Protesters and politicians alike have recently been noticing how little American corporations pay in taxes. (G.E. famously made $14 billion in worldwide profit last year without paying anything to the federal government.) Above, diagrams of some famous IRS-dodging strategies.

Have good intel? Send tips to intel@nymag.com.

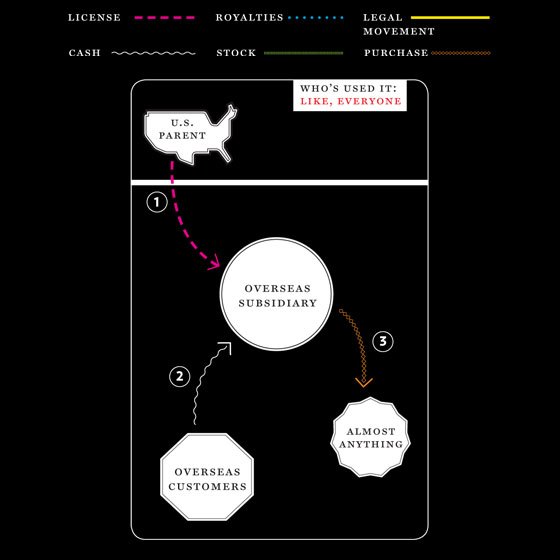

PRE (Permanently Reinvested Earnings)

(1) A U.S. company gives a foreign subsidiary the license to use its

intellectual property (patents, designs, etc.) to make

money overseas.

(2) This unit collects all foreign earnings. (3) Those earnings, subject only to (lower) foreign tax rates, can be reinvested anywhere in the world; the

only place they

can’t go is back

to the U.S. company as cash profits.