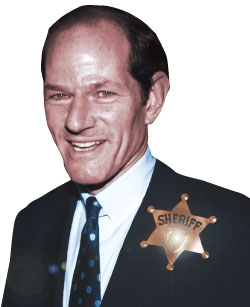

Is it already time for Spitzer nostalgia? Recently, bankers and government officials have insisted that they were blindsided by the subprime-mortgage cataclysm. “Nobody, including me, anticipated” this crisis, Richard Fuld, CEO of bankrupt Lehman Brothers, told Congress. That claim has left former “sheriff of Wall Street” Eliot Spitzer’s old crew shaking their fists at the TV. Because they saw it coming. Spitzer wanted to regulate the markets—all by himself, if he’d had his way. “Almost no one in public office was willing to state basic truths,” says one former aide. “The one exception was Spitzer.”

In 2001, Spitzer investigated subprime-mortgage giant Household International for misrepresenting the terms of loans. Household paid $484 million—at the time, the largest settlement for victims of predatory lending ever. Later, he found that Ameriquest Mortgage Company had engaged in deceptive and predatory practices; it paid the victims $295 million. (During the recent crisis, it went out of business.) “For far too long, the subprime market has been a feeding ground for unscrupulous lenders looking to gouge the most vulnerable consumers,” Spitzer told a then-adoring press.

But in 2003, the Bush administration stepped in. Regulating national banks is the federal government’s job, it said, invoking the 1863 National Bank Act. All 50 state attorneys general howled in protest, but the Supreme Court upheld the administration’s view in Watters v. Wachovia. Its power affirmed, the administration then did little; it believed financial institutions were their own best regulators. This year Wachovia, crippled by $42 billion in risky loans on its books, sold itself to avoid bankruptcy.

The former Spitzer aides, most of them now out of government, say it’s not redemption they’re after. Spitzer’s sex scandal was of his own making, they know. Still, it’s hard not to say: We told you so.

Have good intel? Send tips to intel@nymag.com.