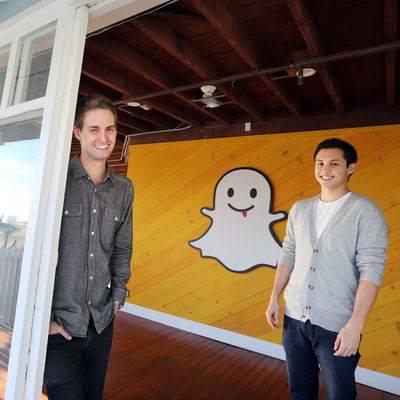

Almost exactly three years ago, Snapchat co-founders Evan Spiegel and Bobby Murphy, both of whom were then in their early 20s, had just turned down Facebook’s offer to buy their company for $3 billion in cash, which reportedly would have meant approximately $750 million for each of them personally. At the time, Snapchat was making no money and didn’t have any apparent mechanism for doing so. Meanwhile, its technology, which allowed users to send photos and video that disappeared seconds after being opened, was, while very popular, easy to copy. (Shortly after Spiegel and Murphy rejected Facebook’s proposal, Facebook launched Poke, which did almost the exact same thing as Snapchat but never took off.)

Were Spiegel and Murphy holding out for an even (unlikely-to-materialize) huger payday, or did they simply believe that their app — one mostly associated with teens and/or nudes — would eventually grow into a permanent fixture of online life, like, say, Facebook? (It’s possible they weren’t sure themselves: In an email leaked during the Sony hack, a Snapchat board member wrote, “I’ve talked to [Spiegel] a couple of times each day since late last week and he’s been oscillating back and forth between appearing to want to sell the business and wanting to go long twice a day.”) Whatever it was, many were of the opinion that the pair was some combination of dumb, reckless, and deluded. Recently, it’s become clear that that was probably the wrong assessment. Over the last couple of weeks, several news outlets reported that Snapchat (now officially called Snap Inc.) has filed paperwork for an IPO that would raise $4 billion and value the company at something between $20 billion and $35 billion.

The incredulous response to Snapchat’s decision to walk away from Facebook wasn’t the first time that people didn’t grasp the app’s potential. In a conversation with Forbes, Spiegel described the time he presented the idea for Snapchat in one of his Stanford classes:

“Everyone said, ‘That is a terrible idea,’” Spiegel remembers. “Not only is nobody going to use it, they said, but the only people who do, will use it for sexting.” A venture capitalist sitting in on the class said it could be interesting, if he made the photos permanent and partnered with Best Buy. Spiegel nearly gagged.

(Spiegel famously dropped out of Stanford just before graduation, having received Snapchat’s first investment.)

In the years since the Facebook incident, Snapchat has raised around $3 billion in funding and now claims 150 million daily users. And it has started acting like a real business. From The Wall Street Journal:

Snap’s main source of revenue is selling ads on Snapchat that are slotted in between stories contributed by media partners and video diaries posted by the app’s users. Marketers also can buy location-based or event-based geofilters and “lenses” that add quirky characteristics to photos and videos.

But marketers and ad agencies have been frustrated with Snap’s tight controls on ad content and the long wait times some have experience getting ads approved by the platform. Others say those problems amount to growing pains.

Snap has been taking some steps to make life easier for advertisers. It released an “application programming interface” that helps advertisers buy ads through a more automated process. And it has lifted some previous restrictions, allowing marketers to target customers using email databases and other data sources.

It also just released some high-tech glasses, for those who are into that sort of thing.

According to TechCrunch, forecasters believe the company will generate $367 million by the end of 2016, growing to nearly $1 billion in 2017.

“There are very few people in the world who get to build a business like this,” Spiegel told Forbes in 2014. “I think trading that for some short-term gain isn’t very interesting.”