. “We can’t cure the recession here,” a psychiatrist told me, and he was right. There’s no pill for debt relief, either. It’s politics. It’s Biden’s job. And it’s time for him to act.