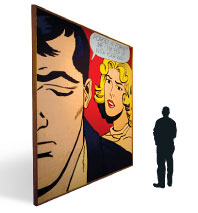

Brandeis University’s decision to close its Rose Art Museum might be more than a curatorial transgression. It might also be a bad business move—and not just for the university. Certainly, an important piece like the Rose’s big red Roy Lichtenstein “Forget It! Forget Me!” wouldn’t go for what it would have before the current downturn. But with it and the rest of the 6,000-work Rose collection poised for sale, collectors and dealers are worried about the value of their own art, too. If the Rose art went on the market, it would be clear how much less everything is actually worth. “So far, there’ve been no new quality benchmarks that would indicate the real values of art, whether high or low, in today’s market,” said New York art dealer Perry Rubenstein. “A Rose sale would, sadly but certainly, add clarity.” In other words, the last thing dealers want now is lower “comparables” for prices.

Some of the art world’s biggest players could be affected. An investment group that includes Larry Gagosian bought a slew of rare paintings at the top of the market last spring from the Ileana Sonnabend estate. Her Andy Warhols and other key works were among the last of their kind in private hands. Now Brandeis threatens to sell “superb and extraordinary” works from the same period, says art appraiser Victor Wiener, and some dealers and collectors may find “you still have a great work of art, but it’s not the greatest—and you may have paid too much for it.” The record for a Warhol is $71.7 million, set two years ago for his Green Car Crash painting. Brandeis has its own very good car-crash painting titled, appropriately enough, Saturday Disaster.

Have good intel? Send tips to intel@nymag.com.